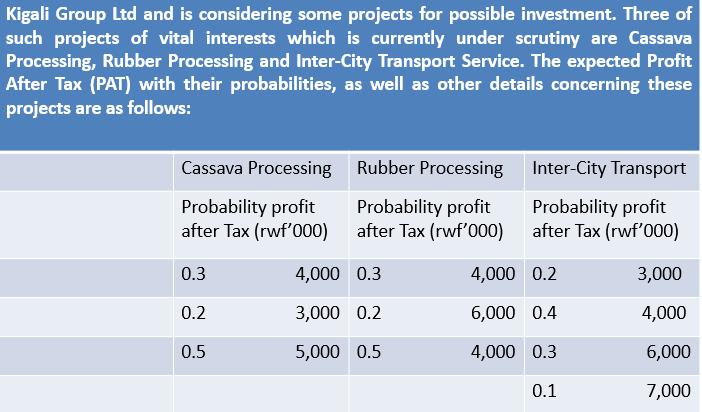

Question: Kigali Group Ltd and is considering some projects for possible investment. Three of such projects of vital interests which is currently under scrutiny are

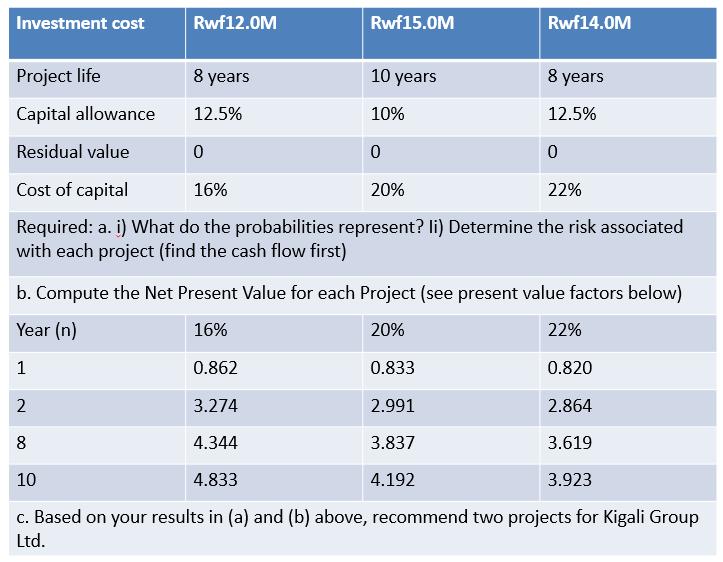

Kigali Group Ltd and is considering some projects for possible investment. Three of such projects of vital interests which is currently under scrutiny are Cassava Processing, Rubber Processing and Inter-City Transport Service. The expected Profit After Tax (PAT) with their probabilities, as well as other details concerning these projects are as follows: Cassava Processing Probability profit after Tax (rwf'000) 0.3 0.2 0.5 Rubber Processing Probability profit after Tax (rwf'000) 4,000 0.3 3,000 0.2 5,000 0.5 Inter-City Transport Probability profit after Tax (rwf'000) 4,000 0.2 6,000 0.4 4,000 0.3 0.1 3,000 4,000 6,000 7,000 Investment cost Project life Capital allowance Residual value Rwf12.0M 8 years 12.5% Rwf15.0M 0 Rwf14.0M 8 years 12.5% 10 years 10% 0 Cost of capital 16% 20% 22% Required: a. i) What do the probabilities represent? li) Determine the risk associated with each project (find the cash flow first) 0 b. Compute the Net Present Value for each Project (see present value factors below) Year (n) 16% 20% 22% 1 0.862 0.833 0.820 2 3.274 2.991 2.864 8 4.344 3.837 3.619 10 4.833 4.192 3.923 c. Based on your results in (a) and (b) above, recommend two projects for Kigali Group Ltd.

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

ANSWER Solution P 1 151 2k A 225 2 B 32 3 AB AB BA 3 ... View full answer

Get step-by-step solutions from verified subject matter experts