Question: Kindly answer the question with work shown, thanks Walter is employed as the chief operating officer at Generous Incorporated. To entice Walter to work for

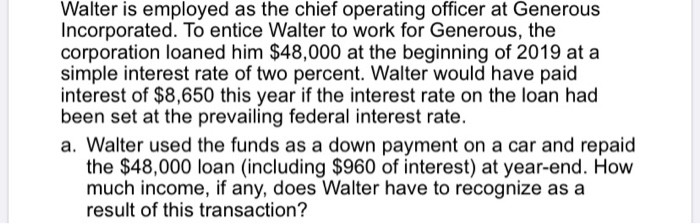

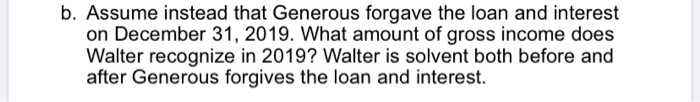

Walter is employed as the chief operating officer at Generous Incorporated. To entice Walter to work for Generous, the corporation loaned him $48,000 at the beginning of 2019 at a simple interest rate of two percent. Walter would have paid interest of $8,650 this year if the interest rate on the loan had been set at the prevailing federal interest rate. a. Walter used the funds as a down payment on a car and repaid the $48,000 loan (including $960 of interest) at year-end. How much income, if any, does Walter have to recognize as a result of this transaction? b. Assume instead that Generous forgave the loan and interest on December 31, 2019. What amount of gross income does Walter recognize in 2019? Walter is solvent both before and after Generous forgives the loan and interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts