Question: Kindly answer the given below question with an explanation to the solved values 5 Problem 4-3 Measuring Performance (LO2) Here are simplified financial statements for

Kindly answer the given below question with an explanation to the solved values

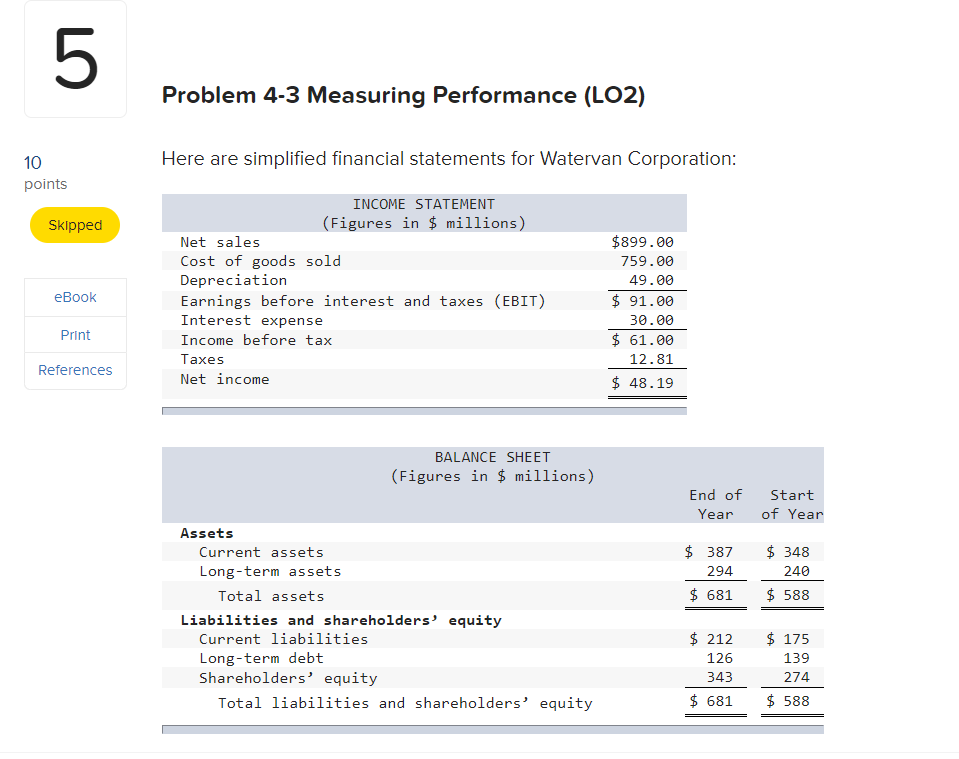

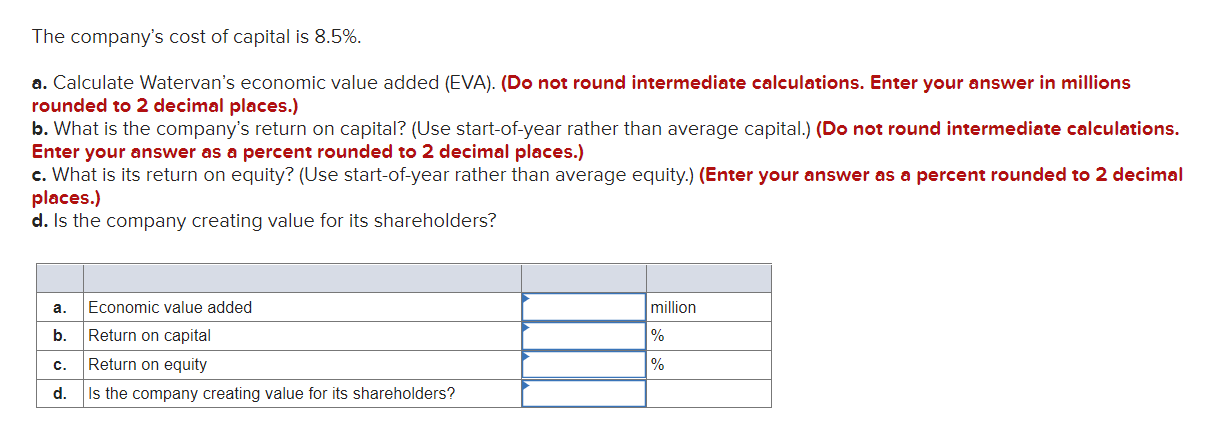

5 Problem 4-3 Measuring Performance (LO2) Here are simplified financial statements for Watervan Corporation: 10 points Skipped eBook INCOME STATEMENT (Figures in $ millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes (EBIT) Interest expense Income before tax Taxes Net income $899.00 759.00 49.00 $ 91.00 30.00 $ 61.00 12.81 $ 48.19 Print References BALANCE SHEET (Figures in $ millions) End of Year Start of Year $ 387 294 $ 348 240 $ 588 $ 681 Assets Current assets Long-term assets Total assets Liabilities and shareholders' equity Current liabilities Long-term debt Shareholders' equity Total liabilities and shareholders' equity $ 212 126 343 $ 681 $ 175 139 274 $ 588 The company's cost of capital is 8.5%. a. Calculate Watervan's economic value added (EVA). (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) b. What is the company's return on capital? (Use start-of-year rather than average capital.) (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. What is its return on equity? (Use start-of-year rather than average equity.) (Enter your answer as a percent rounded to 2 decimal places.) d. Is the company creating value for its shareholders? a. million b. % Economic value added Return on capital Return on equity Is the company creating value for its shareholders? C. % d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts