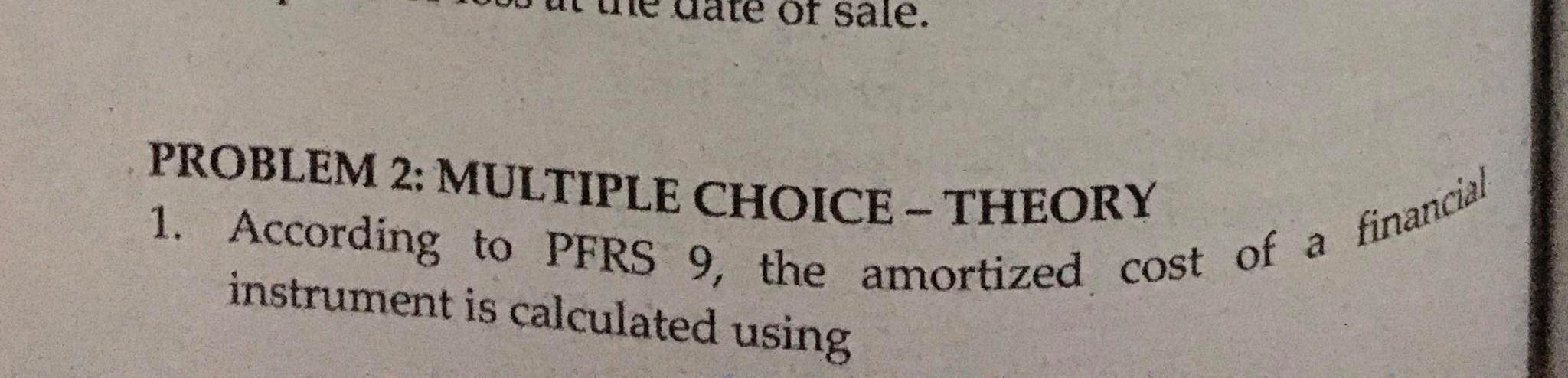

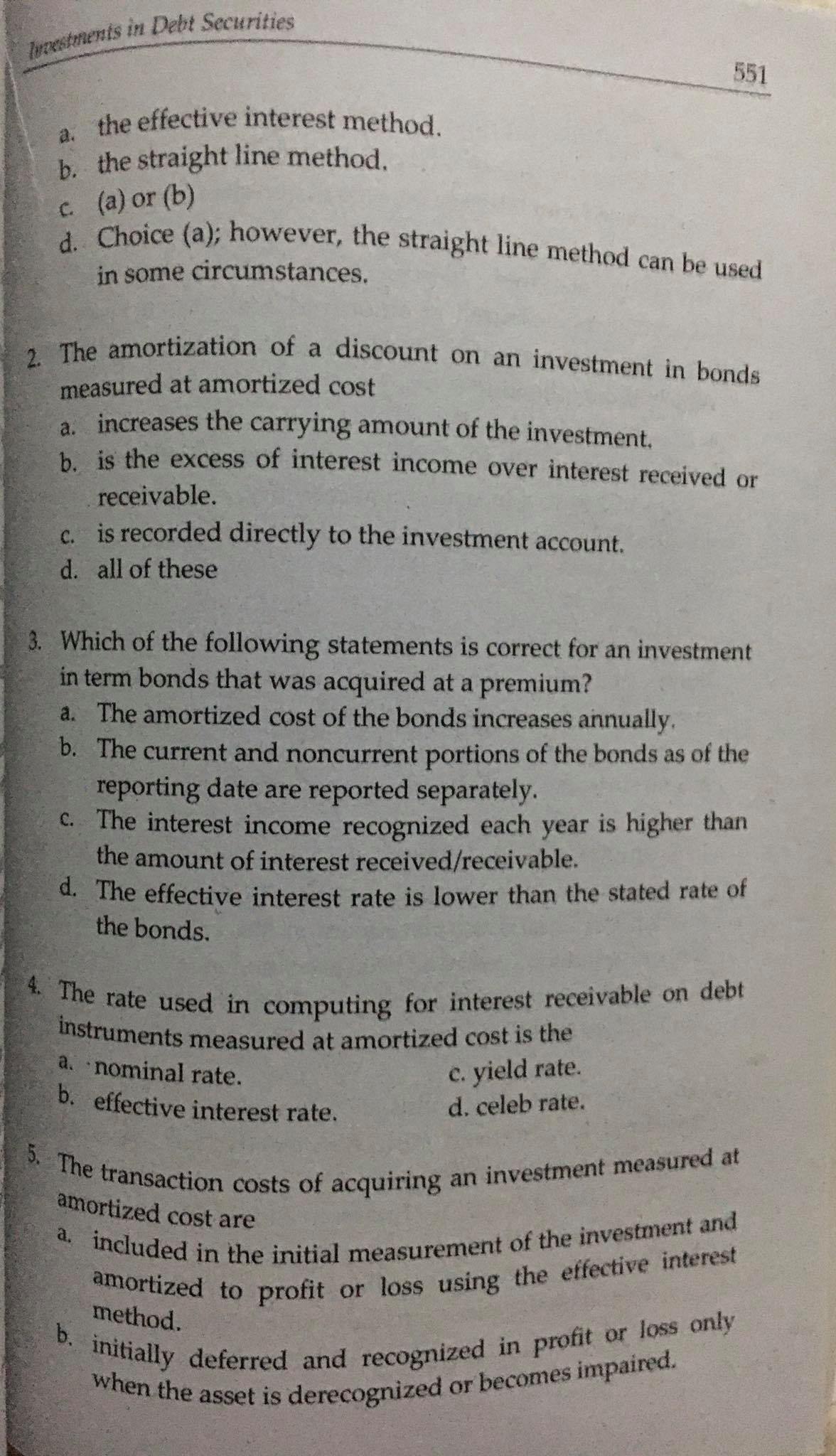

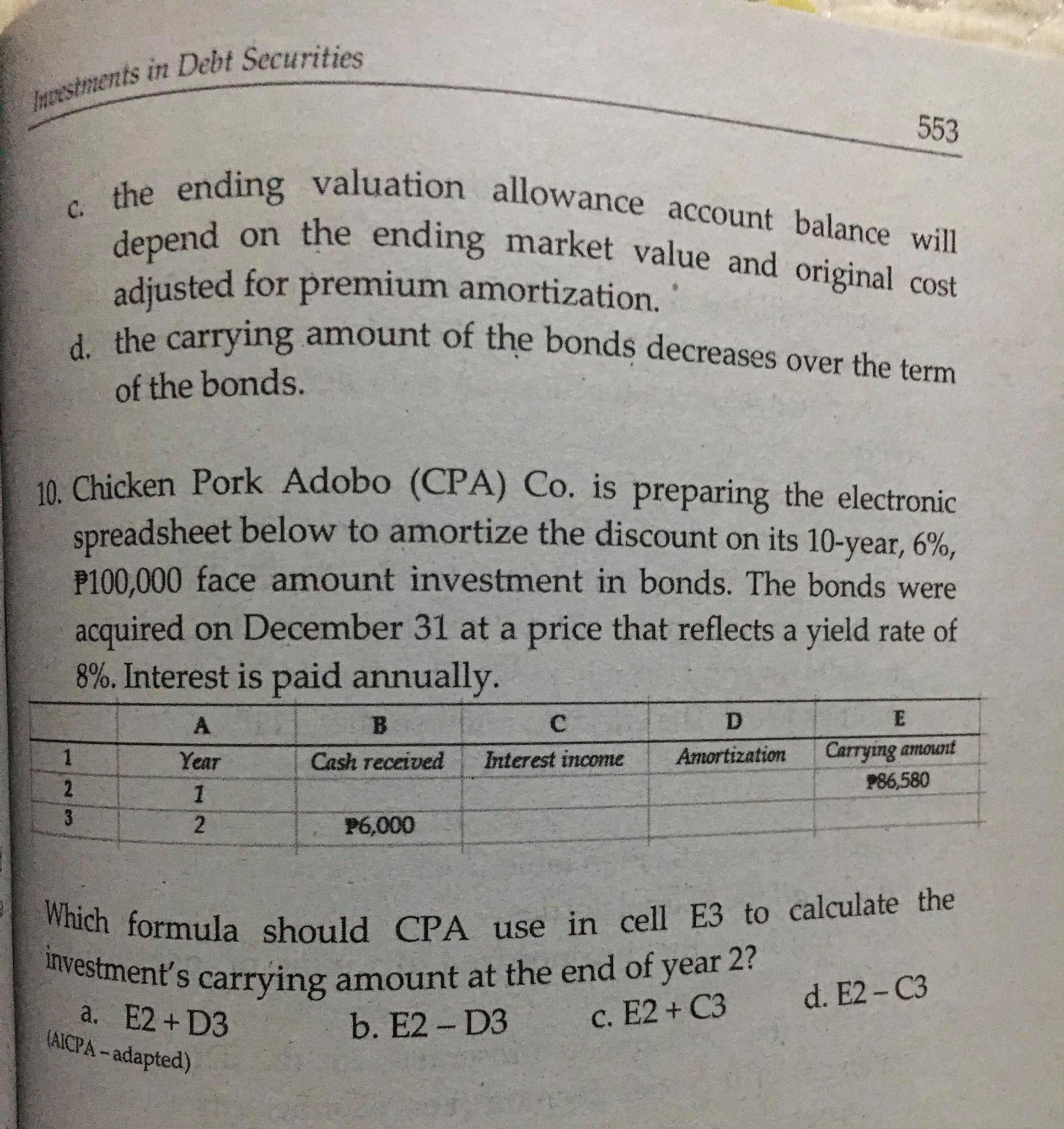

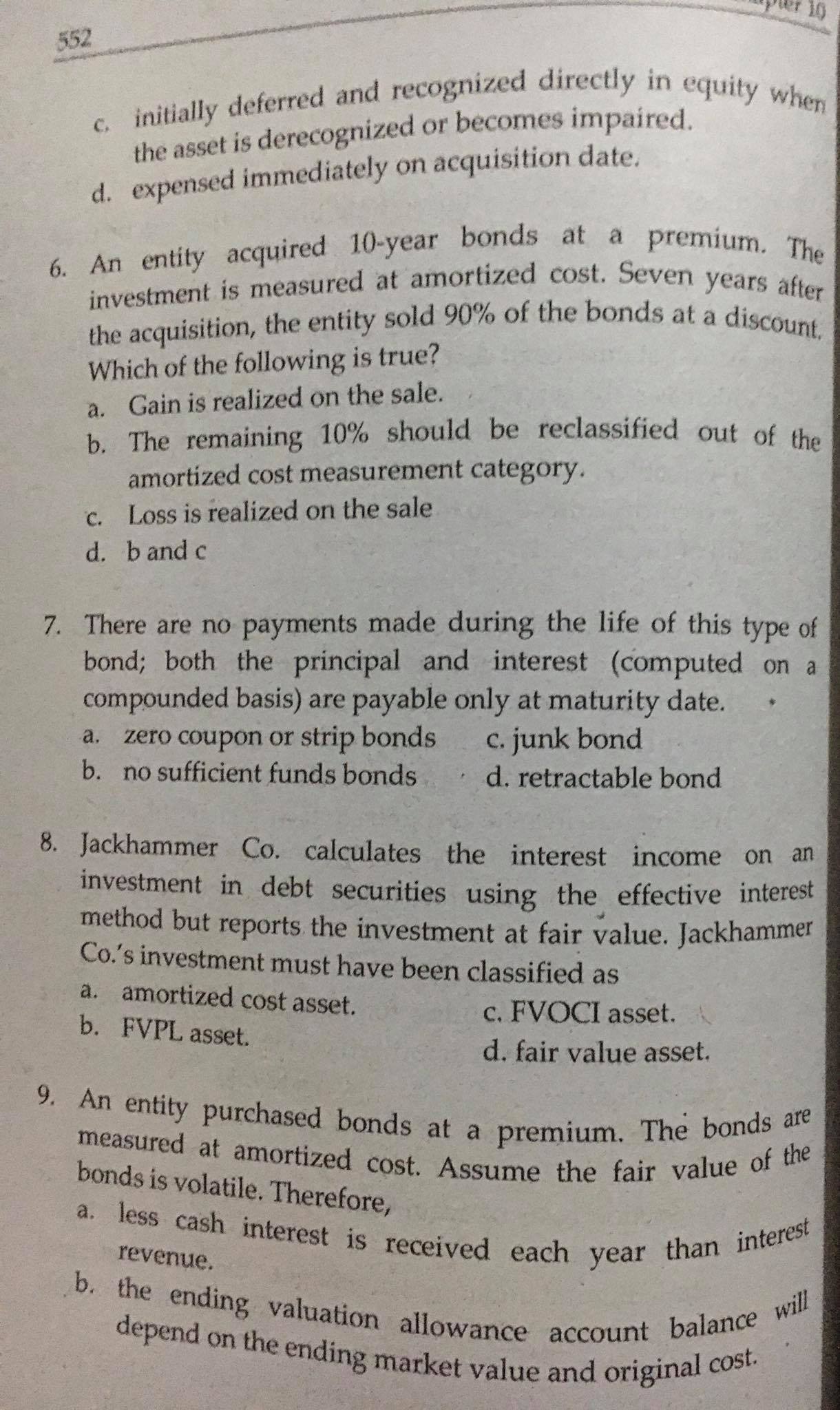

Question: Kindly indicate solution as my guide for better understanding, thanks! uit date of sale. PROBLEM 2: MULTIPLE CHOICE - THEORY 1 According to PFRS 9,

"Kindly indicate solution as my guide for better understanding, thanks!"

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock