Question: Kindly answer the given below question with the exact mentioned options and table structure Thanks in advance For 20X1, Silvertip Construction, Inc., reported income from

Kindly answer the given below question with the exact mentioned options and table structure

Thanks in advance

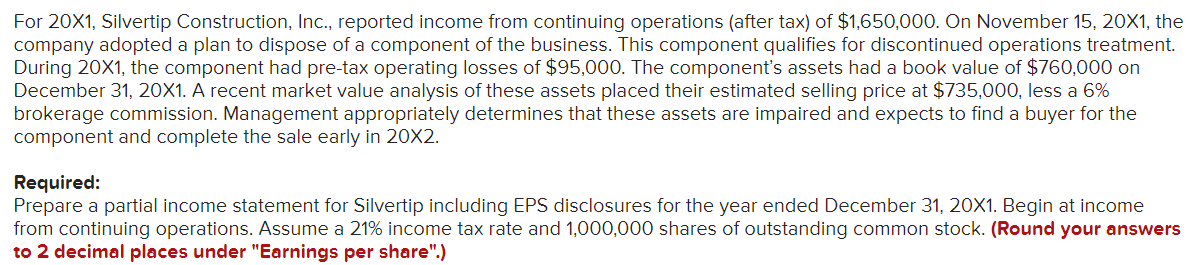

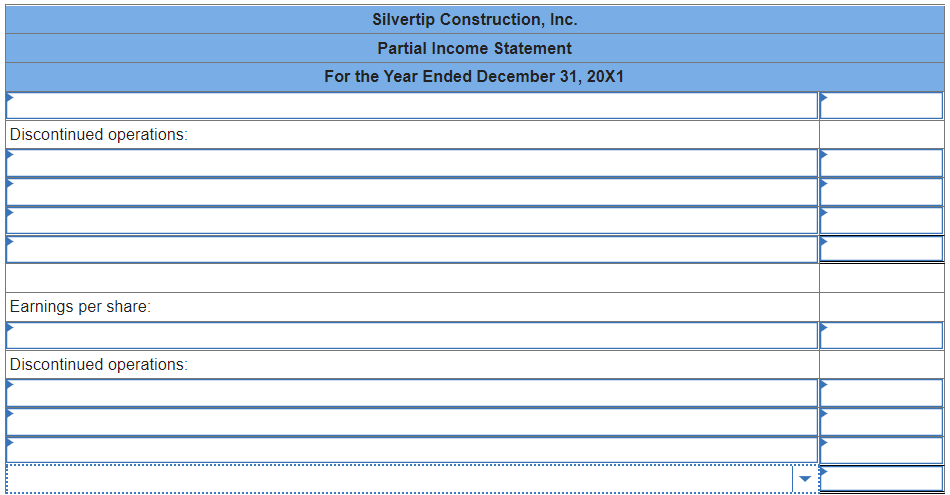

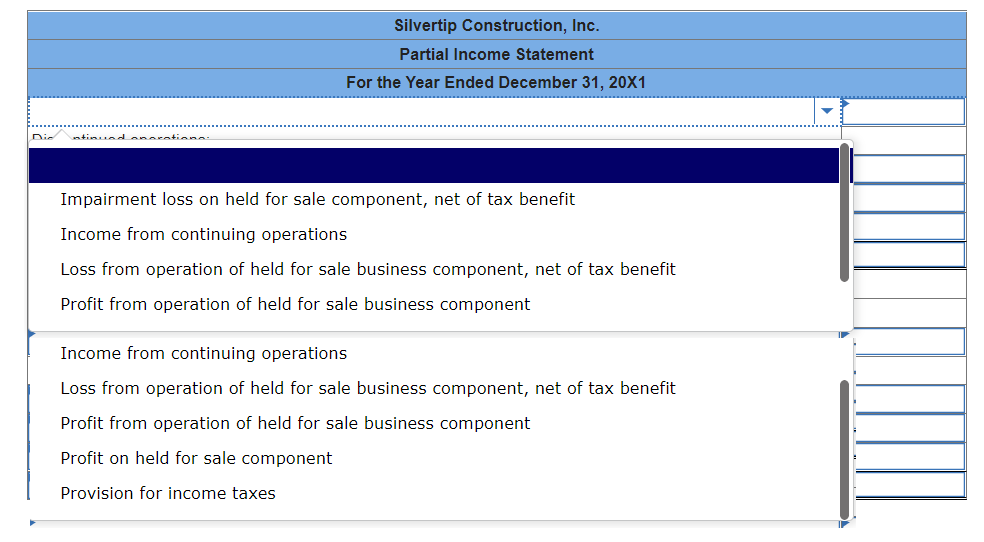

For 20X1, Silvertip Construction, Inc., reported income from continuing operations (after tax) of $1,650,000. On November 15, 20X1, the company adopted a plan to dispose of a component of the business. This component qualifies for discontinued operations treatment. During 20X1, the component had pre-tax operating losses of $95,000. The component's assets had a book value of $760,000 on December 31, 20X1. A recent market value analysis of these assets placed their estimated selling price at $735,000, less a 6% brokerage commission. Management appropriately determines that these assets are impaired and expects to find a buyer for the component and complete the sale early in 20x2. Required: Prepare a partial income statement for Silvertip including EPS disclosures for the year ended December 31, 20X1. Begin at income from continuing operations. Assume a 21% income tax rate and 1,000,000 shares of outstanding common stock. (Round your answers to 2 decimal places under "Earnings per share".) Silvertip Construction, Inc. Partial Income Statement For the Year Ended December 31, 20X1 Discontinued operations: Earnings per share: Discontinued operations: > Silvertip Construction, Inc. Partial Income Statement For the Year Ended December 31, 20X1 Die Impairment loss on held for sale component, net of tax benefit Income from continuing operations Loss from operation of held for sale business component, net of tax benefit Profit from operation of held for sale business component Income from continuing operations Loss from operation of held for sale business component, net of tax benefit Profit from operation of held for sale business component Profit on held for sale component Provision for income taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts