Question: KIMA KITCHEN is evaluatinf a project that would require an initial investment in equiptmenr of $120,000 and that is expected to last for 3 years.

KIMA KITCHEN is evaluatinf a project that would require an initial investment in equiptmenr of $120,000 and that is expected to last for 3 years. MACRS depreciation would be used where the depreciation rates in years 1,2,3 and 4 are 45%, 25% , 20% and 10% respectively. For each year of the project Kima kitchen expects revelant annual revenue associated with the project to be $75,000 and relevant annual costa associated with the project to be $31,000. The tax rate is 50 percent. what is ( X plus Y) if X is the relevant operating cash flow associatwd wirh the project expected in year 1 of the project and Y is the relevant operating cash flow associated wirh rbe project expected in year 3 of the project?

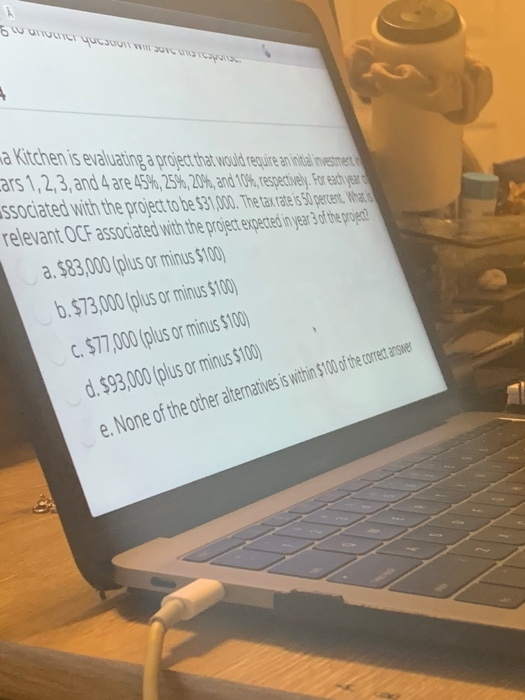

ON YUSUNOD P ma Kitchen is evaluating a project that would require an initial investment i cars 1,2,3, and 4 are 454,25%, 20%, and 10%, respectively. For each year o associated with the project to be $31,000. The tax rate is 50 percent. Whats relevant OCF associated with the project expected in year 3 of the projec? a. $83,000 (plus or minus $100) b. $73,000 (plus or minus $100) C. $77,000 (plus or minus $100) d. $93,000 (plus or minus $100) e. None of the other alternatives is within $100 of the correct

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock