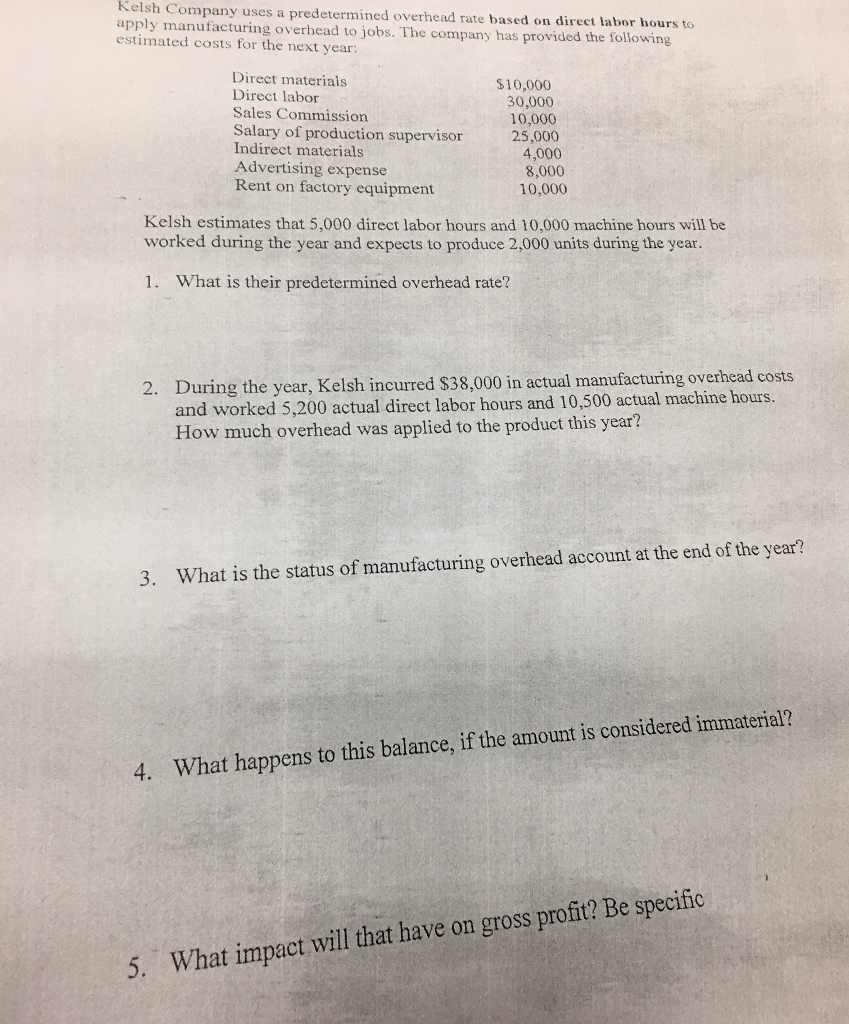

Question: Kelsh Company uses a predetermine overhead rate based on direct labor hours to apply manufacturing overhead to jobs, The company has provided the following estimated

Kelsh Company uses a predetermine overhead rate based on direct labor hours to apply manufacturing overhead to jobs, The company has provided the following estimated costs for the next year. Kelsh estimates that 5,000 direct labor hours and 10,000 machine hours will be worked during the year and expects to produce 2,000 units during the year. What is their predetermined overhead rate? During the year, Kelsh incurred $38,000 in actual manufacturing overhead costs and worked 5, 200 actual direct labor hours and 10, 500 actual machine hours. How much overhead was applied to the product this year? What is their predetermined overhead rate? During the year, Kelsh incurred $38,000 in actual manufacturing overhead costs and worked 5, 200 actual direct labor houses and 10, 500 actual machine hours. How much overhead was applied to the product this year? What is the status of manufacturing overhead account at the end of the year? What happens to this balance, if the amount is considered immaterial? What impact will that have on gross profit? Be specific

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts