Question: Kindly help with ratios??? First attachment is hidden enteries and amounts for 2018 (Important) Accounts Receivable ratio Kindly consider the hidden enteries to calculate credit

Kindly help with ratios??? First attachment is hidden enteries and amounts for 2018 (Important)

Accounts Receivable ratio Kindly consider the hidden enteries to calculate credit sales. Also for Avg Accounts receivable Do we need to take Accounts receiavble avg OR Accounts Receiable,Net allowance for doubt debts Average??? Since 2018 only has Accounts Receiable,Net allowance for doubt debts Average.

Debt equity ratio??? In text book there is formula shorttermdebt+long termdebt-Cash/shareholders equity but on google its showing total liabilities/shareholders equity kindly help with this correct solution and reasoning

Return on Assets ???? In hidden enteries there is information given abkut depreciation but as seen in 2019 assets are already depreciated and 2018 we dont have bifurcation of assets so is this entery just for confusion??? please help with solution and reasoning

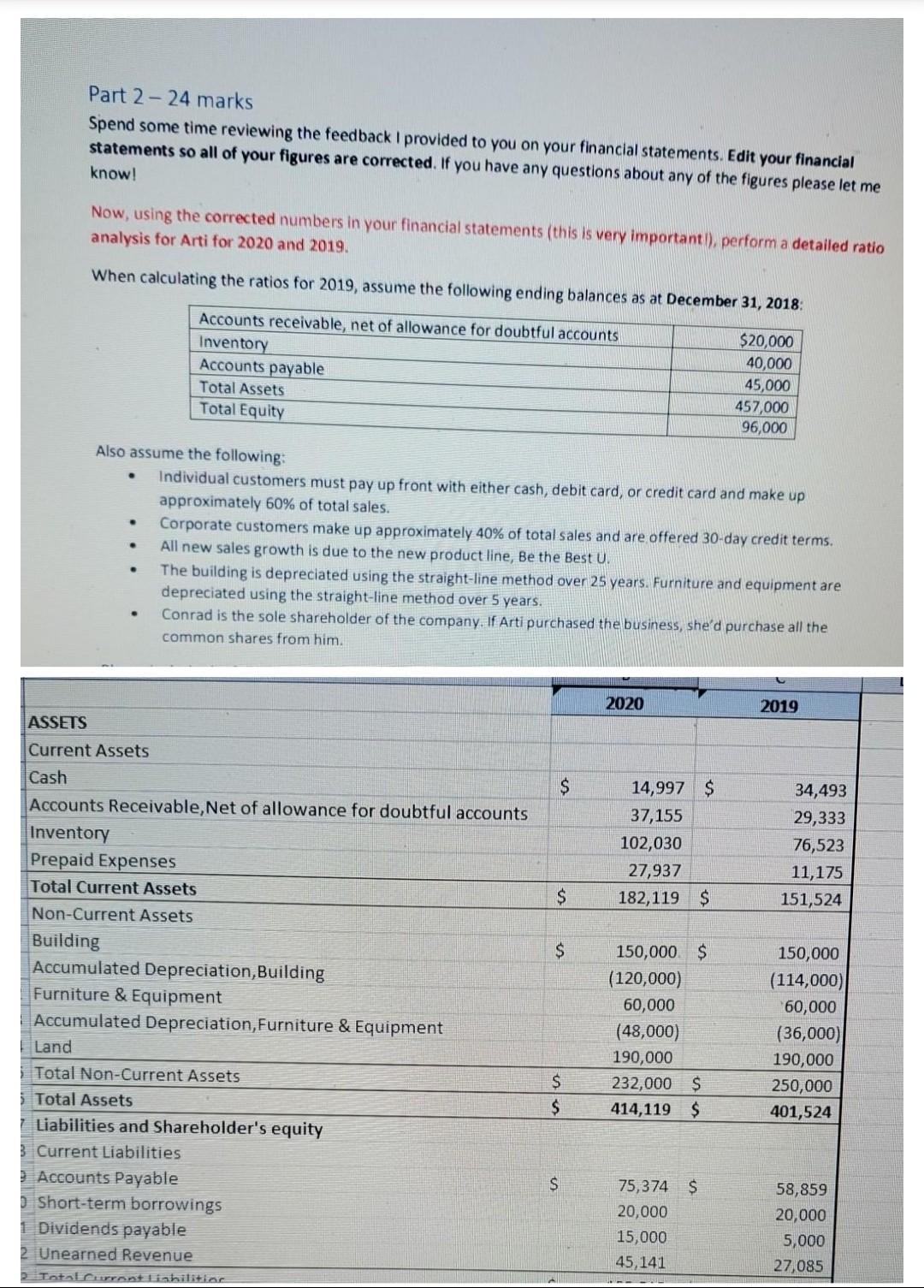

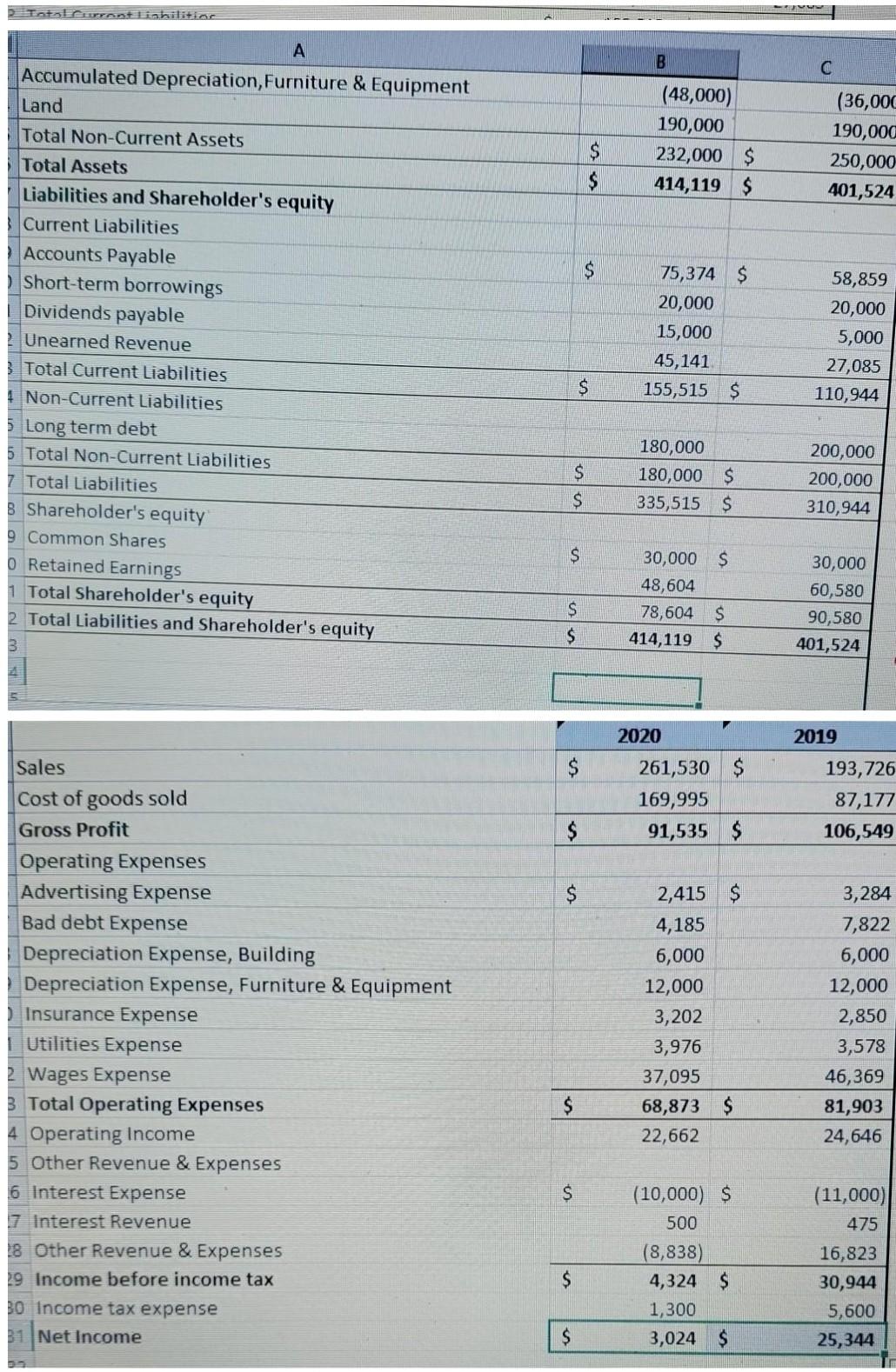

Part 2 - 24 marks Spend some time reviewing the feedback I provided to you on your financial statements. Edit your financial statements so all of your figures are corrected. If you have any questions about any of the figures please let me know! Now, using the corrected numbers in your financial statements (this is very important), perform a detailed ratio analysis for Arti for 2020 and 2019 When calculating the ratios for 2019, assume the following ending balances as at December 31, 2018 Accounts receivable, net of allowance for doubtful accounts Inventory Accounts payable Total Assets Total Equity $20,000 40,000 45,000 457,000 96,000 . Also assume the following: Individual customers must pay up front with either cash, debit card, or credit card and make up approximately 60% of total sales. Corporate customers make up approximately 40% of total sales and are offered 30-day credit terms. All new sales growth is due to the new product line, Be the Best U. The building is depreciated using the straight-line method over 25 years. Furniture and equipment are depreciated using the straight-line method over 5 years. Conrad is the sole shareholder of the company. If Arti purchased the business, she'd purchase all the common shares from him. 2020 2019 $ 14,997 $ 37,155 102,030 27,937 182,119 $ 34,493 29,333 76,523 11,175 151,524 $ $ ASSETS Current Assets Cash Accounts Receivable, Net of allowance for doubtful accounts Inventory Prepaid Expenses Total Current Assets Non-Current Assets Building Accumulated Depreciation, Building Furniture & Equipment Accumulated Depreciation, Furniture & Equipment Land Total Non-Current Assets Total Assets Liabilities and Shareholder's equity 3 Current Liabilities Accounts Payable Short-term borrowings Dividends payable 2 Unearned Revenue Total Curront liabilitiar 150,000 $ (120,000) 60,000 (48,000) 190,000 232,000 $ 414,119 $ 150,000 (114,000) 60,000 (36,000) 190,000 250,000 401,524 $ $ S 75,374 $ 20,000 15,000 45,141 58,859 20,000 5,000 27,085 Tata inhittiar A C (48,000) 190,000 232,000 $ 414,119 $ $ $ (36,000 190,000 250,000 401,524 $ Accumulated Depreciation, Furniture & Equipment Land Total Non-Current Assets Total Assets Liabilities and Shareholder's equity Current Liabilities Accounts Payable Short-term borrowings Dividends payable Unearned Revenue 3 Total Current Liabilities 1 Non-Current Liabilities 5 Long term debt 5 Total Non-Current Liabilities 7 Total Liabilities 8 Shareholder's equity 9 Common Shares O Retained Earnings 1 Total Shareholder's equity 2 Total Liabilities and Shareholder's equity 3 75,374 $ 20,000 15,000 45,141 155,515 $ 58,859 20,000 5,000 27,085 110,944 $ $ $ 180,000 180,000 $ 335,515 $ 200,000 200,000 310,944 $ 30,000 $ 48,604 78,604 $ 414,119 $ $ $ 30,000 60,580 90,580 401,524 2019 $ 2020 261,530 $ 169,995 91,535 $ 193,726 87,177 106,549 $ $ Sales Cost of goods sold Gross Profit Operating Expenses Advertising Expense Bad debt Expense Depreciation Expense, Building Depreciation Expense, Furniture & Equipment ) Insurance Expense | Utilities Expense 2 Wages Expense 3 Total Operating Expenses 4 Operating Income 5 Other Revenue & Expenses 6 Interest Expense 7 Interest Revenue 18 Other Revenue & Expenses 19 Income before income tax 30 Income tax expense 31 Net Income 2,415 $ 4,185 6,000 12,000 3,202 3,976 37,095 68,873 $ 22,662 3,284 7,822 6,000 12,000 2,850 3,578 46,369 81,903 24,646 $ $ (10,000) $ 500 (8,838) 4,324 $ 1,300 3,024 $ (11,000) 475 16,823 30,944 5,600 25,344 $ $ Part 2 - 24 marks Spend some time reviewing the feedback I provided to you on your financial statements. Edit your financial statements so all of your figures are corrected. If you have any questions about any of the figures please let me know! Now, using the corrected numbers in your financial statements (this is very important), perform a detailed ratio analysis for Arti for 2020 and 2019 When calculating the ratios for 2019, assume the following ending balances as at December 31, 2018 Accounts receivable, net of allowance for doubtful accounts Inventory Accounts payable Total Assets Total Equity $20,000 40,000 45,000 457,000 96,000 . Also assume the following: Individual customers must pay up front with either cash, debit card, or credit card and make up approximately 60% of total sales. Corporate customers make up approximately 40% of total sales and are offered 30-day credit terms. All new sales growth is due to the new product line, Be the Best U. The building is depreciated using the straight-line method over 25 years. Furniture and equipment are depreciated using the straight-line method over 5 years. Conrad is the sole shareholder of the company. If Arti purchased the business, she'd purchase all the common shares from him. 2020 2019 $ 14,997 $ 37,155 102,030 27,937 182,119 $ 34,493 29,333 76,523 11,175 151,524 $ $ ASSETS Current Assets Cash Accounts Receivable, Net of allowance for doubtful accounts Inventory Prepaid Expenses Total Current Assets Non-Current Assets Building Accumulated Depreciation, Building Furniture & Equipment Accumulated Depreciation, Furniture & Equipment Land Total Non-Current Assets Total Assets Liabilities and Shareholder's equity 3 Current Liabilities Accounts Payable Short-term borrowings Dividends payable 2 Unearned Revenue Total Curront liabilitiar 150,000 $ (120,000) 60,000 (48,000) 190,000 232,000 $ 414,119 $ 150,000 (114,000) 60,000 (36,000) 190,000 250,000 401,524 $ $ S 75,374 $ 20,000 15,000 45,141 58,859 20,000 5,000 27,085 Tata inhittiar A C (48,000) 190,000 232,000 $ 414,119 $ $ $ (36,000 190,000 250,000 401,524 $ Accumulated Depreciation, Furniture & Equipment Land Total Non-Current Assets Total Assets Liabilities and Shareholder's equity Current Liabilities Accounts Payable Short-term borrowings Dividends payable Unearned Revenue 3 Total Current Liabilities 1 Non-Current Liabilities 5 Long term debt 5 Total Non-Current Liabilities 7 Total Liabilities 8 Shareholder's equity 9 Common Shares O Retained Earnings 1 Total Shareholder's equity 2 Total Liabilities and Shareholder's equity 3 75,374 $ 20,000 15,000 45,141 155,515 $ 58,859 20,000 5,000 27,085 110,944 $ $ $ 180,000 180,000 $ 335,515 $ 200,000 200,000 310,944 $ 30,000 $ 48,604 78,604 $ 414,119 $ $ $ 30,000 60,580 90,580 401,524 2019 $ 2020 261,530 $ 169,995 91,535 $ 193,726 87,177 106,549 $ $ Sales Cost of goods sold Gross Profit Operating Expenses Advertising Expense Bad debt Expense Depreciation Expense, Building Depreciation Expense, Furniture & Equipment ) Insurance Expense | Utilities Expense 2 Wages Expense 3 Total Operating Expenses 4 Operating Income 5 Other Revenue & Expenses 6 Interest Expense 7 Interest Revenue 18 Other Revenue & Expenses 19 Income before income tax 30 Income tax expense 31 Net Income 2,415 $ 4,185 6,000 12,000 3,202 3,976 37,095 68,873 $ 22,662 3,284 7,822 6,000 12,000 2,850 3,578 46,369 81,903 24,646 $ $ (10,000) $ 500 (8,838) 4,324 $ 1,300 3,024 $ (11,000) 475 16,823 30,944 5,600 25,344 $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts