Question: Kelly's Camera Shop Income Statement (partial) Year ending December 31, 2021 Operating Expenses: Journal entry worksheet Record the estimated bad debt losses at 2 percent

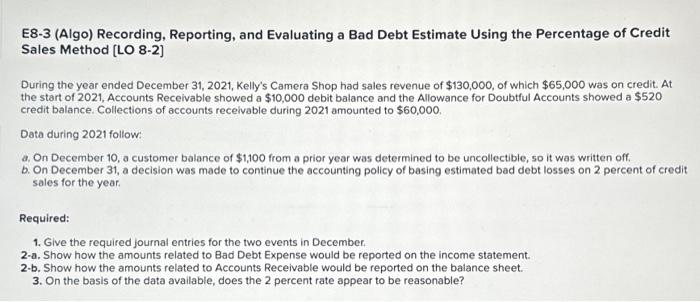

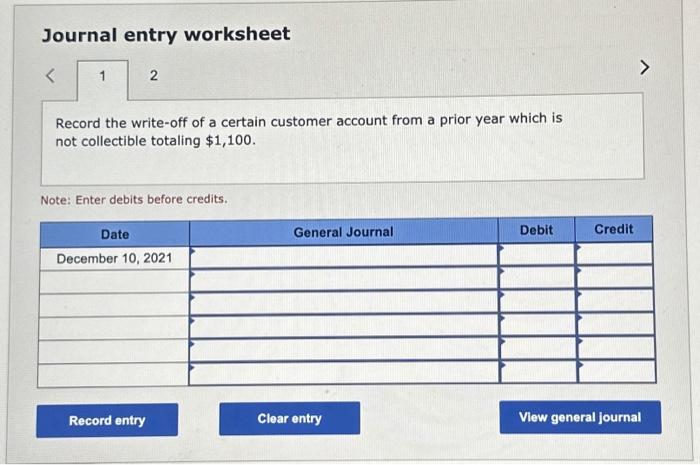

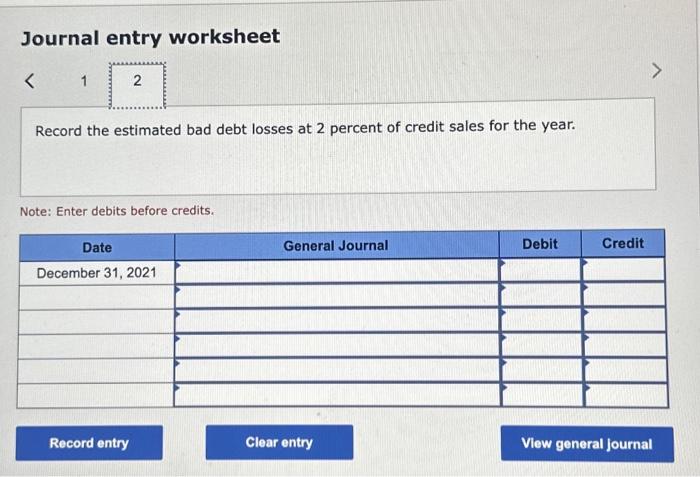

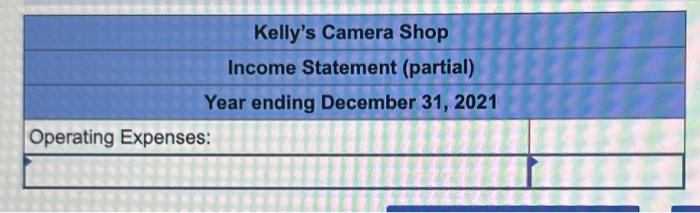

Kelly's Camera Shop Income Statement (partial) Year ending December 31, 2021 Operating Expenses: Journal entry worksheet Record the estimated bad debt losses at 2 percent of credit sales for the year. Note: Enter debits before credits. On the basis of the data available, does the 2 percent rate appea Journal entry worksheet Record the write-off of a certain customer account from a prior year which is not collectible totaling $1,100. Note: Enter debits before credits. E8-3 (Algo) Recording, Reporting, and Evaluating a Bad Debt Estimate Using the Percentage of Credit Sales Method [LO 8-2] During the year ended December 31, 2021, Kelly's Camera Shop had sales revenue of $130,000, of which $65,000 was on credit. At the start of 2021, Accounts Receivable showed a $10,000 debit balance and the Allowance for Doubtful Accounts showed a $520 credit balance. Collections of accounts recelvable during 2021 amounted to $60,000. Data during 2021 follow: a. On December 10, a customer balance of $1,100 from a prior year was determined to be uncollectible, so it was written off. b. On December 31 , a decision was made to continue the accounting policy of basing estimated bad debt losses on 2 percent of credit sales for the year. Required: 1. Give the required journal entries for the two events in December. 2-a. Show how the amounts related to Bad Debt Expense would be reported on the income statement. 2-b. Show how the amounts related to Accounts Receivable would be reported on the balance sheet. 3. On the basis of the data available, does the 2 percent rate appear to be reasonable? Show how the amounts related to Accounts Receivable would De

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts