Question: Keter to problem 1. suppose that live years ago the corporation had decided to own ra- ther than lease the real estate. Assume that it

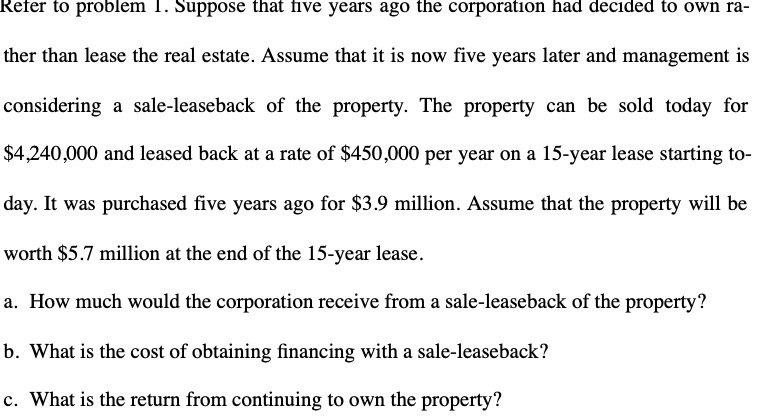

Keter to problem 1. suppose that live years ago the corporation had decided to own ra- ther than lease the real estate. Assume that it is now five years later and management is considering a sale-leaseback of the property. The property can be sold today for $4 240,000 and leased back at a rate of $450,000 per year on a 15-year lease starting to- day. It was purchased ve years ago for $3.9 million. Assume that the property will be worth $5 .? million at the end of the 15-year lease. a. How much would the corporation receive from a sale-leasehack of the property? b. What is the cost of obtaining nancing with a sale-leasehack? c. What is the return from continuing to own the property

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts