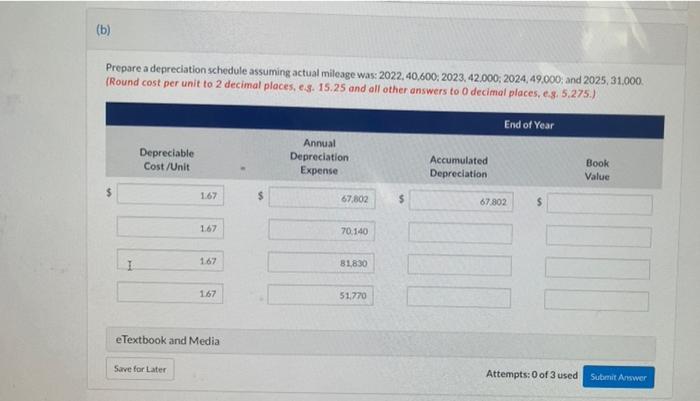

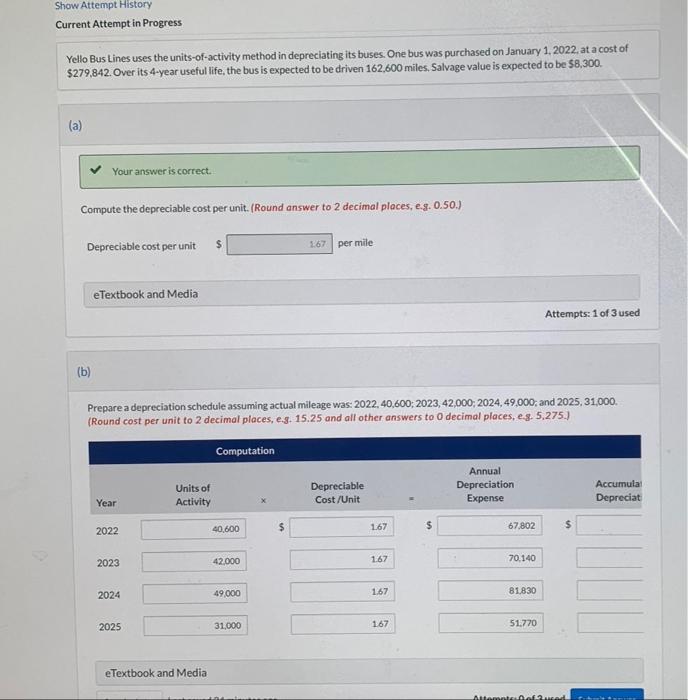

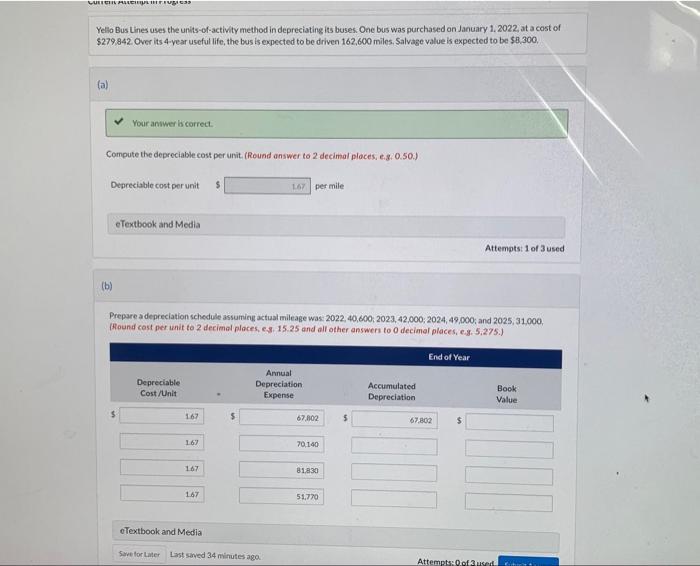

Question: kindly answer missing parts (b) Prepare a depreciation schedule assuming actual mileage was: 2022, 40,600; 2023, 42.000; 2024, 49,000; and 2025, 31.000. (Round cost per

(b) Prepare a depreciation schedule assuming actual mileage was: 2022, 40,600; 2023, 42.000; 2024, 49,000; and 2025, 31.000. (Round cost per unit to 2 decimal places, e.g. 15.25 and all other answers to 0 decimal places, e.g. 5,275.) Depreciable Cost/Unit 1.67 Save for Later 1.67 1.67 167 eTextbook and Media Annual Depreciation. Expense 67,802 70.140 81,830 51,770 Accumulated Depreciation. End of Year 67.802 $ Attempts: 0 of 3 used Book Value Submit Answer Show Attempt History Current Attempt in Progress Yello Bus Lines uses the units-of-activity method in depreciating its buses. One bus was purchased on January 1, 2022, at a cost of $279,842. Over its 4-year useful life, the bus is expected to be driven 162,600 miles. Salvage value is expected to be $8,300. (a) Your answer is correct. Compute the depreciable cost per unit. (Round answer to 2 decimal places, e.g. 0.50.) Depreciable cost per unit $ (b) eTextbook and Media Year Prepare a depreciation schedule assuming actual mileage was: 2022, 40,600; 2023, 42,000; 2024, 49,000; and 2025, 31,000. (Round cost per unit to 2 decimal places, e.g. 15.25 and all other answers to O decimal places, e.g. 5,275.) 2022 2023 2024 2025 Units of Activity eTextbook and Media Computation 40,600 42,000 49,000 31,000 1.04 um 1.67 per mile $ Depreciable Cost/Unit 1.67 1.67 1.67 167 $ Annual Depreciation Expense 67,802 70.140 81,830 Attempts: 1 of 3 used 51,770 $ Attemptc0af2uced Accumula Depreciat CUITCH PLESS Yello Bus Lines uses the units-of-activity method in depreciating its buses. One bus was purchased on January 1, 2022, at a cost of $279,842. Over its 4-year useful life, the bus is expected to be driven 162,600 miles. Salvage value is expected to be $8,300, (a) Your answer is correct. Compute the depreciable cost per unit. (Round answer to 2 decimal places, e.g. 0.50.) Depreciable cost per unit $ (b) eTextbook and Media Depreciable Cost/Unit Prepare a depreciation schedule assuming actual mileage was: 2022, 40,600; 2023, 42,000; 2024, 49,000; and 2025, 31,000, (Round cost per unit to 2 decimal places, e.g. 15.25 and all other answers to 0 decimal places, e.g. 5.275.) 167 167 167 167 167 per mile Annual Depreciation. Expense eTextbook and Media Save for Later Last saved 34 minutes ago. 67,802 70.140 81.830 51,770 Accumulated Depreciation End of Year 67,802 1000 Attempts: 1 of 3 used $ Book Value 100 Attempts:0 of 3used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts