Question: Keyser Mining is considering a project that will require the purchase of $980,000 in new equipment. The equipment is in a seven-year MACRS class. The

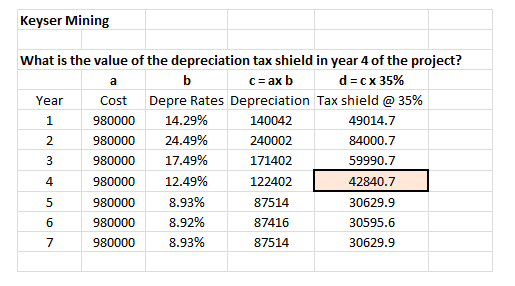

Keyser Mining is considering a project that will require the purchase of $980,000 in new equipment. The equipment is in a seven-year MACRS class. The equipment can be scrapped at the end of the project for 5 percent of its original cost. Annual sales from this project are estimated at $420,000. Net working capital equal to 20 percent of sales will be required to support the project. All of the net working capital will be recouped. The required return is 16 percent and the tax rate is 35 percent. What is the recovery amount attributable to net working capital at the end of the project? Answer: 84,000. Given the information, what is the value of the depreciation tax shield in year 4 of the project? Answer: $42,840.70

In the work shown, how did this person get the depreciation rates? What is the formula? 1/7 is 14.29% but how was 24.49, 17.49 etc... obtained?

Keyser Mining What is the value of the depreciation tax shield in year 4 of the project? d = c x 35% Depre Rates Depreciation Tax shield @ 35% Cost 980000 980000 980000 980000 980000 980000 Year 1 2 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 140042 240002 171402 122402 87514 87416 87514 49014.7 84000.7 59990.7 42840.7 30629. 30595.6 30629. 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts