Question: Kemahim nou Question Completion Status: Close Window > A Moving to another question will save this response. Question 22 of 30 Save Answer Question 22

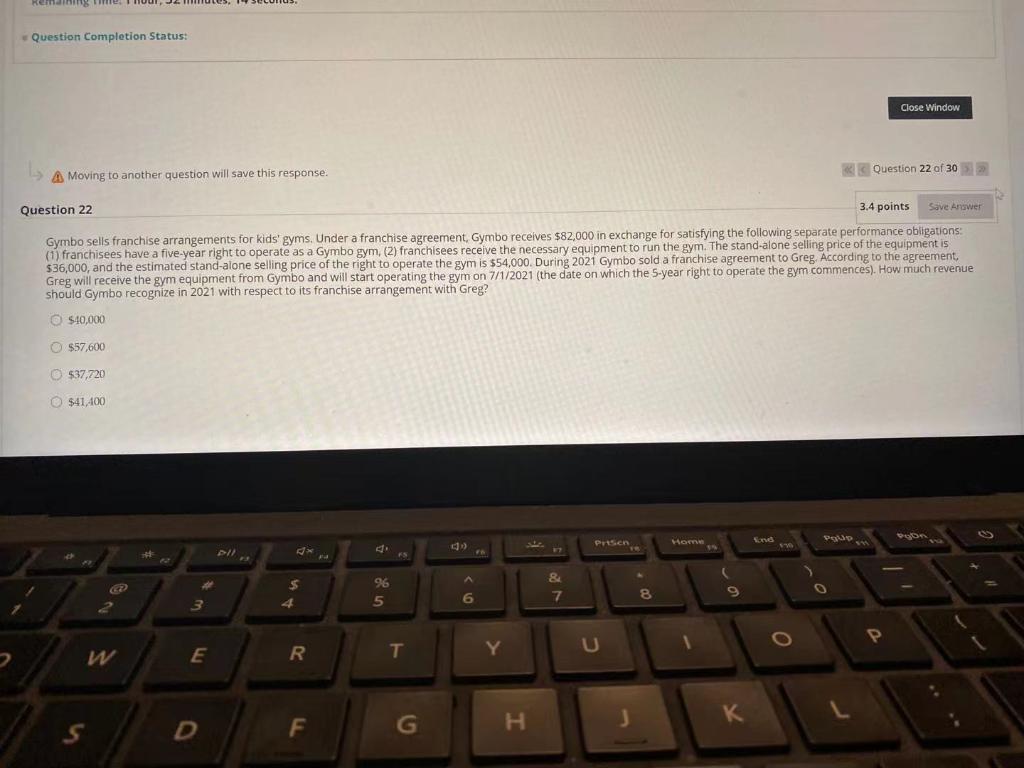

Kemahim nou Question Completion Status: Close Window > A Moving to another question will save this response. Question 22 of 30 Save Answer Question 22 3.4 points Gymbo sells franchise arrangements for kids' gyms. Under a franchise agreement Gymbo receives $82,000 in exchange for satisfying the following separate performance obligations: (1) franchisees have a five-year right to operate as a Gymbo gym, (2) franchisees receive the necessary equipment to run the gym. The stand-alone selling price of the equipment is $36,000, and the estimated stand-alone selling price of the right to operate the gym is $54,000. During 2021 Gymbo sold a franchise agreement to Greg. According to the agreement Greg will receive the gym equipment from Gymbo and will start operating the gym on 7/1/2021 (the date on which the 5-year right to operate the gym commences). How much revenue should Gymbo recognize in 2021 with respect to its franchise arrangement with Greg? $10,000 $57,600 $37,720 $41,400 Evd Don Pren ) Home * FS $ 96 5 & 7 6 8 0 9 3 P R Y U 1 T S K D F . G

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts