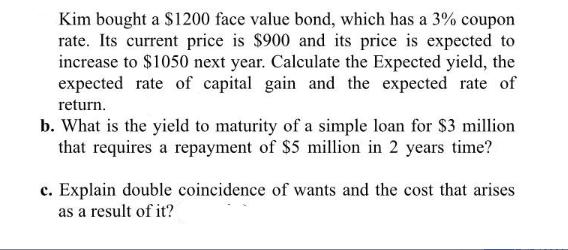

Question: Kim bought a $1200 face value bond, which has a 3% coupon rate. Its current price is $900 and its price is expected to

Kim bought a $1200 face value bond, which has a 3% coupon rate. Its current price is $900 and its price is expected to increase to $1050 next year. Calculate the Expected yield, the expected rate of capital gain and the expected rate of return. b. What is the yield to maturity of a simple loan for $3 million that requires a repayment of $5 million in 2 years time? c. Explain double coincidence of wants and the cost that arises as a result of it?

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

a Expected yield Annual coupon payment Current price Annual coupon payment Face value Coupon rate 1200 3 36 Current price 900 Expected yield 36 900 Ex... View full answer

Get step-by-step solutions from verified subject matter experts