Question: kindly show the calculation methods 100% step by step kindly show the calculation methods 100% step by step Answer all the questions 1. Justin is

kindly show the calculation methods 100% step by step

kindly show the calculation methods 100% step by step Answer all the questions

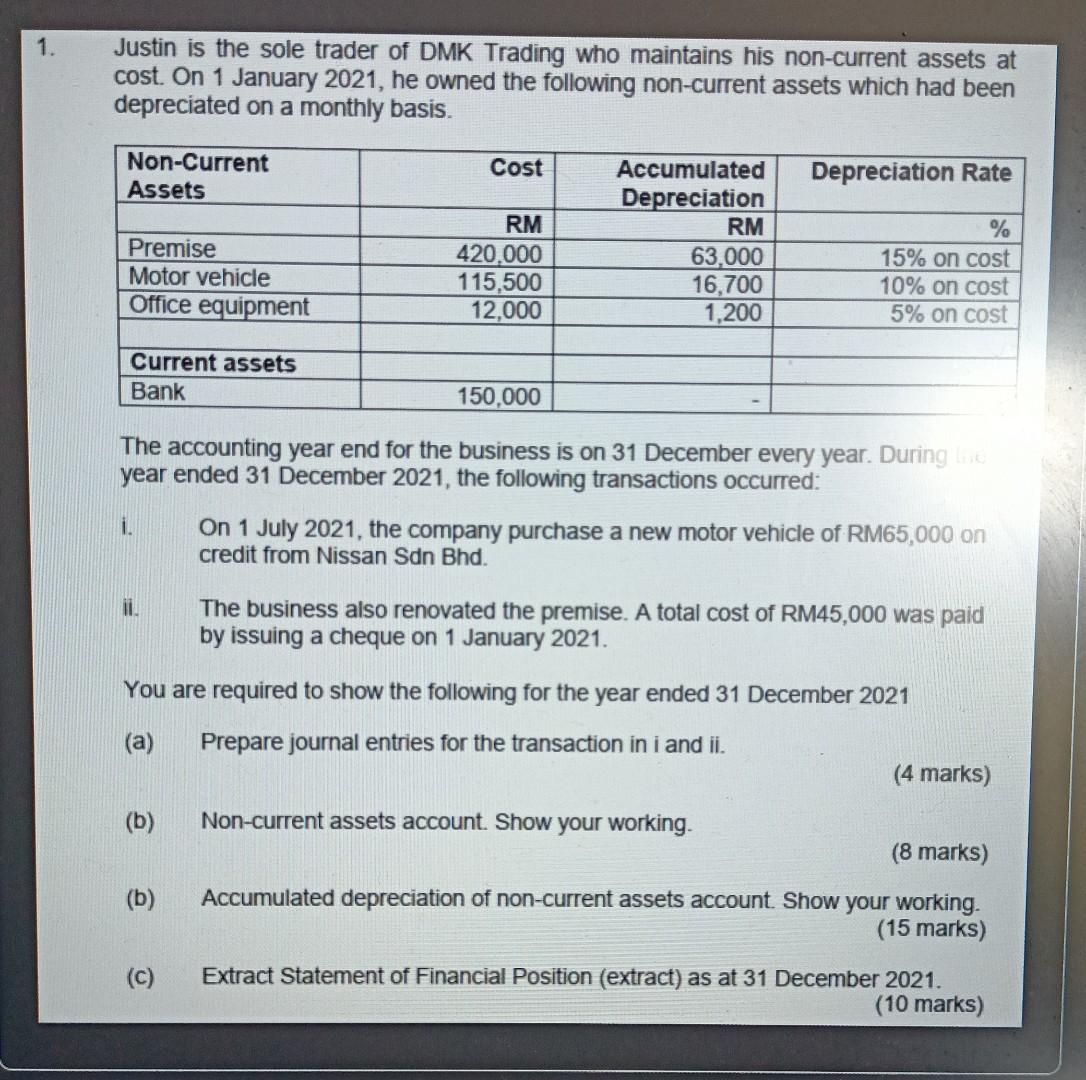

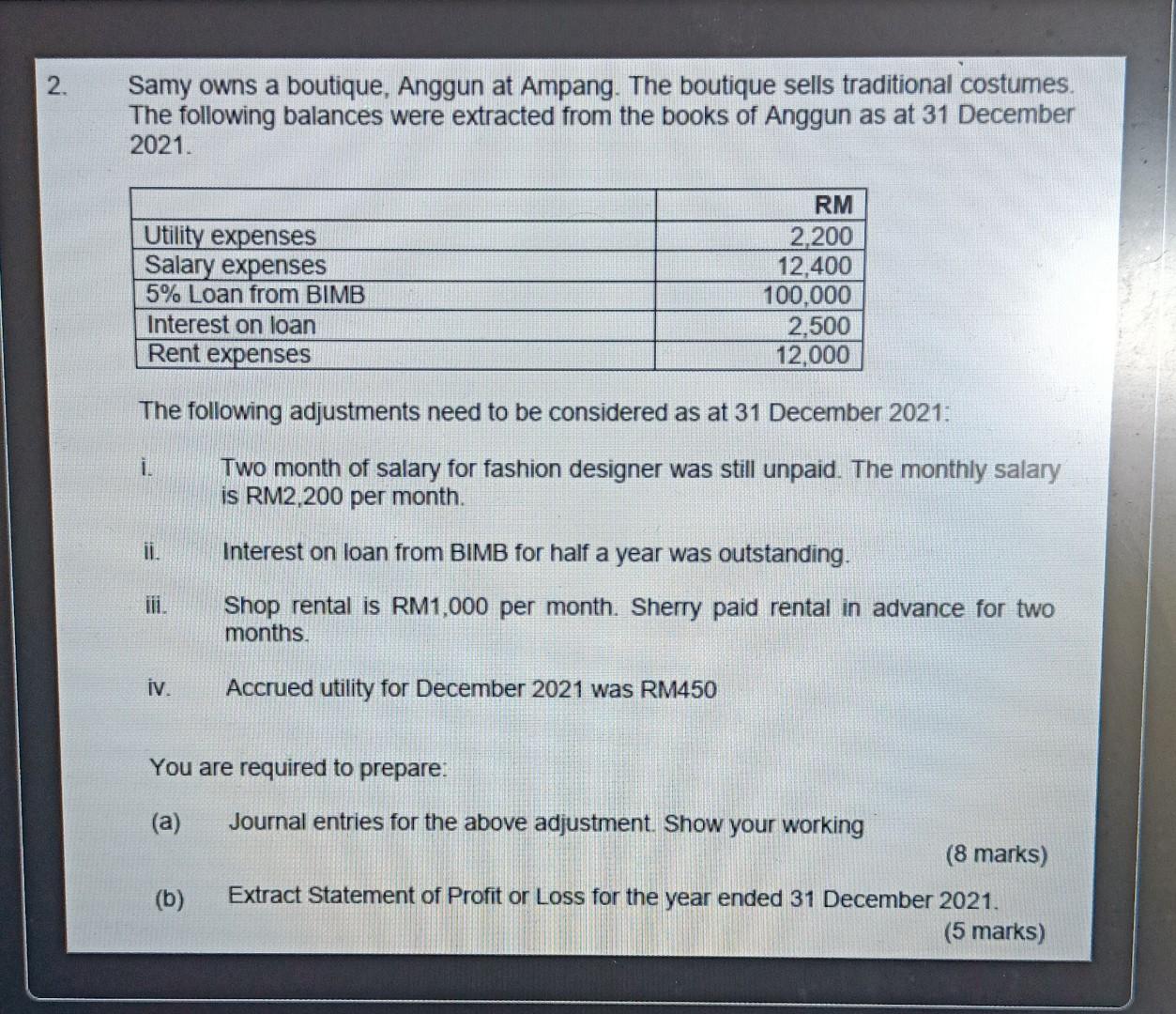

1. Justin is the sole trader of DMK Trading who maintains his non-current assets at cost. On 1 January 2021, he owned the following non-current assets which had been depreciated on a monthly basis. Non-Current Cost Depreciation Rate Accumulated Depreciation Assets RM RM % Premise 420,000 63,000 15% on cost Motor vehicle 115,500 16,700 10% on cost Office equipment 12,000 1,200 5% on cost Current assets Bank 150,000 The accounting year end for the business is on 31 December every year. During line year ended 31 December 2021, the following transactions occurred: 1. On 1 July 2021, the company purchase a new motor vehicle of RM65,000 on credit from Nissan Sdn Bhd. 11. The business also renovated the premise. A total cost of RM45,000 was paid by issuing a cheque on 1 January 2021. You are required to show the following for the year ended 31 December 2021 Prepare journal entries for the transaction in i and ii. (a) (4 marks) (b) Non-current assets account. Show your working. (8 marks) (b) Accumulated depreciation of non-current assets account. Show your working. (15 marks) (C) Extract Statement of Financial Position (extract) as at 31 December 2021. (10 marks) 2. Samy owns a boutique, Anggun at Ampang. The boutique sells traditional costumes. The following balances were extracted from the books of Anggun as at 31 December 2021. RM Utility expenses 2,200 Salary expenses 12,400 5% Loan from BIMB 100,000 Interest on loan 2,500 Rent expenses 12,000 The following adjustments need to be considered as at 31 December 2021: i. Two month of salary for fashion designer was still unpaid. The monthly salary is RM2,200 per month. ii. Interest on loan from BIMB for half a year was outstanding. Shop rental is RM1,000 per month. Sherry paid rental in advance for two months. iv. Accrued utility for December 2021 was RM450 You are required to prepare: (a) urnal entries for the above adjustment. Show your working (8 marks) (b) Extract Statement of Profit or Loss for the year ended 31 December 2021. (5 marks) N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts