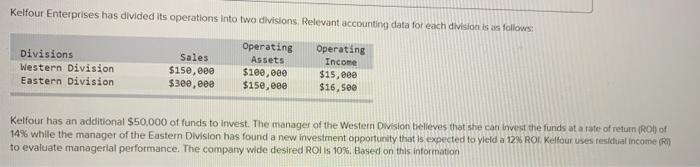

Question: Kelfour Enterprises has divided its operations into two divisions. Relevant accounting data for each division is as follows: Divisions Western Division Eastern Division Sales $150,000

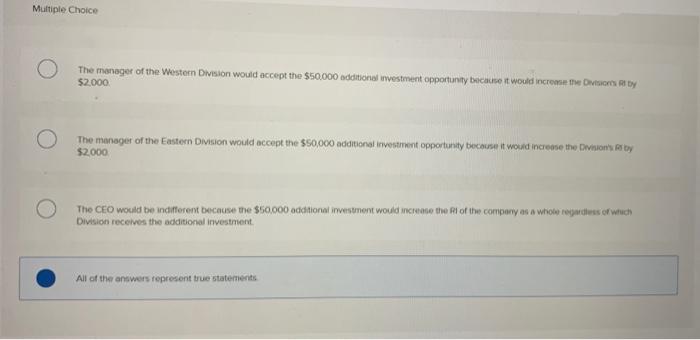

Kelfour Enterprises has divided its operations into two divisions. Relevant accounting data for each division is as follows: Divisions Western Division Eastern Division Sales $150,000 $3ee, eee Operating Assets $100,000 $150,000 Operating Income $15, eee $16,500 Kelfour has an additional $50,000 of funds to invest. The manager of the Western Division Belleves that she can Invest the funds at a rate of return (RO) of 14% while the manager of the Eastern Division has found a new investment opportunity that is expected to yield a 12% ROI Kelfour uses residual income (R) to evaluate managerial performance. The company wide desired ROI is 10%. Based on this information Multiple Choice The manager of the Western Division would accept the $50.000 additional investment opportunity because it would increme e Dorty $2.000 The manager of the Eastern Division would accept the $50,000 additional investment opportunity because it would increase the Dino's P by $2.000 The CEO would be indifferent because me $50.000 additional investment would increase the Rl of the company as a whole regardless of which Division receives the additional investment All of the answers represent true statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts