Question: Keyser Mining is considering a project that will require the purchase of $875,000 of equipment. The equipment will be depreciated straight-line to a zero book

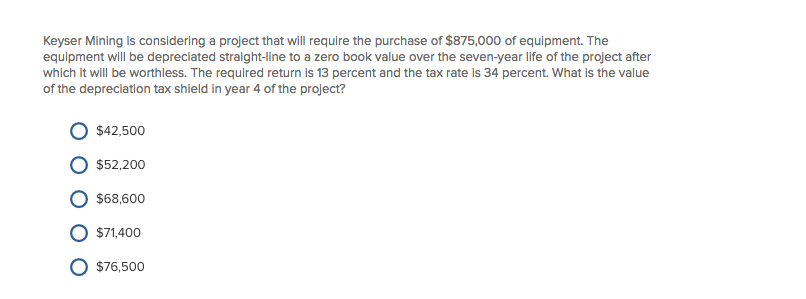

Keyser Mining is considering a project that will require the purchase of $875,000 of equipment. The equipment will be depreciated straight-line to a zero book value over the seven-year life of the project after which it will be worthless. The required return is 13 percent and the tax rate is 34 percent. What is the value of the depreclation tax shield in year 4 of the project? O $42,500 O $52.200 O $68,600 O $71,400 O $76,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts