Question: ki Saved Problem 9-6A Prepare a bond amortization schedule and record transactions for the bond issuer (LO9-5) [The following information applies to the questions displayed

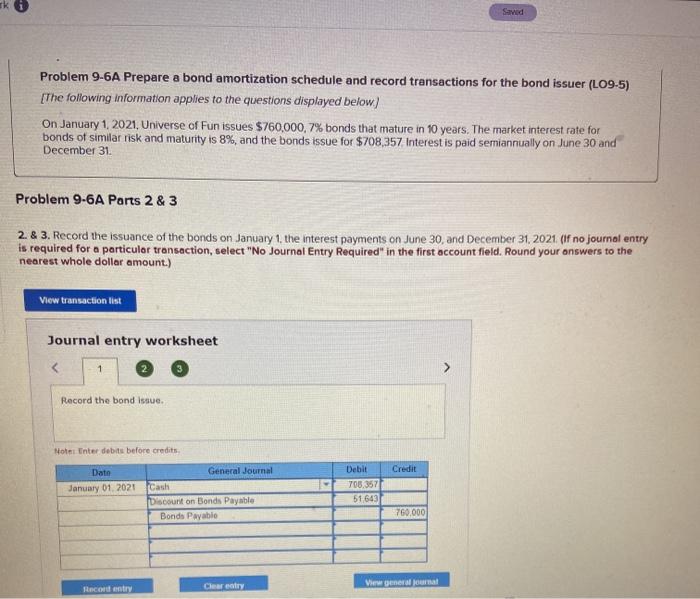

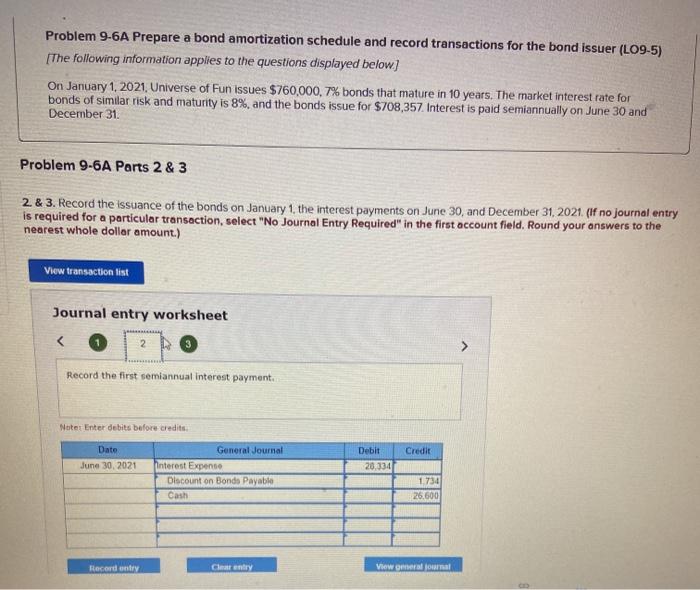

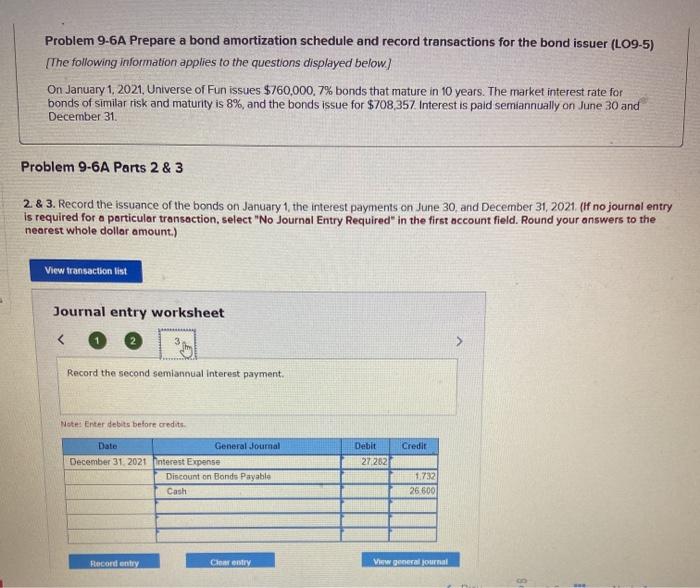

ki Saved Problem 9-6A Prepare a bond amortization schedule and record transactions for the bond issuer (LO9-5) [The following information applies to the questions displayed below) On January 1, 2021, Universe of Fun issues $760,000,7% bonds that mature in 10 years. The market interest rate for bonds of similar risk and maturity is 8%, and the bonds issue for $708,357 Interest is paid semiannually on June 30 and December 31. Problem 9-6A Parts 2&3 2. & 3. Record the issuance of the bonds on January 1, the interest payments on June 30, and December 31, 2021 (If no journal entry is required for a particular transaction, select "No Journal Entry Required" in the first account field. Round your answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet Record the bond issue. Not Enter debts before credits Credit Date January 01, 2021 General Journal Cash Discount on Bonds Payable Bonds Payable Debit 700.357 51 643 760.000 Record entry Clear entry View general Journal Problem 9-6A Prepare a bond amortization schedule and record transactions for the bond issuer (LO9-5) [The following information applies to the questions displayed below] On January 1, 2021. Universe of Fun issues $760,000, 7% bonds that mature in 10 years. The market interest rate for bonds of similar risk and maturity is 8%, and the bonds issue for $708,357 Interest is paid semiannually on June 30 and December 31 Problem 9-6A Parts 2 & 3 2. & 3. Record the issuance of the bonds on January 1, the interest payments on June 30, and December 31, 2021. (If no journal entry is required for a particular transaction, select "No Journal Entry Required" in the first account field. Round your answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet Record the first semiannual interest payment Note: Enter debits before credits Credit Date June 30, 2021 Debit 20,334 General Journal Pinterest Expense Discount on Bonds Payable Cash 1734 26,600 Record entry Centry View oneralommal Problem 9-6A Prepare a bond amortization schedule and record transactions for the bond issuer (L09-5) [The following information applies to the questions displayed below) On January 1, 2021. Universe of Fun issues $760,000,7% bonds that mature in 10 years. The market interest rate for bonds of similar risk and maturity is 8%, and the bonds issue for $708,357 Interest is paid semiannually on June 30 and December 31 Problem 9-6A Parts 2&3 2. & 3. Record the issuance of the bonds on January 1, the interest payments on June 30, and December 31, 2021 (If no journal entry is required for a particular transaction, select "No Journal Entry Required" in the first account field. Round your answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet Record the second semiannual interest payment. Note: Enter debits before credite Credit Debit 27 262 Date General Journal December 31, 2021 interest Expense Discount on Bonds Payable Cash 1.732 26 600 Recordenty Content Vw general Journal ki Saved Problem 9-6A Prepare a bond amortization schedule and record transactions for the bond issuer (LO9-5) [The following information applies to the questions displayed below) On January 1, 2021, Universe of Fun issues $760,000,7% bonds that mature in 10 years. The market interest rate for bonds of similar risk and maturity is 8%, and the bonds issue for $708,357 Interest is paid semiannually on June 30 and December 31. Problem 9-6A Parts 2&3 2. & 3. Record the issuance of the bonds on January 1, the interest payments on June 30, and December 31, 2021 (If no journal entry is required for a particular transaction, select "No Journal Entry Required" in the first account field. Round your answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet Record the bond issue. Not Enter debts before credits Credit Date January 01, 2021 General Journal Cash Discount on Bonds Payable Bonds Payable Debit 700.357 51 643 760.000 Record entry Clear entry View general Journal Problem 9-6A Prepare a bond amortization schedule and record transactions for the bond issuer (LO9-5) [The following information applies to the questions displayed below] On January 1, 2021. Universe of Fun issues $760,000, 7% bonds that mature in 10 years. The market interest rate for bonds of similar risk and maturity is 8%, and the bonds issue for $708,357 Interest is paid semiannually on June 30 and December 31 Problem 9-6A Parts 2 & 3 2. & 3. Record the issuance of the bonds on January 1, the interest payments on June 30, and December 31, 2021. (If no journal entry is required for a particular transaction, select "No Journal Entry Required" in the first account field. Round your answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet Record the first semiannual interest payment Note: Enter debits before credits Credit Date June 30, 2021 Debit 20,334 General Journal Pinterest Expense Discount on Bonds Payable Cash 1734 26,600 Record entry Centry View oneralommal Problem 9-6A Prepare a bond amortization schedule and record transactions for the bond issuer (L09-5) [The following information applies to the questions displayed below) On January 1, 2021. Universe of Fun issues $760,000,7% bonds that mature in 10 years. The market interest rate for bonds of similar risk and maturity is 8%, and the bonds issue for $708,357 Interest is paid semiannually on June 30 and December 31 Problem 9-6A Parts 2&3 2. & 3. Record the issuance of the bonds on January 1, the interest payments on June 30, and December 31, 2021 (If no journal entry is required for a particular transaction, select "No Journal Entry Required" in the first account field. Round your answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet Record the second semiannual interest payment. Note: Enter debits before credite Credit Debit 27 262 Date General Journal December 31, 2021 interest Expense Discount on Bonds Payable Cash 1.732 26 600 Recordenty Content Vw general Journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts