Question: Kindly please solve Question (ii) for me: Here is the data provided for the question: And here is Question (ii) : A B E F

Kindly please solve Question (ii) for me:

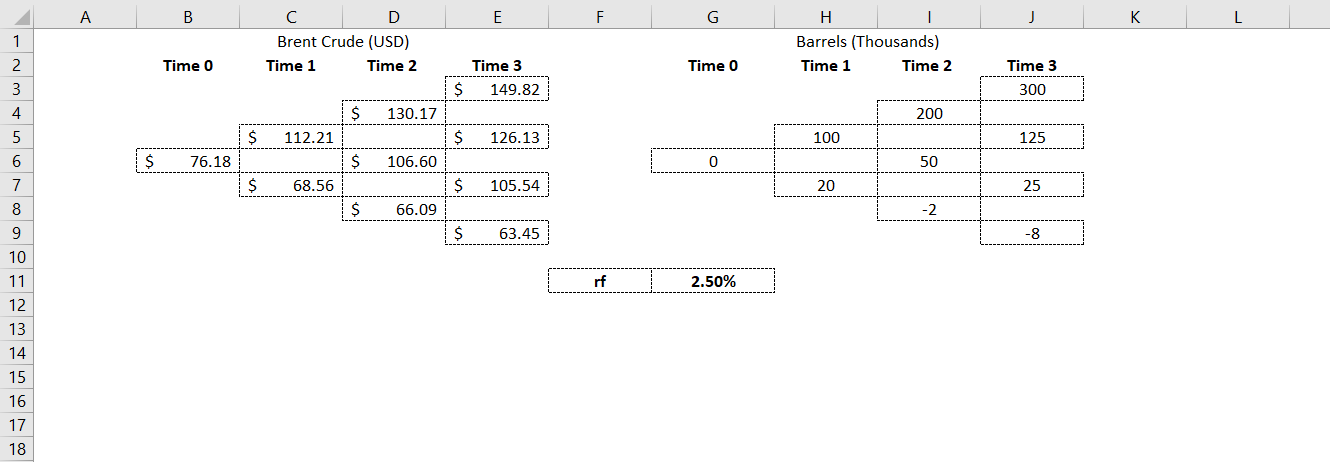

Here is the data provided for the question:

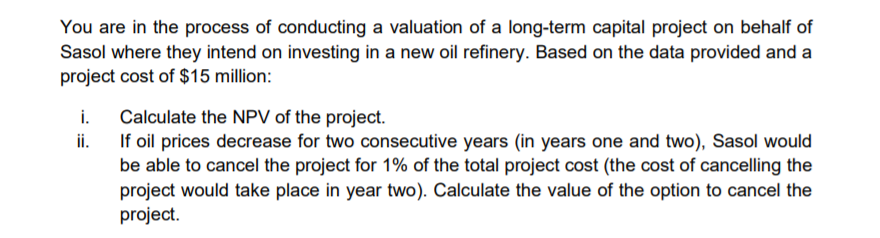

And here is Question (ii):

A B E F G j K L C D Brent Crude (USD) Time 1 Time 2 H Barrels (Thousands) Time 1 Time 2 Time 0 Time 0 1 2 3 4 5 Time 3 $ 149.82 Time 3 300 $ 130.17 200 $ 112.21 $ 126.13 100 125 $ 76.18 $ 106.60 0 50 $ 68.56 $ 105.54 20 25 $ 66.09 -2 $ 63.45 -8 rf 2.50% 6 7 8 9 10 11 12 13 14 15 16 17 18 You are in the process of conducting a valuation of a long-term capital project on behalf of Sasol where they intend on investing in a new oil refinery. Based on the data provided and a project cost of $15 million: i. Calculate the NPV of the project. ii. If oil prices decrease for two consecutive years in years one and two), Sasol would be able to cancel the project for 1% of the total project cost (the cost of cancelling the project would take place in year two). Calculate the value of the option to cancel the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts