Question: Kindly show how to answer 5-6 until 5-9 Problem 5-6 (AICPA Adapted) United Company reported the following unadjusted current Problem 5-8 (LAA) assets and shareholders'

Kindly show how to answer 5-6 until 5-9

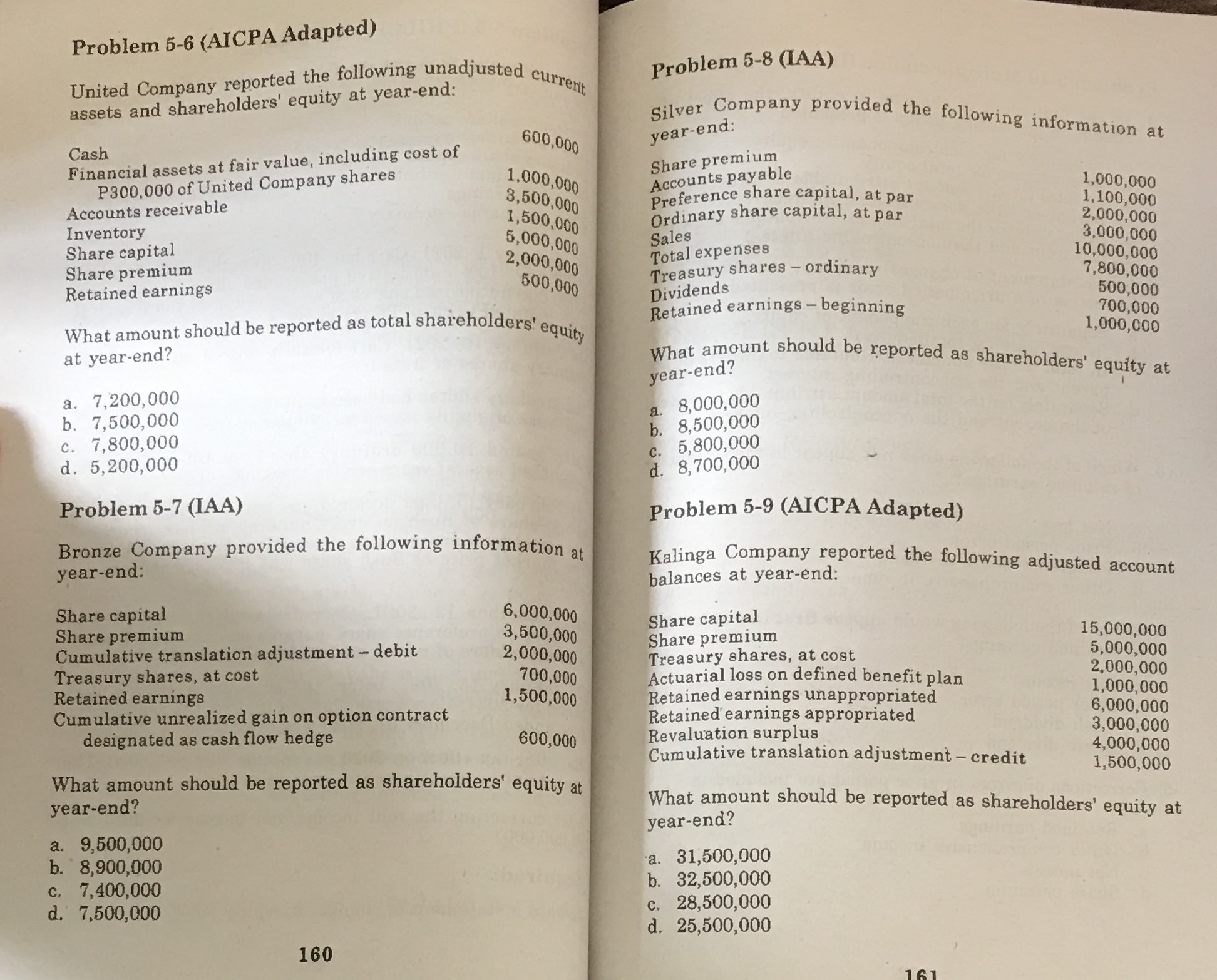

Problem 5-6 (AICPA Adapted) United Company reported the following unadjusted current Problem 5-8 (LAA) assets and shareholders' equity at year-end: year-end: Silver Company provided the following information at Cash 600,000 Financial assets at fair value, including cost of Share premium P300,000 of United Company shares 1,000,000 Accounts payable 1,000,000 Accounts receivable 3,500,000 Preference share capital, at par Inventory 1,500,000 Ordinary share capital, at par 1,100,000 2,000,000 Share capital 5,000,000 Sales 3,000,000 Share premium 2,000,000 Total expenses 10,000,000 Retained earnings 500,000 Treasury shares - ordinary 7,800,000 Dividends 500,000 What amount should be reported as total shareholders' equity Retained earnings - beginning 700,000 1,000,000 at year-end? year-end? What amount should be reported as shareholders' equity at a. 7,200,000 b. 7,500, 000 a. 8,000,000 C. 7,800, 000 b. 8,500,000 c. 5,800,000 d. 5,200,000 d. 8, 700,000 Problem 5-7 (IAA) Problem 5-9 (AICPA Adapted) Bronze Company provided the following information at year-end: Kalinga Company reported the following adjusted account balances at year-end: Share capital 6,000,000 Share premium 3,500,000 Share capital Cumulative translation adjustment - debit Share premium 15,000,000 2,000,000 Treasury shares, at cost 5,000,000 Treasury shares, at cost 700,000 Retained earnings Actuarial loss on defined benefit plan 2,000,000 1,500,000 Retained earnings unappropriated 1,000,000 Cumulative unrealized gain on option contract Retained earnings appropriated 6,000,000 designated as cash flow hedge 600,000 Revaluation surplus 3,000,000 Cumulative translation adjustment - credit 4,000,000 What amount should be reported as shareholders' equity at 1,500,000 year-end? What amount should be reported as shareholders' equity at year-end? a. 9,500,000 b. 8,900,000 a. 31,500,000 C. 7,400,000 b. 32,500,000 d. 7,500,000 c. 28,500,000 d. 25,500,000 160