Question: kindly provide me the working solution (a) Butte Inc., a well-known branded company, and XDA Corp., a generic (unbranded) company comepete in an industry expected

kindly provide me the working solution

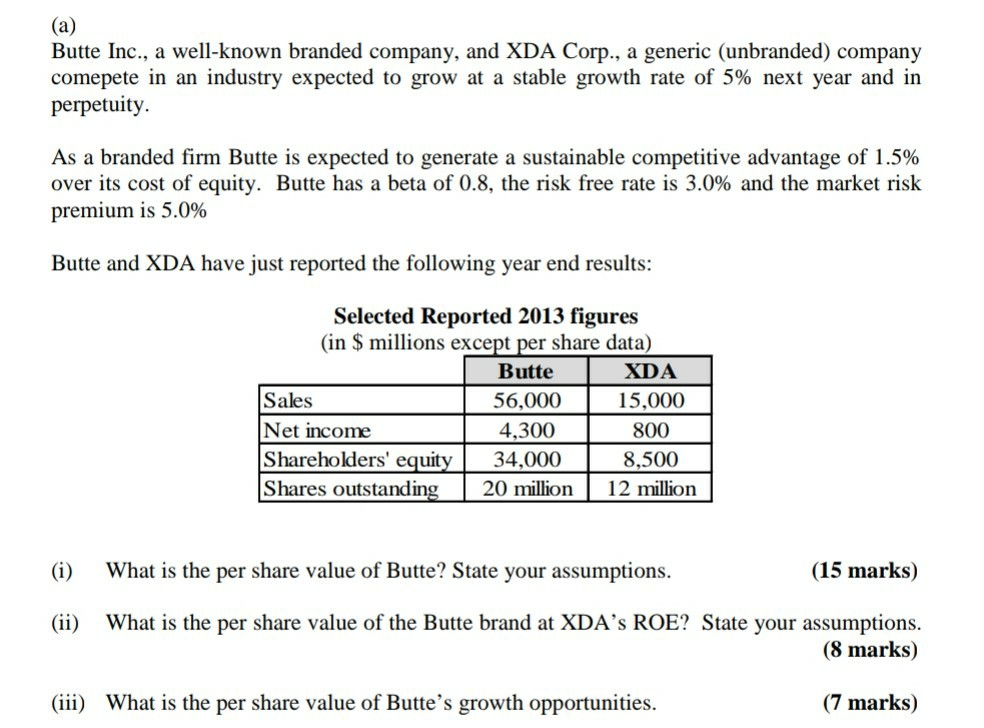

(a) Butte Inc., a well-known branded company, and XDA Corp., a generic (unbranded) company comepete in an industry expected to grow at a stable growth rate of 5% next year and in perpetuity. As a branded firm Butte is expected to generate a sustainable competitive advantage of 1.5% over its cost of equity. Butte has a beta of 0.8, the risk free rate is 3.0% and the market risk premium is 5.0% Butte and XDA have just reported the following year end results: Selected Reported 2013 figures (in $ millions except per share data) Butte XDA Sales 56,000 15,000 Net income 4,300 800 Shareholders' equity 34,000 8,500 Shares outstanding 20 million 12 million (i) What is the per share value of Butte? State your assumptions. (15 marks) What is the per share value of the Butte brand at XDA's ROE? State your assumptions. (8 marks) (iii) What is the per share value of Butte's growth opportunities. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts