Question: Keisha and Jay are married and file a joint return Jay is an employee and received a Form W-2 showing $30,000 in wages for the

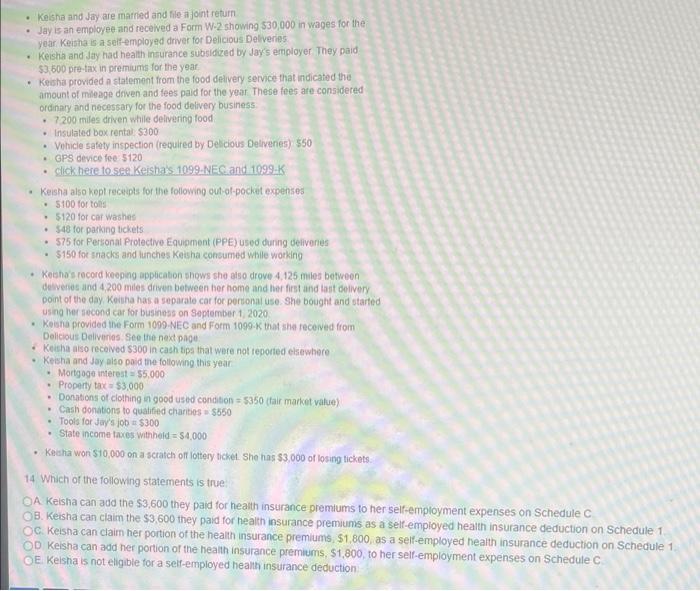

Keisha and Jay are married and file a joint return Jay is an employee and received a Form W-2 showing $30,000 in wages for the year Keisha is a self-employed driver for Delicious Deliveries Keisha and Jay had health insurance subsidized by Jay's employer They paid $3.500 pre-tax in premiums for the year Keisha provided a statement from the food delivery service that indicated the amount of mileage driven and fees paid for the year. These fees are considered ordinary and necessary for the food delivery business 7200 miles driven while delivering food Insulated box rental $300 Vehicle safety inspection required by Delicious Delivenes) $50 GPS device fee 5120 click here to see Keisha's 1099-NEC and 1099-K Keisha also opt receipts for the following out of-pocket expenses 5100 for tons 5120 for car washes 548 for parking tickets 575 for Personal Protective Equipment (PPE) used during delivenes 5150 for snacks and lunches Kelisha consumed while working . Kechos record keeping application shows she ato drove 4.125 miles between deliveries and 4 200 miles driven between her home and her first and fast delivery point of the day Keitha has a separate car for personal use. She bought and started using her second car for business on September 1 2020 Konna provided the Form 1099 NEC and Form 1099.K that she received from Delicious Deliveries See the next page Kotha also received $300 in cash tips that were not reported elsewhere Keisha and Jay also paid the following this year Mortgage interest = 55.000 Property tax- $3,000 Donations of clothing in good used condition = $350 (fair market value) Cash conditions to qualified charities $650 Tools for Jay's job $300 State income taxes withheld = $4,000 kocha won $10,000 on a scratch off lottery ticket. She has $3,000 of losing tickets 14 Which of the following statements is true OA Keisha can add the $3,600 they paid for health insurance premiums to her self-employment expenses on Schedule C B. Keisha can claim the $3,600 they paid for health insurance premiums as a self-employed health insurance deduction on Schedule 1 OC. Keisha can claim her portion of the health insurance premiums. $1,800, as a self-employed health insurance deduction on Schedule 1 OD Keisha can add her portion of the health insurance premiums, $1,800, to her self-employment expenses on Schedule C E. Kelsha is not eligible for a self-employed health insurance deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts