Question: Kindly do critique analysis for my case attached below thanks Visa Inc. (NYSE: V) is the world's largest provider of digital payment services. There goal

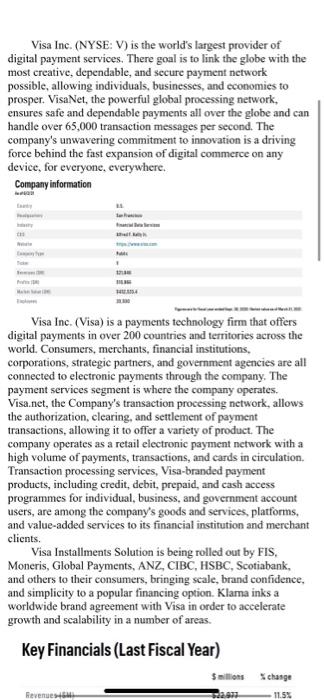

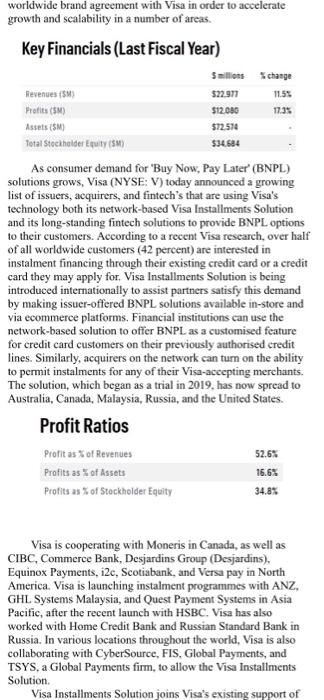

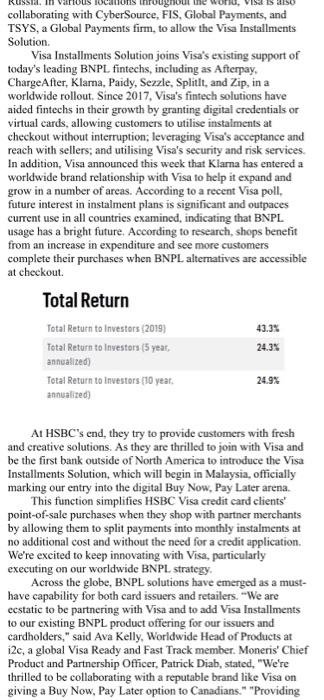

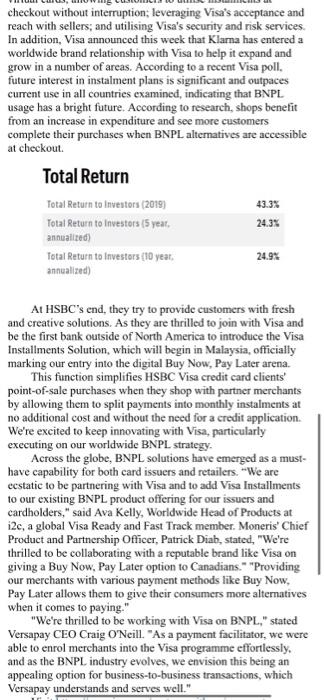

Visa Inc. (NYSE: V) is the world's largest provider of digital payment services. There goal is to link the globe with the most creative, dependable, and secure payment network possible, allowing individuals, businesses, and economies to prosper. VisaNet, the powerful global processing network, ensures safe and dependable payments all over the globe and can handle over 65,000 transaction messages per second. The company's unwavering commitment to innovation is a driving force behind the fast expansion of digital commerce on any device, for everyone, everywhere. Company information ter ha 4 Visa Inc. (Visa) is a payments technology firm that offers digital payments in over 200 countries and territories across the world. Consumers, merchants, financial institutions, corporations, strategic partners, and government agencies are all connected to electronic payments through the company. The payment services segment is where the company operates. Visa.net, the Company's transaction processing network, allows the authorization, clearing, and settlement of payment transactions, allowing it to offer a variety of product. The company operates as a retail electronic payment network with a high volume of payments, transactions, and cards in circulation Transaction processing services, Visa-branded payment products, including credit, debit, prepaid, and cash access programmes for individual, business, and government account users, are among the company's goods and services, platforms, and value-added services to its financial institution and merchant clients. Visa Installments Solution is being rolled out by FIS. Moneris, Global Payments, ANZ, CIBC, HSBC, Scotiabank, and others to their consumers, bringing scale, brand confidence, and simplicity to a popular financing option. Klama inks a worldwide brand agreement with Visa in order to accelerate growth and scalability in a number of areas. Key Financials (Last Fiscal Year) $ illos Schange Revenues 11.5% $22.977 11.55 17.3% $72.574 worldwide brand agreement with Visa in order to accelerate growth and scalability in a number of areas. Key Financials (Last Fiscal Year) Sillions change Revenues (5) Profits (SM) $12.00 Assets (SM) Total Stockholder Equity (5) $34.684 As consumer demand for "Buy Now, Pay Later' (BNPL) solutions grows, Visa (NYSE: V) today announced a growing list of issuers, acquirers, and fintech's that are using Visa's technology both its network-based Visa Installments Solution and its long-standing fintech solutions to provide BNPL options to their customers. According to a recent Visa research, over half of all worldwide customers (42 percent) are interested in instalment financing through their existing credit card or a credit card they may apply for. Visa Installments Solution is being introduced internationally to assist partners satisfy this demand by making issuer-offered BNPL solutions available in-store and via ecommerce platforms. Financial institutions can use the network-based solution to offer BNPL as a customised feature for credit card customers on their previously authorised credit lines. Similarly, acquirers on the network can turn on the ability to permit instalments for any of their Visa-accepting merchants. The solution, which began as a trial in 2019, has now spread to Australia, Canada, Malaysia, Russia, and the United States. Profit Ratios Profit as of Revenues Profits as I of Assets 16.6% Profits as % of Stockholder Equity 52.6% 34.8% Visa is cooperating with Moneris in Canada, as well as CIBC, Commerce Bank, Desjardins Group (Desjardins), Equinox Payments, i2c, Scotiabank, and Versa pay in North America. Visa is launching instalment programmes with ANZ, GHL Systems Malaysia, and Quest Payment Systems in Asia Pacific, after the recent launch with HSBC. Visa has also worked with Home Credit Bank and Russian Standard Bank in Russia. In various locations throughout the world, Visa is also collaborating with CyberSource, FIS, Global Payments, and TSYS, a Global Payments firm, to allow the Visa Installments Solution Visa Installments Solution joins Visa's existing support of 11 collaborating with CyberSource, FIS, Global Payments, and TSYS, a Global Payments firm, to allow the Visa Installments Solution Visa Installments Solution joins Visa's existing support of today's leading BNPL. fintechs, including as Afterpay, ChargeAfter, Klarna, Paidy, Sezzle, Splitit, and Zip, in a worldwide rollout. Since 2017. Visa's fintech solutions have aided fintechs in their growth by granting digital credentials or virtual cards, allowing customers to utilise instalments at checkout without interruption, leveraging Visa's acceptance and reach with sellers, and utilising Visa's security and risk services. In addition, Visa announced this week that Kiarna has entered a worldwide brand relationship with Visa to help it expand and grow in a number of areas. According to a recent Visa poll, future interest in instalment plans is significant and outpaces current use in all countries examined, indicating that BNPL usage has a bright future. According to research, shops benefit from an increase in expenditure and see more customers complete their purchases when BNPL alternatives are accessible at checkout Total Return Total Return to Investors (2019) Total Return to investors (5 year, 24.3% annualized Total Return to Investors (10 year. annualized 43.3% 24.9% At HSBC's end, they try to provide customers with fresh and creative solutions. As they are thrilled to join with Visa and be the first bank outside of North America to introduce the Visa Installments Solution, which will begin in Malaysia, officially marking our entry into the digital Buy Now, Pay Later arena. This function simplifies HSBC Visa credit card clients' point-of-sale purchases when they shop with partner merchants by allowing them to split payments into monthly instalments at no additional cost and without the need for a credit application. We're excited to keep innovating with Visa, particularly executing on our worldwide BNPL strategy. Across the globe, BNPL solutions have emerged as a must- have capability for both card issuers and retailers. "We are ecstatic to be partnering with Visa and to add Visa Installments to our existing BNPL product offering for our issuers and cardholders," said Ava Kelly, Worldwide Head of Products at i2c, a global Visa Ready and Fast Track member. Moneris Chief Product and Partnership Officer, Patrick Diab, stated, "We're thrilled to be collaborating with a reputable brand like Visa on giving a Buy Now, Pay Later option to Canadians." "Providing checkout without interruption; leveraging Visa's acceptance and reach with sellers, and utilising Visa's security and risk services In addition, Visa announced this week that Klarna has entered a worldwide brand relationship with Visa to help it expand and grow in a number of areas. According to a recent Visa poll, future interest in instalment plans is significant and outpaces current use in all countries examined, indicating that BNPL usage has a bright future. According to research, shops benefit from an increase in expenditure and see more customers complete their purchases when BNPL alternatives are accessible at checkout Total Return Total Return to Investors (2019) Total Return to Investors (5 year. annualized) Total Return to Investors (10 year. annualized) 24.3% 24.9% At HSBC's end, they try to provide customers with fresh and creative solutions. As they are thrilled to join with Visa and be the first bank outside of North America to introduce the Visa Installments Solution, which will begin in Malaysia, officially marking our entry into the digital Buy Now, Pay Later arena. This function simplifies HSBC Visa credit card clients' point-of-sale purchases when they shop with partner merchants by allowing them to split payments into monthly instalments at no additional cost and without the need for a credit application. We're excited to keep innovating with Visa, particularly executing on our worldwide BNPL strategy. Across the globe, BNPL solutions have emerged as a must- have capability for both card issuers and retailers. We are ecstatic to be partnering with Visa and to add Visa Installments to our existing BNPL product offering for our issuers and cardholders," said Ava Kelly, Worldwide Head of Products at 2c, a global Visa Ready and Fast Track member. Moneris' Chief Product and Partnership Officer, Patrick Diab, stated, "We're thrilled to be collaborating with a reputable brand like Visa on giving a Buy Now, Pay Later option to Canadians." "Providing our merchants with various payment methods like Buy Now, Pay Later allows them to give their consumers more alternatives when it comes to paying." "We're thrilled to be working with Visa on BNPL," stated Versapay CEO Craig O'Neill. "As a payment facilitator, we were able to enrol merchants into the Visa programme effortlessly. and as the BNPL industry evolves, we envision this being an appealing option for business-to-business transactions, which Versapay understands and serves well." Visa Inc. (NYSE: V) is the world's largest provider of digital payment services. There goal is to link the globe with the most creative, dependable, and secure payment network possible, allowing individuals, businesses, and economies to prosper. VisaNet, the powerful global processing network, ensures safe and dependable payments all over the globe and can handle over 65,000 transaction messages per second. The company's unwavering commitment to innovation is a driving force behind the fast expansion of digital commerce on any device, for everyone, everywhere. Company information ter ha 4 Visa Inc. (Visa) is a payments technology firm that offers digital payments in over 200 countries and territories across the world. Consumers, merchants, financial institutions, corporations, strategic partners, and government agencies are all connected to electronic payments through the company. The payment services segment is where the company operates. Visa.net, the Company's transaction processing network, allows the authorization, clearing, and settlement of payment transactions, allowing it to offer a variety of product. The company operates as a retail electronic payment network with a high volume of payments, transactions, and cards in circulation Transaction processing services, Visa-branded payment products, including credit, debit, prepaid, and cash access programmes for individual, business, and government account users, are among the company's goods and services, platforms, and value-added services to its financial institution and merchant clients. Visa Installments Solution is being rolled out by FIS. Moneris, Global Payments, ANZ, CIBC, HSBC, Scotiabank, and others to their consumers, bringing scale, brand confidence, and simplicity to a popular financing option. Klama inks a worldwide brand agreement with Visa in order to accelerate growth and scalability in a number of areas. Key Financials (Last Fiscal Year) $ illos Schange Revenues 11.5% $22.977 11.55 17.3% $72.574 worldwide brand agreement with Visa in order to accelerate growth and scalability in a number of areas. Key Financials (Last Fiscal Year) Sillions change Revenues (5) Profits (SM) $12.00 Assets (SM) Total Stockholder Equity (5) $34.684 As consumer demand for "Buy Now, Pay Later' (BNPL) solutions grows, Visa (NYSE: V) today announced a growing list of issuers, acquirers, and fintech's that are using Visa's technology both its network-based Visa Installments Solution and its long-standing fintech solutions to provide BNPL options to their customers. According to a recent Visa research, over half of all worldwide customers (42 percent) are interested in instalment financing through their existing credit card or a credit card they may apply for. Visa Installments Solution is being introduced internationally to assist partners satisfy this demand by making issuer-offered BNPL solutions available in-store and via ecommerce platforms. Financial institutions can use the network-based solution to offer BNPL as a customised feature for credit card customers on their previously authorised credit lines. Similarly, acquirers on the network can turn on the ability to permit instalments for any of their Visa-accepting merchants. The solution, which began as a trial in 2019, has now spread to Australia, Canada, Malaysia, Russia, and the United States. Profit Ratios Profit as of Revenues Profits as I of Assets 16.6% Profits as % of Stockholder Equity 52.6% 34.8% Visa is cooperating with Moneris in Canada, as well as CIBC, Commerce Bank, Desjardins Group (Desjardins), Equinox Payments, i2c, Scotiabank, and Versa pay in North America. Visa is launching instalment programmes with ANZ, GHL Systems Malaysia, and Quest Payment Systems in Asia Pacific, after the recent launch with HSBC. Visa has also worked with Home Credit Bank and Russian Standard Bank in Russia. In various locations throughout the world, Visa is also collaborating with CyberSource, FIS, Global Payments, and TSYS, a Global Payments firm, to allow the Visa Installments Solution Visa Installments Solution joins Visa's existing support of 11 collaborating with CyberSource, FIS, Global Payments, and TSYS, a Global Payments firm, to allow the Visa Installments Solution Visa Installments Solution joins Visa's existing support of today's leading BNPL. fintechs, including as Afterpay, ChargeAfter, Klarna, Paidy, Sezzle, Splitit, and Zip, in a worldwide rollout. Since 2017. Visa's fintech solutions have aided fintechs in their growth by granting digital credentials or virtual cards, allowing customers to utilise instalments at checkout without interruption, leveraging Visa's acceptance and reach with sellers, and utilising Visa's security and risk services. In addition, Visa announced this week that Kiarna has entered a worldwide brand relationship with Visa to help it expand and grow in a number of areas. According to a recent Visa poll, future interest in instalment plans is significant and outpaces current use in all countries examined, indicating that BNPL usage has a bright future. According to research, shops benefit from an increase in expenditure and see more customers complete their purchases when BNPL alternatives are accessible at checkout Total Return Total Return to Investors (2019) Total Return to investors (5 year, 24.3% annualized Total Return to Investors (10 year. annualized 43.3% 24.9% At HSBC's end, they try to provide customers with fresh and creative solutions. As they are thrilled to join with Visa and be the first bank outside of North America to introduce the Visa Installments Solution, which will begin in Malaysia, officially marking our entry into the digital Buy Now, Pay Later arena. This function simplifies HSBC Visa credit card clients' point-of-sale purchases when they shop with partner merchants by allowing them to split payments into monthly instalments at no additional cost and without the need for a credit application. We're excited to keep innovating with Visa, particularly executing on our worldwide BNPL strategy. Across the globe, BNPL solutions have emerged as a must- have capability for both card issuers and retailers. "We are ecstatic to be partnering with Visa and to add Visa Installments to our existing BNPL product offering for our issuers and cardholders," said Ava Kelly, Worldwide Head of Products at i2c, a global Visa Ready and Fast Track member. Moneris Chief Product and Partnership Officer, Patrick Diab, stated, "We're thrilled to be collaborating with a reputable brand like Visa on giving a Buy Now, Pay Later option to Canadians." "Providing checkout without interruption; leveraging Visa's acceptance and reach with sellers, and utilising Visa's security and risk services In addition, Visa announced this week that Klarna has entered a worldwide brand relationship with Visa to help it expand and grow in a number of areas. According to a recent Visa poll, future interest in instalment plans is significant and outpaces current use in all countries examined, indicating that BNPL usage has a bright future. According to research, shops benefit from an increase in expenditure and see more customers complete their purchases when BNPL alternatives are accessible at checkout Total Return Total Return to Investors (2019) Total Return to Investors (5 year. annualized) Total Return to Investors (10 year. annualized) 24.3% 24.9% At HSBC's end, they try to provide customers with fresh and creative solutions. As they are thrilled to join with Visa and be the first bank outside of North America to introduce the Visa Installments Solution, which will begin in Malaysia, officially marking our entry into the digital Buy Now, Pay Later arena. This function simplifies HSBC Visa credit card clients' point-of-sale purchases when they shop with partner merchants by allowing them to split payments into monthly instalments at no additional cost and without the need for a credit application. We're excited to keep innovating with Visa, particularly executing on our worldwide BNPL strategy. Across the globe, BNPL solutions have emerged as a must- have capability for both card issuers and retailers. We are ecstatic to be partnering with Visa and to add Visa Installments to our existing BNPL product offering for our issuers and cardholders," said Ava Kelly, Worldwide Head of Products at 2c, a global Visa Ready and Fast Track member. Moneris' Chief Product and Partnership Officer, Patrick Diab, stated, "We're thrilled to be collaborating with a reputable brand like Visa on giving a Buy Now, Pay Later option to Canadians." "Providing our merchants with various payment methods like Buy Now, Pay Later allows them to give their consumers more alternatives when it comes to paying." "We're thrilled to be working with Visa on BNPL," stated Versapay CEO Craig O'Neill. "As a payment facilitator, we were able to enrol merchants into the Visa programme effortlessly. and as the BNPL industry evolves, we envision this being an appealing option for business-to-business transactions, which Versapay understands and serves well

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts