Question: Keller Construction is considering two new investments. Project E calls for the purchase of earth moving equipment Project H represents the investment in a hydraulic

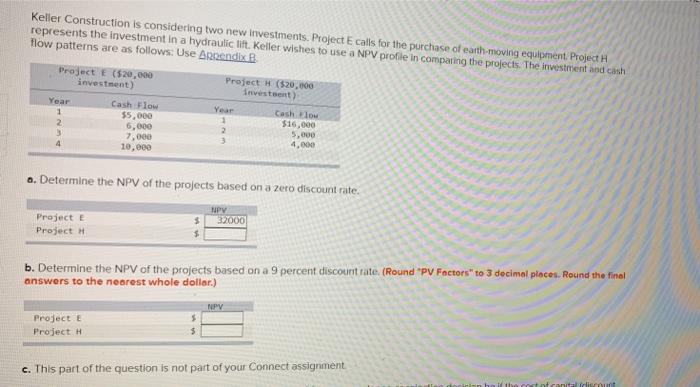

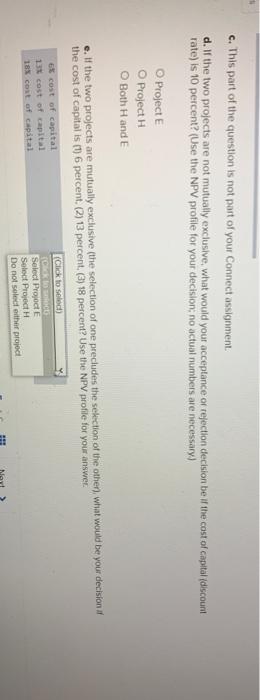

Keller Construction is considering two new investments. Project E calls for the purchase of earth moving equipment Project H represents the investment in a hydraulic lift. Keller wishes to use a NPV profile in comparing the projects. The investment and cash flow patterns are as follows: Use Arpendix B Project E (520,000 Project H (520,000 investment) Investeet) Year Cash Flow Your cash vow $5,000 1 $16.000 6,000 2 5,000 7,000 3 4.000 10,000 1 2 3 4 a. Determine the NPV of the projects based on a zero discount rate. Project Project MPY 32000 b. Determine the NPV of the projects based on a 9 percent discount rate (Round "PV Foctors" to 3 decimal places. Round the final answers to the nearest whole dollar.) NPY Project Project H c. This part of the question is not part of your Connect assignment stotranitidiscount c. This part of the question is not part of your Connect assignment d. If the two projects are not mutually exclusive, what would your acceptance of rejection decision be if the cost of capital discount rate) is 10 percent? (Use the NPV profile for your decision, no actual numbers are necessary) O Projecte Project H Both Hand E If the two projects are mutually exclusive (the selection of one precludes the selection of the other, what would be your decision af the cost of capitalis (1) 6 percent. (2) 13 percent. (3) 18 percent? Use the NPV profile for your answer. e cost of capital Click to sold 13% cost of capital C C 16 cont of capital Select Project Select Project Do not soled other project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts