Question: Kindly please answer the questions that are wrong with explanation Break-Even with Multiple Products Wagner Enterprise sells two products, large tractors and small tractors. A

Kindly please answer the questions that are wrong with explanation

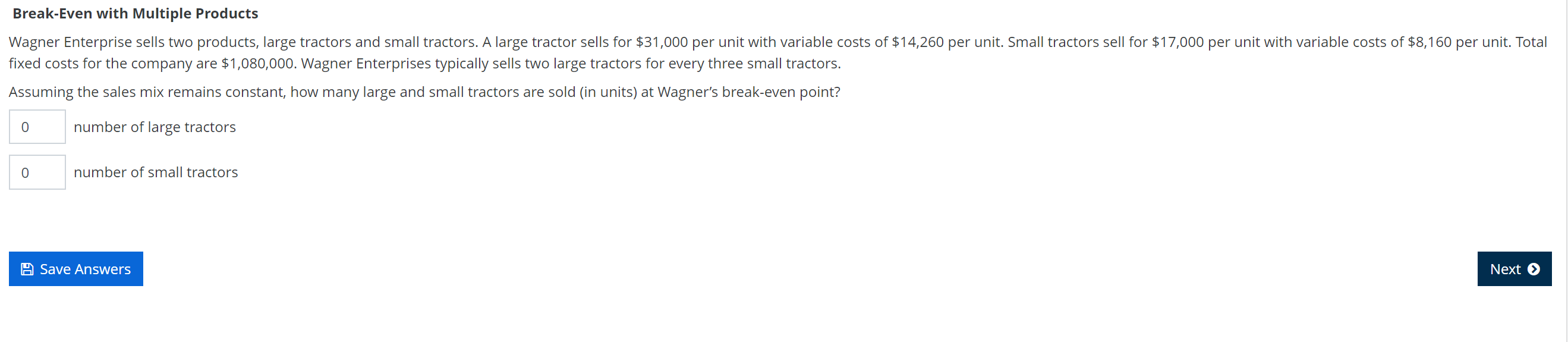

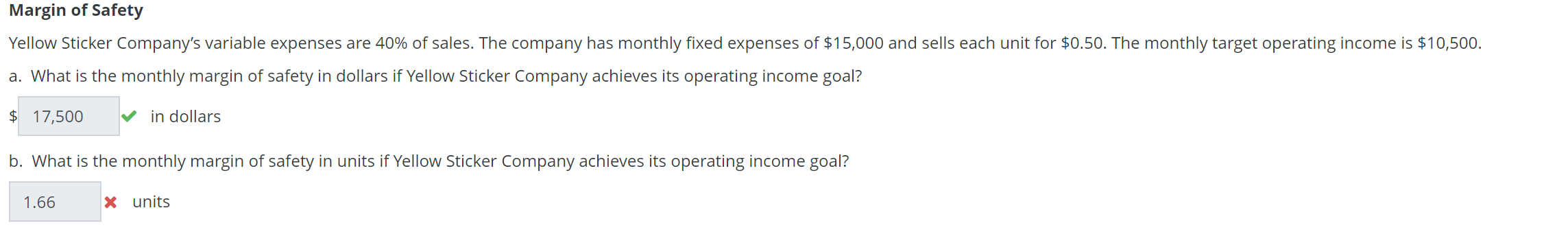

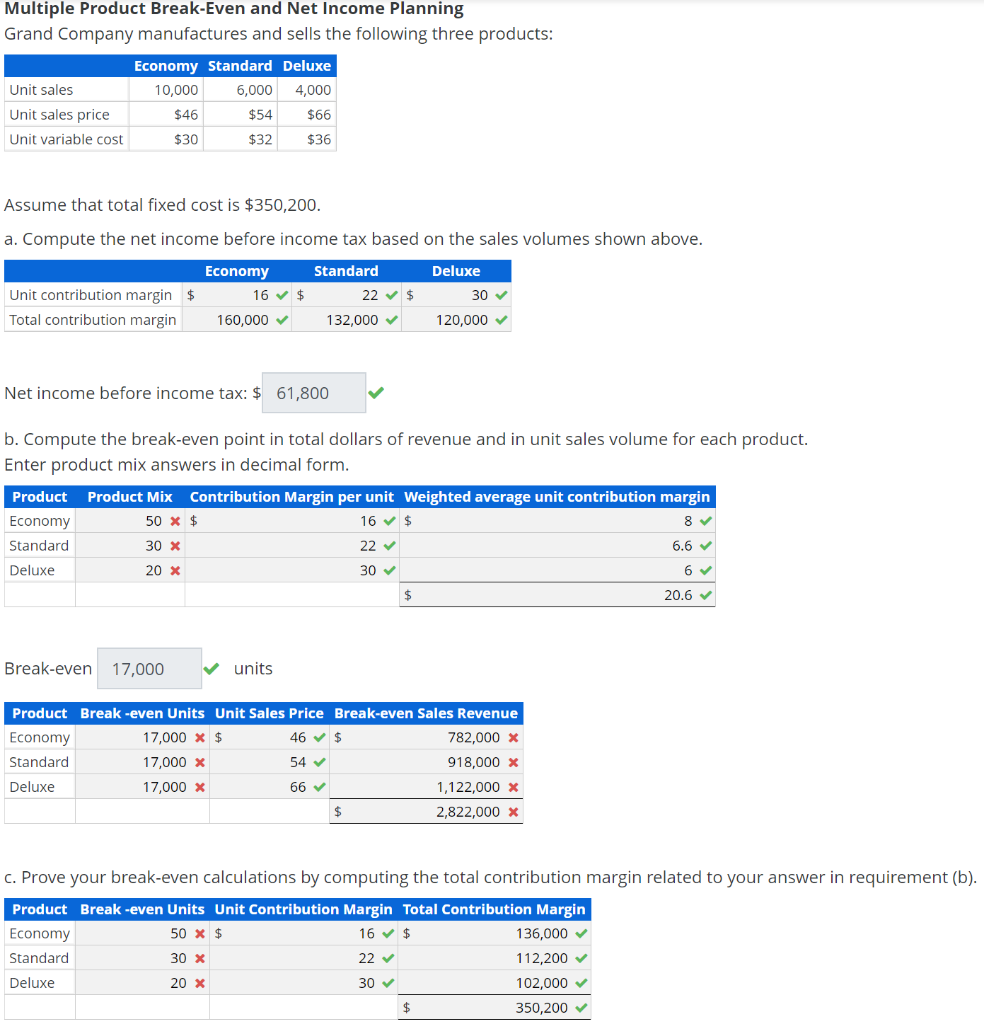

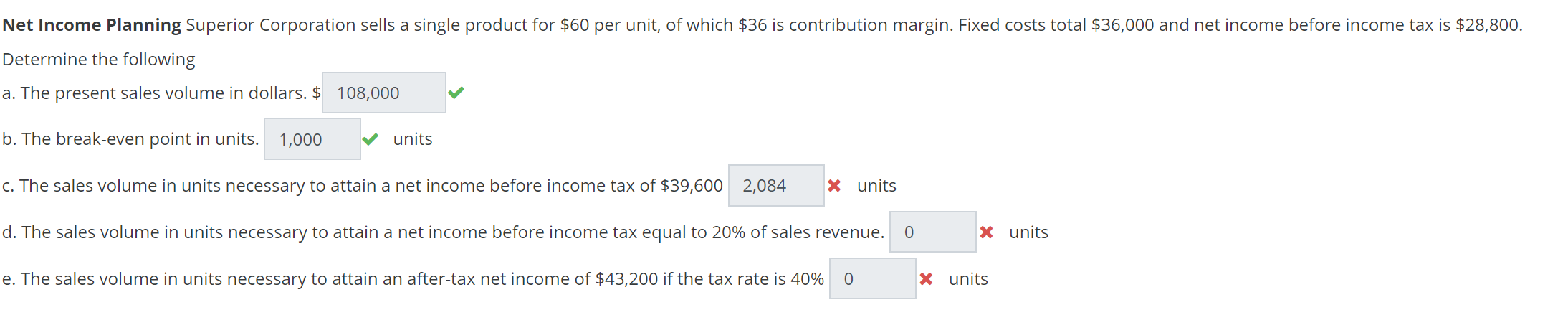

Break-Even with Multiple Products Wagner Enterprise sells two products, large tractors and small tractors. A large tractor sells for $31,000 per unit with variable costs of $14,260 per unit. Small tractors sell for $17,000 per unit with variable costs of $8,160 per unit. Total fixed costs for the company are $1,080,000. Wagner Enterprises typically sells two large tractors for every three small tractors. Assuming the sales mix remains constant, how many large and small tractors are sold (in units) at Wagner's break-even point? O number of large tractors number of small tractors A Save Answers Next > Margin of Safety Yellow Sticker Company's variable expenses are 40% of sales. The company has monthly fixed expenses of $15,000 and sells each unit for $0.50. The monthly target operating income is $10,500. a. What is the monthly margin of safety in dollars if Yellow Sticker Company achieves its operating income goal? $ 17,500 in dollars b. What is the monthly margin of safety in units if Yellow Sticker Company achieves its operating income goal? 1.66 x units Multiple Product Break-Even and Net Income Planning Grand Company manufactures and sells the following three products: Unit sales Unit sales price Unit variable cost Economy Standard Deluxe 10,000 6,000 4,000 $46 $54 $66 $30 $32 $36 Assume that total fixed cost is $350,200. a. Compute the net income before income tax based on the sales volumes shown above. Economy Standard Deluxe Unit contribution margin $ 16 $ 22 $ 30 Total contribution margin 160,000 132,000 120,000 Net income before income tax: $ 61,800 b. Compute the break-even point in total dollars of revenue and in unit sales volume for each product. Enter product mix answers in decimal form. Product Product Mix Contribution Margin per unit Weighted average unit contribution margin Economy 50 * $ 16 $ 8 Standard 30 x 22 6.6 Deluxe 20 X 30 20.6 Break-even 17,000 units Product Break-even Units Unit Sales Price Break-even Sales Revenue Economy 17,000 x $ 46 $ 782,000 x Standard 17,000 x 54 918,000 x Deluxe 17,000 x 66 1,122,000 x 2,822,000 X C. Prove your break-even calculations by computing the total contribution margin related to your answer in requirement (b). Product Break-even Units Unit Contribution Margin Total Contribution Margin Economy 50 X $ 16 $ 136,000 Standard 30 x 22 112,200 Deluxe 20 x 30 102,000 350,200 Net Income Planning Superior Corporation sells a single product for $60 per unit, of which $36 is contribution margin. Fixed costs total $36,000 and net income before income tax is $28,800. Determine the following a. The present sales volume in dollars. $ 108,000 b. The break-even point in units. 1,000 units C. The sales volume in units necessary to attain a net income before income tax of $39,600 2,084 x units d. The sales volume in units necessary to attain a net income before income tax equal to 20% of sales revenue. O x units e. The sales volume in units necessary to attain an after-tax net income of $43,200 if the tax rate is 40% 0 units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts