Question: Kendall Industries is considering purchasing a new Widget Making Machine. The cost of the machine will be $33,623. The machine will be put into use

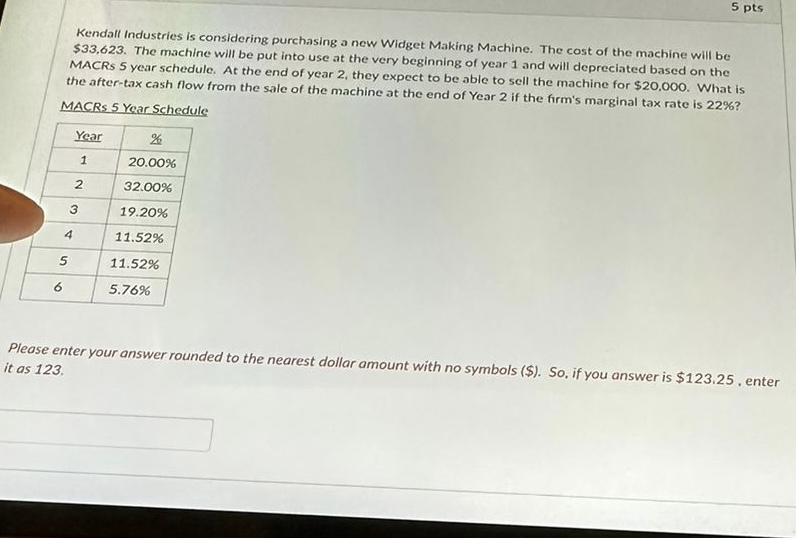

Kendall Industries is considering purchasing a new Widget Making Machine. The cost of the machine will be \$33,623. The machine will be put into use at the very beginning of year 1 and will depreciated based on the MACRs 5 year schedule. At the end of year 2, they expect to be able to sell the machine for $20,000. What is the after-tax cash flow from the sale of the machine at the end of Year 2 if the firm's marginal tax rate is 22% ? MACRs 5 Year Schedule Please enter your answer rounded to the nearest dollar amount with no symbols ($). So, if you answer is $123.25. enter it as 123

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts