Question: Kell Bells is a kmber-processing company that produces two main products: wooden spindles for outdoor railings and wooden baseball bats. The company puts its humber

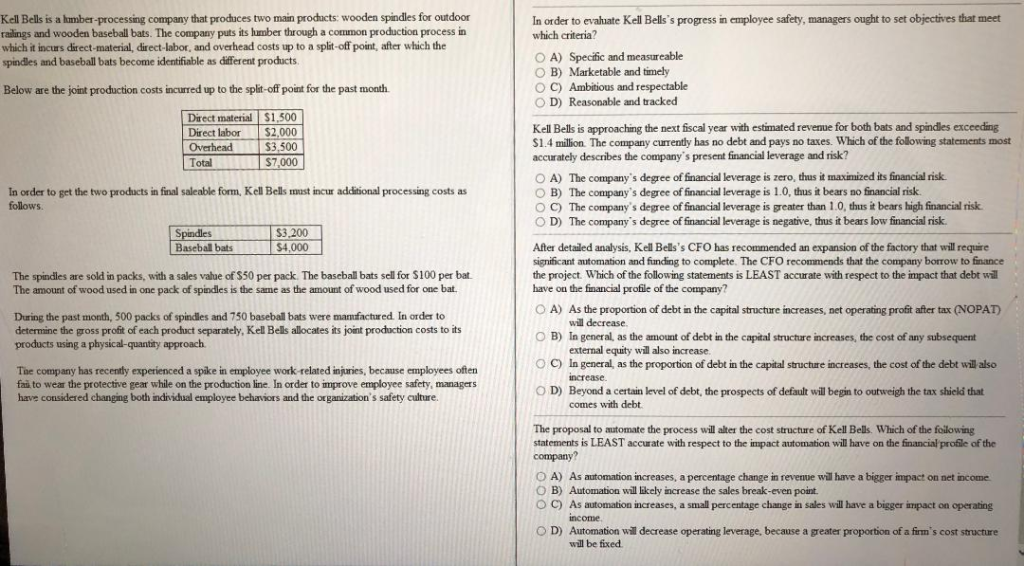

Kell Bells is a kmber-processing company that produces two main products: wooden spindles for outdoor railings and wooden baseball bats. The company puts its humber through a common production process in which it incurs direct-material, direct-labor, and overhead costs up to a split-off point, after which the spindles and baseball bats become identifiable as different products In order to evahuate Kell Bells's progress in employee safety, managers ought to set objectives that meet which criteria? O A) Specific and measureable O B) Marketable and timely O C) Ambitious and respectable O D) Reasonable and tracked Below are the joint production costs incurred up to the split-off point for the past month Direct material $1500 Direct labor $2,000 Overhead Total Kell Bells is approaching the next fiscal year with estimated revenue for both bats and spindles exceeding S1.4 million The company currently has no debt and pays no taxes. Which of the following statements most accurately describes the company's present financial leverage and risk? O A) The company's degree of financial leverage is zero, thus it maximized its financial risk $3,500 $7,000 In order to get the two products in final saleable form, Kell Bells must incur additional processing costs as follows B) The company's degree of financial leverage is 1 0, thus it bears no financial risk. O C) The company's degree of financial leverage is greater than 1.0, thus it bears high financial risk O D) The company's degree of financial leverage is negative, thus it bears low financial risk S3,200 $4,000 Basebal bats After detailed analysis, Kell Bells's CFO has recommended an expansion of the factory that will require significant automation and fanding to complete. The CFO recommends that the company borrow to finance the project. Which of the following statements is LEAST accurate with respect to the impact that debt wil have on the financial profile of the company? The spindles are sold in packs, with a sales value of $50 per pack. The baseball bats sell for $100 per bat The amount of wood used in one pack of spindles is the same as the amount of wood used for one bat O A) As the proportion of debt in the capital structure increases, net operating profit after tax (NOPAT) O B) In general, as the amount of debt in the capital structure increases, the cost of any subsequent O C) In general, as the proportion of debt in the capital structure increases, the cost of the debt will also O D) Beyond a certain level of debt, the prospects of default will begin to outweigh the tax shield that During the past month, 500 packs of spindles and 750 baseball bats were manfactured. In order to determine the gross profit of each product separately, Kell Bells allocates its joint production costs to its products using a physical-quantity approach will decrease external equity will also increase increase comes with debt The company has recently experienced a spike in employee work-related injuries, because employees often fai to wear the protective gear while on the production line. In order to improve employee safety, managers have considered changing both individual employee behaviors and the organization's safety culture. The proposal to automate the process will alter the cost structure of Kell Bells. Which of the foilowing statements is LEAST accurate with respect to the impact automation will have on the financialprofle of the company? O A) As automation increases, a percentage change in revenue will have a bigger impact on net income O B) Automation will likely increase the sales break-even point O C) As automation increases, a small percentage change in sales will have a bigger impact on operating ncome O D) Automation will decrease operating leverage, because a greater proportion of a firm's cost structure wll be fixed Kell Bells is a kmber-processing company that produces two main products: wooden spindles for outdoor railings and wooden baseball bats. The company puts its humber through a common production process in which it incurs direct-material, direct-labor, and overhead costs up to a split-off point, after which the spindles and baseball bats become identifiable as different products In order to evahuate Kell Bells's progress in employee safety, managers ought to set objectives that meet which criteria? O A) Specific and measureable O B) Marketable and timely O C) Ambitious and respectable O D) Reasonable and tracked Below are the joint production costs incurred up to the split-off point for the past month Direct material $1500 Direct labor $2,000 Overhead Total Kell Bells is approaching the next fiscal year with estimated revenue for both bats and spindles exceeding S1.4 million The company currently has no debt and pays no taxes. Which of the following statements most accurately describes the company's present financial leverage and risk? O A) The company's degree of financial leverage is zero, thus it maximized its financial risk $3,500 $7,000 In order to get the two products in final saleable form, Kell Bells must incur additional processing costs as follows B) The company's degree of financial leverage is 1 0, thus it bears no financial risk. O C) The company's degree of financial leverage is greater than 1.0, thus it bears high financial risk O D) The company's degree of financial leverage is negative, thus it bears low financial risk S3,200 $4,000 Basebal bats After detailed analysis, Kell Bells's CFO has recommended an expansion of the factory that will require significant automation and fanding to complete. The CFO recommends that the company borrow to finance the project. Which of the following statements is LEAST accurate with respect to the impact that debt wil have on the financial profile of the company? The spindles are sold in packs, with a sales value of $50 per pack. The baseball bats sell for $100 per bat The amount of wood used in one pack of spindles is the same as the amount of wood used for one bat O A) As the proportion of debt in the capital structure increases, net operating profit after tax (NOPAT) O B) In general, as the amount of debt in the capital structure increases, the cost of any subsequent O C) In general, as the proportion of debt in the capital structure increases, the cost of the debt will also O D) Beyond a certain level of debt, the prospects of default will begin to outweigh the tax shield that During the past month, 500 packs of spindles and 750 baseball bats were manfactured. In order to determine the gross profit of each product separately, Kell Bells allocates its joint production costs to its products using a physical-quantity approach will decrease external equity will also increase increase comes with debt The company has recently experienced a spike in employee work-related injuries, because employees often fai to wear the protective gear while on the production line. In order to improve employee safety, managers have considered changing both individual employee behaviors and the organization's safety culture. The proposal to automate the process will alter the cost structure of Kell Bells. Which of the foilowing statements is LEAST accurate with respect to the impact automation will have on the financialprofle of the company? O A) As automation increases, a percentage change in revenue will have a bigger impact on net income O B) Automation will likely increase the sales break-even point O C) As automation increases, a small percentage change in sales will have a bigger impact on operating ncome O D) Automation will decrease operating leverage, because a greater proportion of a firm's cost structure wll be fixed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts