Question: Kelly Green Corp. uses the allowance method for estimating bad debts. Total Sales for the year were $ 1 , 4 5 0 , 0

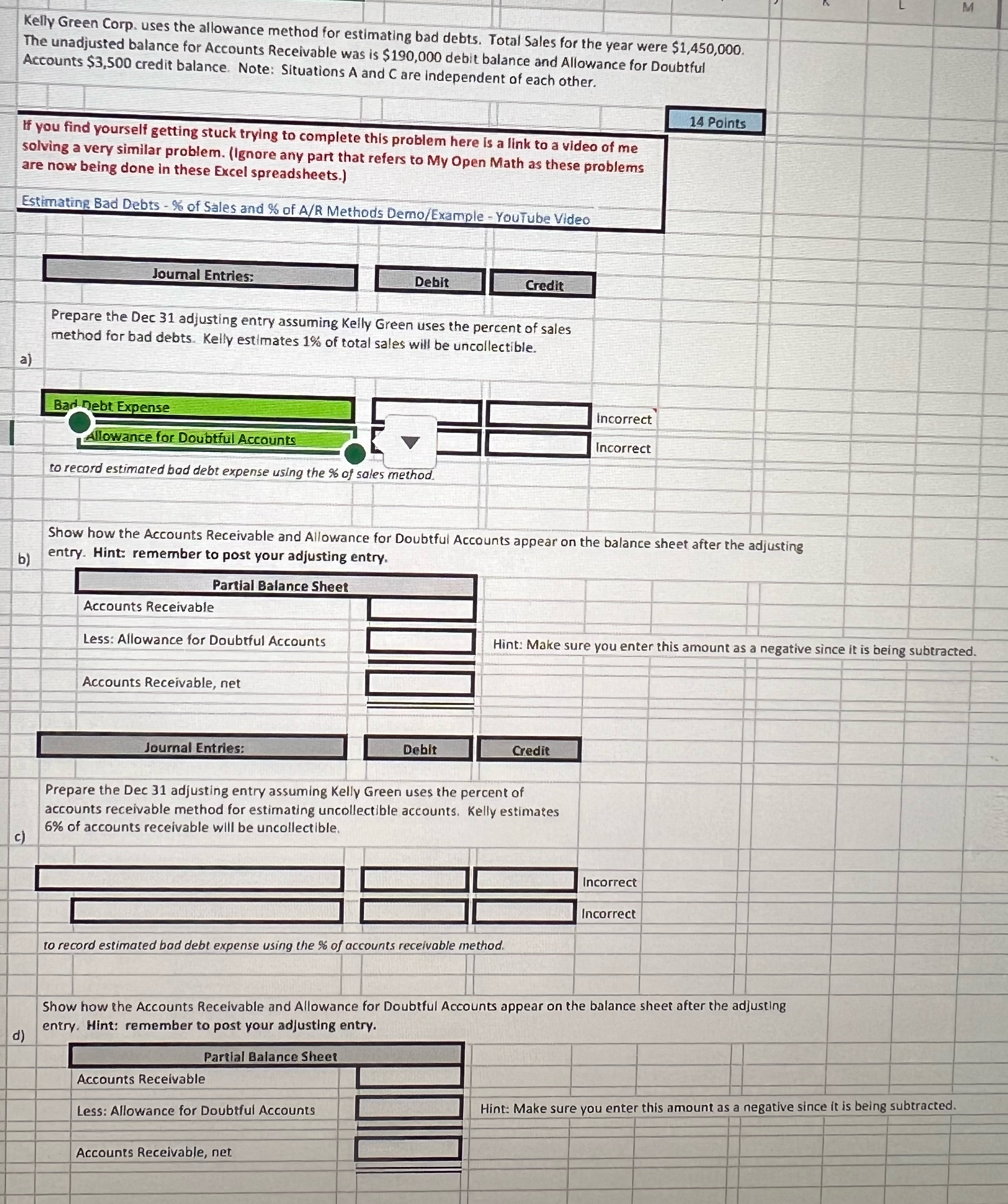

Kelly Green Corp. uses the allowance method for estimating bad debts. Total Sales for the year were $ The unadjusted balance for Accounts Receivable was is $ debit balance and Allowance for Doubtful Accounts $ credit balance. Note: Situations A and are independent of each other.

If you find yourself getting stuck trying to complete this problem here is a link to a video of me solving a very similar problem. Ignore any part that refers to My Open Math as these problems are now being done in these Excel spreadsheets.

Estimating Bad Debts Sof Sales and Ss of AR Methods DemoExample YouTube Video

Journal Entries:

Debit

Gredit

Prepare the Dec adjusting entry assuming Kelly Green uses the percent of sales method for bad debts. Kelly estimates of total sales will be uncollectible.

a

b entry. Hint: remember to pose your adjusting entry.

tablePartial Balance SheetAccounts ReceivableLess: Allowance for Doubrful AccountsAccounts Receivable, net

Prepare the Dec adjusting entry assuming Kelly Green uses the percent of accounts receivable method for estimating uncollectible accounts. Kelly estimates

c of accounts receivable will be uncollectible.

d

Show how she Accounts Receivable and Allowance for Doubtful Accounts appear on the balance sheet after the adjusting eniry. Hint: remember to post your adjusting entry.

tablePartial Balance Shee?,Accounts Recelvable,

Less: Allowance for Doubtful Accounts

Hint: Make sure you enter this amount as a negative since it is being subtracted.

Accounts Receivable, net

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock