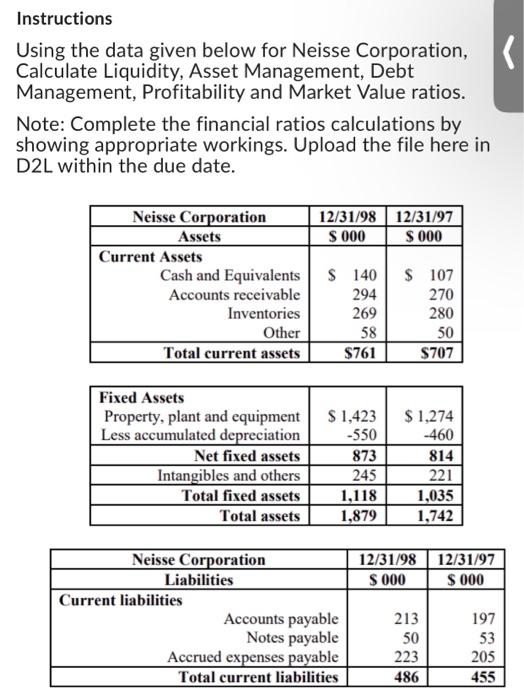

Question: kindly find the below attached. Instructions Using the data given below for Neisse Corporation, Calculate Liquidity, Asset Management, Debt Management, Profitability and Market Value ratios.

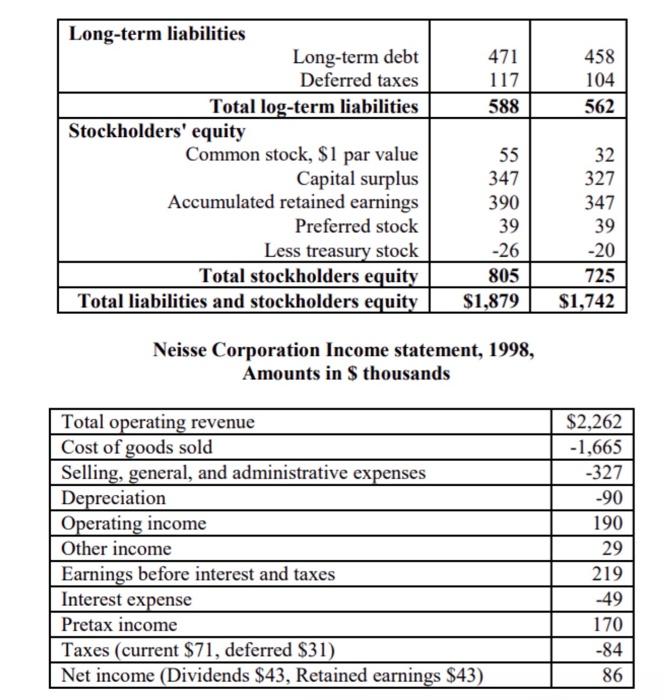

Instructions Using the data given below for Neisse Corporation, Calculate Liquidity, Asset Management, Debt Management, Profitability and Market Value ratios. Note: Complete the financial ratios calculations by showing appropriate workings. Upload the file here in D2L within the due date. 12/31/98 12/31/97 Neisse Corporation Assets $ 000 $ 000 S 140 $ 107 294 270 269 280 58 50 $761 $707 $ 1,423 $ 1,274 -550 -460 873 245 1,118 1,879 Current Assets Cash and Equivalents Accounts receivable Inventories Other Total current assets Fixed Assets Property, plant and equipment Less accumulated depreciation Net fixed assets Intangibles and others Total fixed assets Total assets Neisse Corporation Liabilities Current liabilities Accounts payable Notes payable Accrued expenses payable Total current liabilities 814 221 1,035 1,742 12/31/98 $ 000 213 50 223 486 12/31/97 $ 000 197 53 205 455 Long-term liabilities Long-term debt 471 Deferred taxes 117 Total log-term liabilities 588 Stockholders' equity Common stock, $1 par value 55 Capital surplus 347 Accumulated retained earnings 390 Preferred stock 39 Less treasury stock -26 Total stockholders equity 805 Total liabilities and stockholders equity $1,879 Neisse Corporation Income statement, 1998, Amounts in $ thousands Total operating revenue Cost of goods sold Selling, general, and administrative expenses Depreciation Operating income Other income Earnings before interest and taxes Interest expense Pretax income Taxes (current $71, deferred $31) Net income (Dividends $43, Retained earnings $43) 458 104 562 32 327 347 39 -20 725 $1,742 $2,262 -1,665 -327 -90 190 29 219 -49 170 -84 86

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts