Question: Keller Construction is considering two new investments. Project E calls for the purchase of earthmoving equipment. Project H represents an investment in a hydraulic lift.

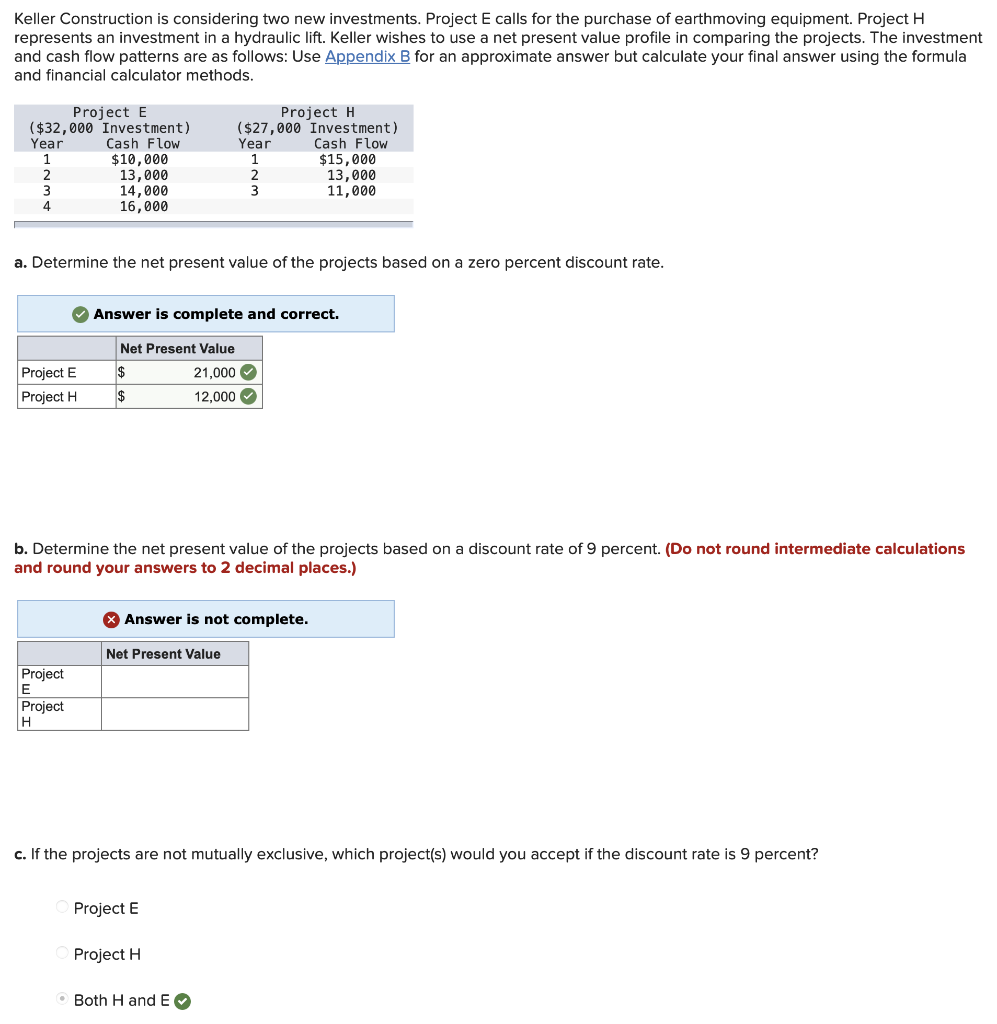

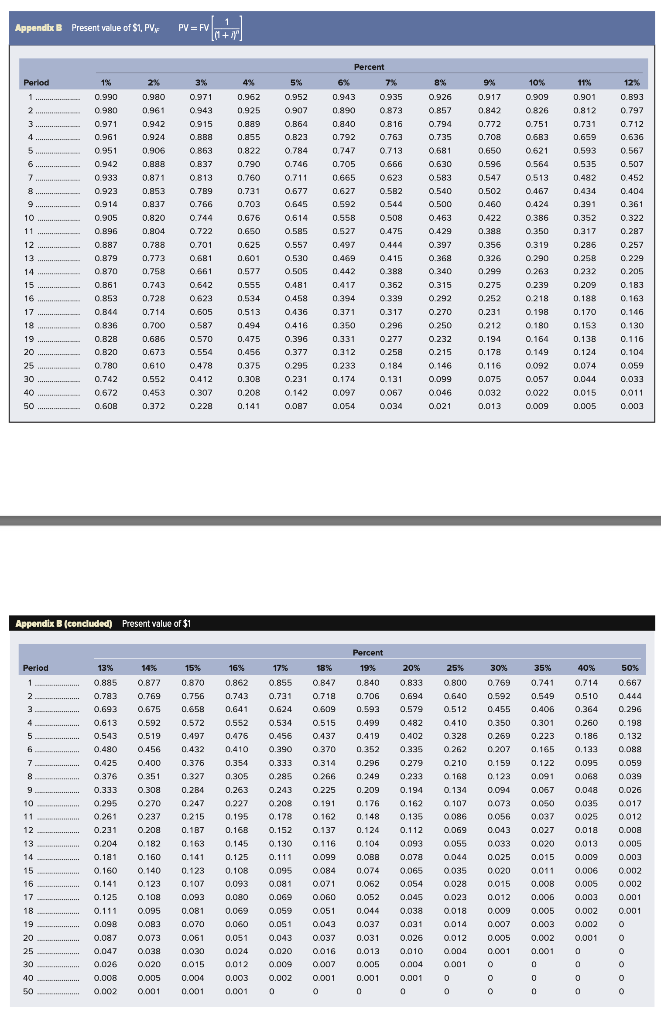

Keller Construction is considering two new investments. Project E calls for the purchase of earthmoving equipment. Project H represents an investment in a hydraulic lift. Keller wishes to use a net present value profile in comparing the projects. The investment and cash flow patterns are as follows: Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. Project E ($32,000 Investment) Year Cash Flow 1 $10,000 2 13,000 3 14,000 4 16,000 Project H ($27,000 Investment) Year Cash Flow 1 $15,000 2 13,000 3 11,000 a. Determine the net present value of the projects based on a zero percent discount rate. Answer is complete and correct. Net Present Value 21,000 Project E Project H $ $ 12,000 b. Determine the net present value of the projects based on a discount rate of 9 percent. (Do not round intermediate calculations and round your answers to 2 decimal places.) Answer is not complete. Net Present Value Project E Project | c. If the projects are not mutually exclusive, which project(s) would you accept if the discount rate is 9 percent? Project E Project Both Hand E Appendbe B Present value of $1, PV PV=FV[6,7 Percent Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 3 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 BER 4 0.961 0.924 0.855 O.B23 0.792 0.763 0.735 0.708 0.6B3 0.659 0.636 5 0.951 +++++ 0.906 0.863 0.822 0 784 0.247 0.713 0.681 0.650 0.621 0.593 0.567 5 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 7 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0583 0.547 0.513 0.482 0.452 8 0.923 0.853 0.789 0.731 0.677 0.627 0.5B2 0.540 0.502 0.467 0.434 0.404 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 10 0.905 0.820 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.744 0.722 11 0.896 0.804 0.650 0.585 0.527 0.475 0.429 0.399 0.350 0.317 0.287 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.257 0.319 0.290 0.286 0.258 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.229 14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0.146 19 0.836 0.700 0587 0,494 0416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 19 0.B28 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.138 0.116 20 0.B20 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 25 0.780 0.610 0.478 0.375 0.295 0233 0.184 0.146 0.116 0.092 0.074 0.059 30 0.742 0.552 0.412 0.30B 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 40 0.672 0.453 0.307 0.208 0.142 0.097 0067 0.046 0.032 0.022 0.015 0.011 50 0.608 0.372 0.228 0.141 0.087 0.054 0.034 0.021 0.013 0.009 0.005 0.003 Appendix B (concluded) Present value of $1 Percent Period 13% 14% 15% 16% 17% 18% 19% 20% 25% 30% 35% % 40% 50% 1 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.800 0.769 0.741 0.714 0.667 2 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.640 0.592 0.549 0.510 0.444 3 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.512 0.455 0.406 0.364 0.296 4 0.613 0.592 0.572 0.552 0.534 0.515 0.499 0.482 0.410 0.350 0.301 0.260 0.198 5 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.328 0.269 0.223 0.186 0.132 6 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.262 0.207 0.165 0.133 0.088 7 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 0.210 0.159 0.122 0.095 0.059 8 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.168 0.123 0.091 0.068 0.039 9 0.33 0.308 0.284 0.263 0.243 0.225 0.209 0.194 0.134 0.094 0.067 0.048 0.026 10 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 0.107 0.073 0.050 0.035 0.017 11 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135 0.086 0.056 0.037 0.025 0.012 12 0.231 0.208 0.187 0.16B 0.152 0.137 0.124 0.112 0.069 0.043 0.027 0.018 0.008 13 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.055 0.033 0.020 0.013 0.005 14 0.181 0.160 0.141 0.125 0.111 0.099 0.05B 0.078 0.044 0.025 0.015 0.009 0.003 15 0.160 0.140 0.123 0.108 0.095 0.084 0074 0.065 0.035 0.020 0.011 0.006 0.002 16 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.028 0.015 0.000 0.005 0.002 17 0.125 0.109 0.093 0.080 0.069 0.060 0.052 0.045 0.023 0.012 0.006 0.002 0.001 18 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.018 0.009 0.005 0.002 0.001 19 0.096 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.014 0.007 0.003 0.002 0 20 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0.012 0.005 0.002 0.001 o 25 0.047 0.039 0.030 0.024 0.020 0.016 0.013 0.010 0.004 0.001 0.001 0 0 30 0.026 0.020 0.015 0.012 0.009 0.007 0.005 0.004 0.001 0 0 0 o 40 0.008 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0 0 0 0 o 50 0.002 0.001 0.001 0.001 0 0 0 0 0 0 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts