Question: Kindly help answer. Question 6 We know that when a company maintains a fixed leverage ratio, the relationship between leverage and the cost of capital

Kindly help answer.

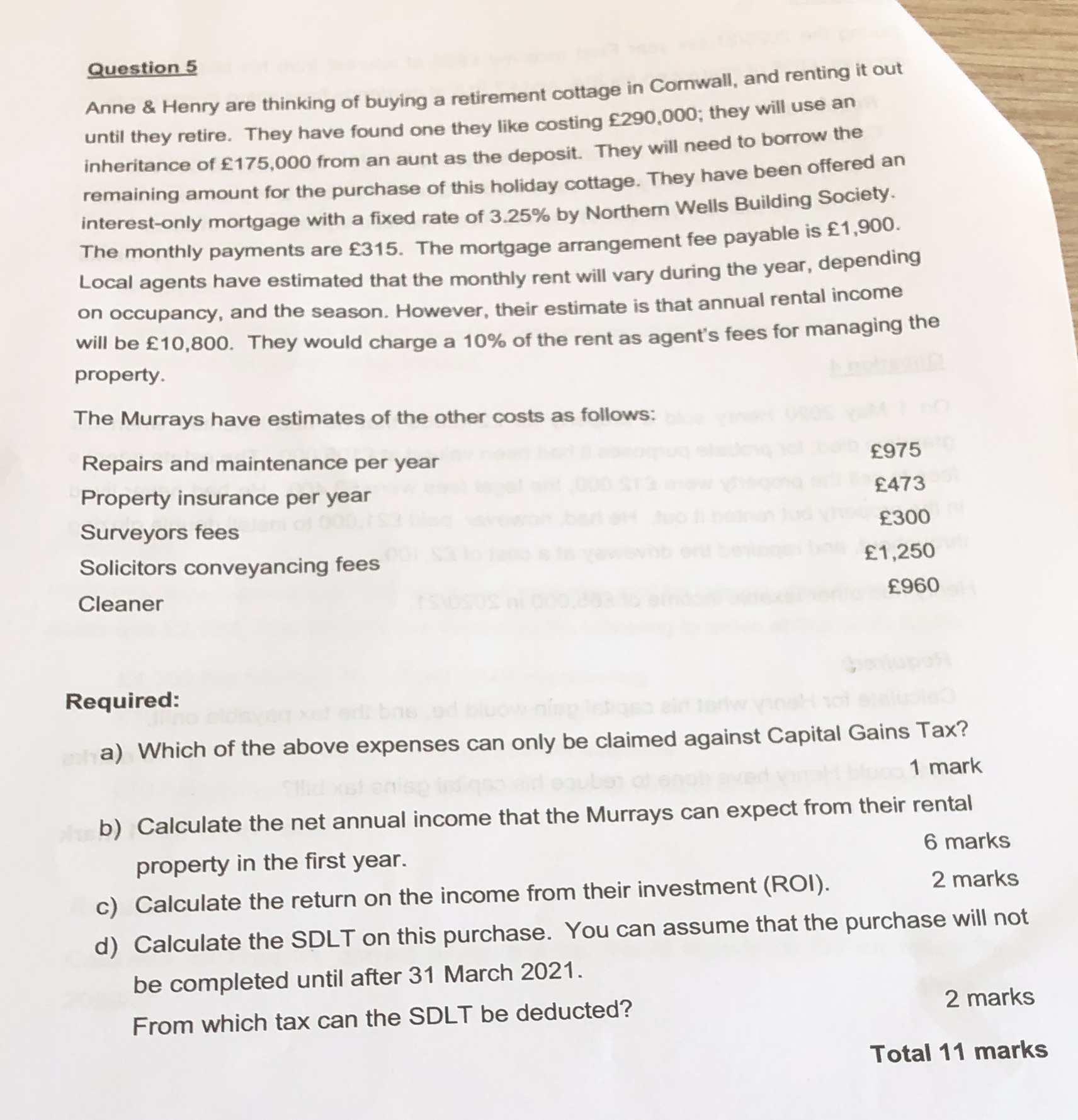

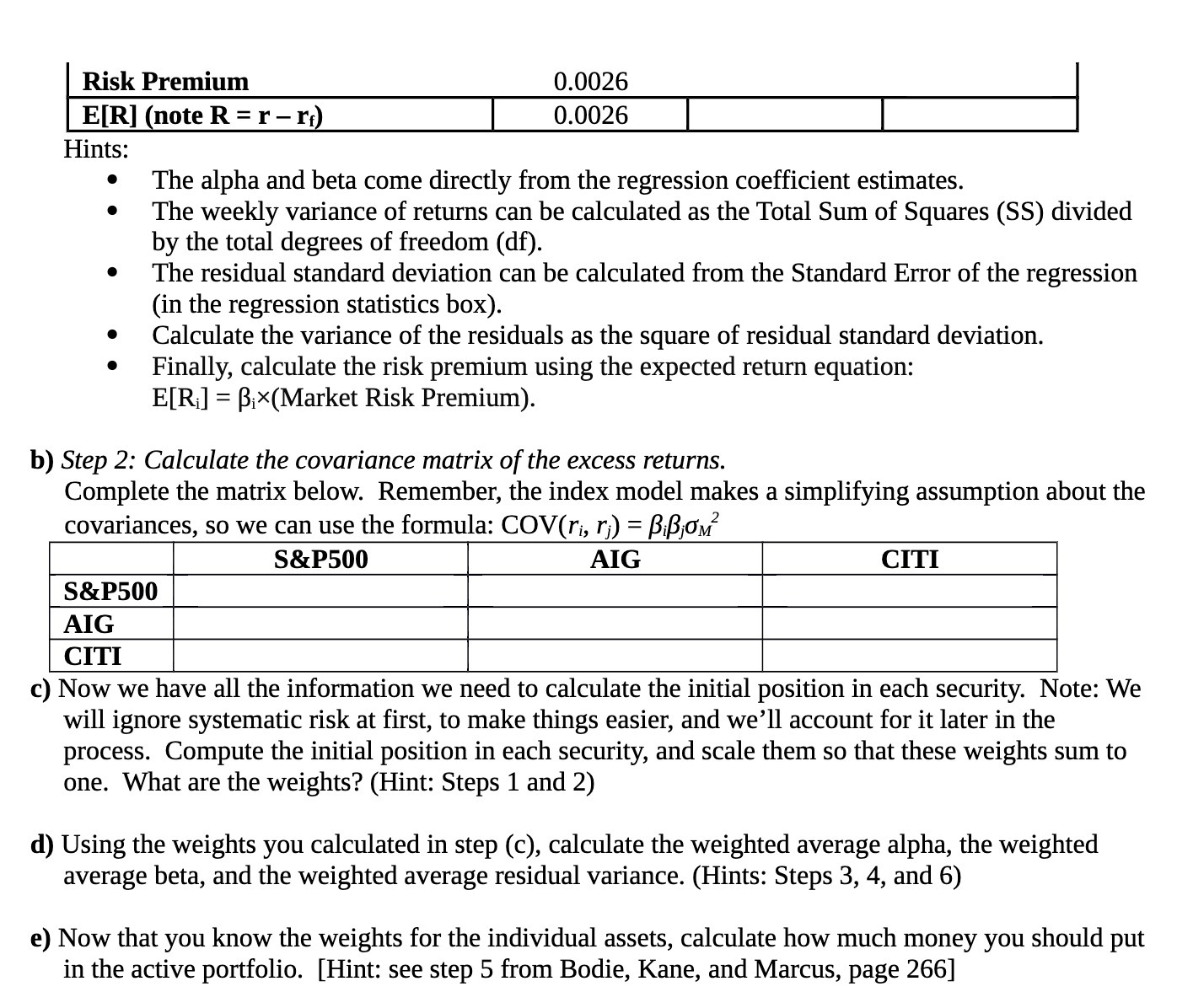

Question 6 We know that when a company maintains a fixed leverage ratio, the relationship between leverage and the cost of capital is given by E D TW ACC D+ED+ ED( 1 - T.). (# ) The rationale for this relationship is that the interest tax shields have the same risk as the company's cash flows. However, when debt is set according to certain schedule for some time, the interest tax shields for that period are known, and thus have the nature of a relatively safe cash-flow. But this implies that these cash flows reduce the effect of leverage on the risk of a firm's equity (in a similar way as cash lowers the impact of debt on the risk of the company's equity). Thus, to account for this effect, we should deduct the value of these "safe" tax shields from the company's debt. Define T's as the present value of the interest tax shields from predetermined debt; then, the risk of a company's equity depends on the debt net of the predetermined tax shields: D' = D-T*. (* * ) With this in mind, consider the following situation. Galt Industries is expected to generate free cash flows of $24 million per year. Galt has permanent debt of $80 million, a corporate tax rate of 40%, and an unlevered cost of capital of 12% and its cost of debt capital is 6%. 1. Compute the value of Galt's equity using the APV method. 2. Obtain a formula that expresses the unlevered cost of capital for a company that has net debt (**) and express re as a function of the adjusted leverage ratio D*/ E. 3. Show that the formula you obtained in point (2) together with (*) yields the following expression for the "WACO' To X D TWACC = TU - D+E Te X D(TU - TD) ) (* * * ) 4. Compute 7" for Galt, and determine the company's WACC. 5. Compute the value of Galt's equity using the WACC method and compute the cost of equity for the company. 6. Compute the expected free cash-flows paid to Galt's equity holders every year.Question 5 Anne & Henry are thinking of buying a retirement cottage in Comwall, and renting it out until they retire. They have found one they like costing $290,000; they will use an inheritance of $175,000 from an aunt as the deposit. They will need to borrow the remaining amount for the purchase of this holiday cottage. They have been offered an interest-only mortgage with a fixed rate of 3.25% by Northern Wells Building Society. The monthly payments are $315. The mortgage arrangement fee payable is $1,900. Local agents have estimated that the monthly rent will vary during the year, depending on occupancy, and the season. However, their estimate is that annual rental income will be $10,800. They would charge a 10% of the rent as agent's fees for managing the property. The Murrays have estimates of the other costs as follows: Repairs and maintenance per year 1975 Property insurance per year E473 Surveyors fees E300 Solicitors conveyancing fees E1,250 Cleaner 1960 Required: a) Which of the above expenses can only be claimed against Capital Gains Tax? 1 mark b) Calculate the net annual income that the Murrays can expect from their rental property in the first year. 6 marks c) Calculate the return on the income from their investment (ROI). 2 marks d) Calculate the SDLT on this purchase. You can assume that the purchase will not be completed until after 31 March 2021. From which tax can the SDLT be deducted? 2 marks Total 11 marksRisk Premium 0.0026 -_ Hints: 0 The alpha and beta come directly from the regression coefficient estimates. 0 The weekly variance of returns can be calculated as the Total Sum of Squares (S S) divided by the total degrees of freedom (df). - The residual standard deviation can be calculated from the Standard Error of the regression (in the regression statistics box). 0 Calculate the variance of the residuals as the square of residual standard deviation. 0 Finally, calculate the risk premium using the expected return equation: HR] = [31X(Market Risk Premium). b) Step 2: Calculate the covariance matrix of the excess returns. Complete the matrix below. Remember, the index model makes a simplifying assumption about the covariances, so we can use the formula: COV(r.-, r,) = BiBjUM2 _ S&P500 S&P500 c) Now we have all the information we need to calculate the initial position in each security. Note: We will ignore systematic risk at first, to make things easier, and we'll account for it later in the process. Compute the initial position in each security, and scale them so that these weights sum to one. What are the weights? (Hint: Steps 1 and 2) d) Using the weights you calculated in step (c), calculate the weighted average alpha, the weighted average beta, and the weighted average residual variance. (Hints: Steps 3, 4, and 6) e) Now that you know the weights for the individual assets, calculate how much money you should put in the active portfolio. [Hint see step 5 from Bodie, Kane, and Marcus, page 266]