Question: kindly solve all steps ( A B C ) Pty Ltd intends to form a special purpose vehicle (SPV) to be incorporated in Australia. This

kindly solve all steps

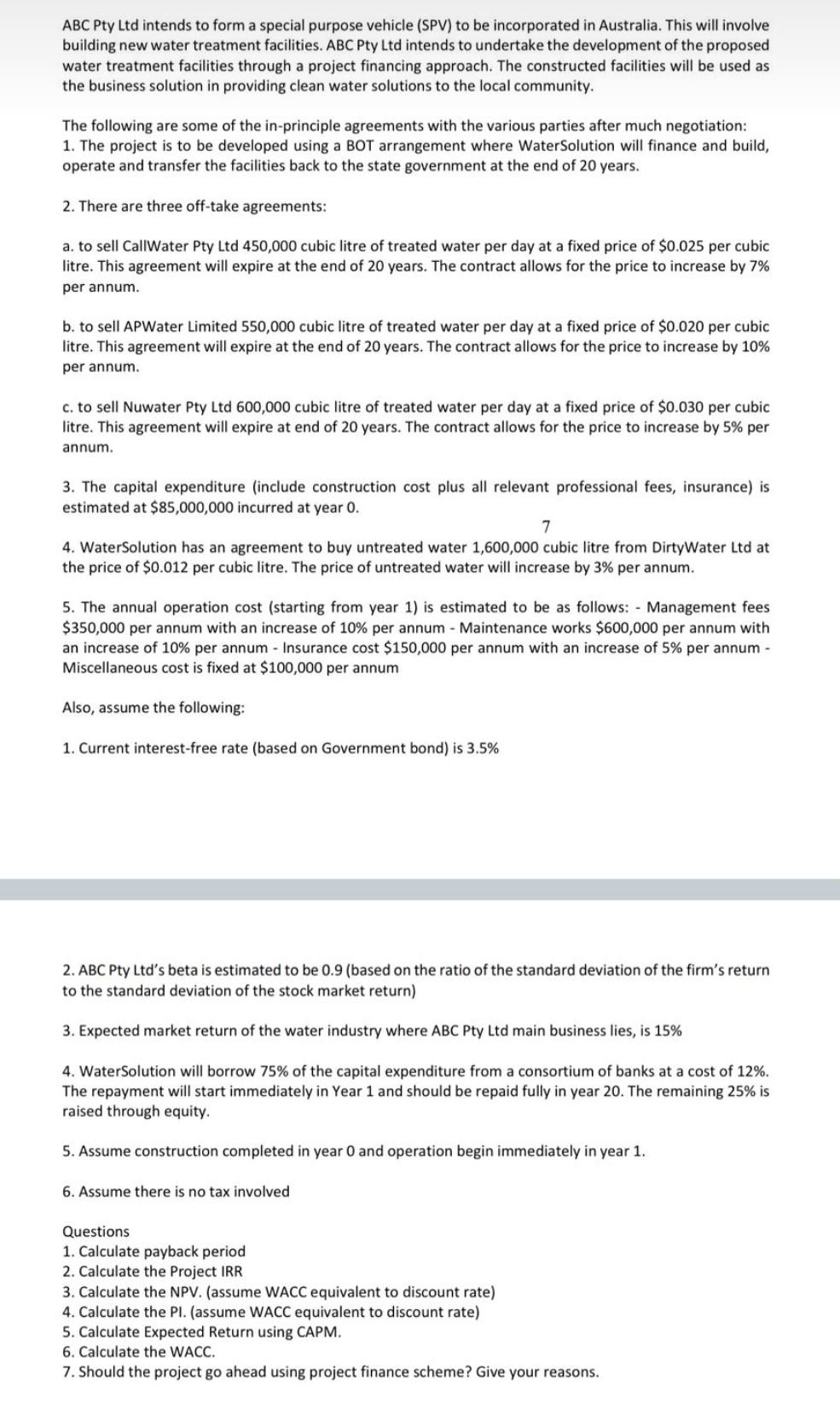

\\( A B C \\) Pty Ltd intends to form a special purpose vehicle (SPV) to be incorporated in Australia. This will involve building new water treatment facilities. ABC Pty Ltd intends to undertake the development of the proposed water treatment facilities through a project financing approach. The constructed facilities will be used as the business solution in providing clean water solutions to the local community. The following are some of the in-principle agreements with the various parties after much negotiation: 1. The project is to be developed using a BOT arrangement where WaterSolution will finance and build, operate and transfer the facilities back to the state government at the end of 20 years. 2. There are three off-take agreements: a. to sell CallWater Pty Ltd 450,000 cubic litre of treated water per day at a fixed price of \\( \\$ 0.025 \\) per cubic litre. This agreement will expire at the end of 20 years. The contract allows for the price to increase by \7 per annum. b. to sell APWater Limited 550,000 cubic litre of treated water per day at a fixed price of \\( \\$ 0.020 \\) per cubic litre. This agreement will expire at the end of 20 years. The contract allows for the price to increase by \10 per annum. c. to sell Nuwater Pty Ltd 600,000 cubic litre of treated water per day at a fixed price of \\( \\$ 0.030 \\) per cubic litre. This agreement will expire at end of 20 years. The contract allows for the price to increase by \5 per annum. 3. The capital expenditure (include construction cost plus all relevant professional fees, insurance) is estimated at \\( \\$ 85,000,000 \\) incurred at year 0 . 7 4. WaterSolution has an agreement to buy untreated water 1,600,000 cubic litre from DirtyWater Ltd at the price of \\( \\$ 0.012 \\) per cubic litre. The price of untreated water will increase by \3 per annum. 5. The annual operation cost (starting from year 1 ) is estimated to be as follows: - Management fees \\( \\$ 350,000 \\) per annum with an increase of \10 per annum - Maintenance works \\( \\$ 600,000 \\) per annum with an increase of \10 per annum - Insurance cost \\( \\$ 150,000 \\) per annum with an increase of \5 per annum Miscellaneous cost is fixed at \\( \\$ 100,000 \\) per annum Also, assume the following: 1. Current interest-free rate (based on Government bond) is \3.5 2. ABC Pty Ltd's beta is estimated to be 0.9 (based on the ratio of the standard deviation of the firm's return to the standard deviation of the stock market return) 3. Expected market return of the water industry where ABC Pty Ltd main business lies, is \15 4. WaterSolution will borrow \75 of the capital expenditure from a consortium of banks at a cost of \12. The repayment will start immediately in Year 1 and should be repaid fully in year 20 . The remaining \25 is raised through equity. 5. Assume construction completed in year 0 and operation begin immediately in year 1 . 6. Assume there is no tax involved Questions 1. Calculate payback period 2. Calculate the Project IRR 3. Calculate the NPV. (assume WACC equivalent to discount rate) 4. Calculate the PI. (assume WACC equivalent to discount rate) 5. Calculate Expected Return using CAPM. 6. Calculate the WACC. 7. Should the project go ahead using project finance scheme? Give your reasons. \\( A B C \\) Pty Ltd intends to form a special purpose vehicle (SPV) to be incorporated in Australia. This will involve building new water treatment facilities. ABC Pty Ltd intends to undertake the development of the proposed water treatment facilities through a project financing approach. The constructed facilities will be used as the business solution in providing clean water solutions to the local community. The following are some of the in-principle agreements with the various parties after much negotiation: 1. The project is to be developed using a BOT arrangement where WaterSolution will finance and build, operate and transfer the facilities back to the state government at the end of 20 years. 2. There are three off-take agreements: a. to sell CallWater Pty Ltd 450,000 cubic litre of treated water per day at a fixed price of \\( \\$ 0.025 \\) per cubic litre. This agreement will expire at the end of 20 years. The contract allows for the price to increase by \7 per annum. b. to sell APWater Limited 550,000 cubic litre of treated water per day at a fixed price of \\( \\$ 0.020 \\) per cubic litre. This agreement will expire at the end of 20 years. The contract allows for the price to increase by \10 per annum. c. to sell Nuwater Pty Ltd 600,000 cubic litre of treated water per day at a fixed price of \\( \\$ 0.030 \\) per cubic litre. This agreement will expire at end of 20 years. The contract allows for the price to increase by \5 per annum. 3. The capital expenditure (include construction cost plus all relevant professional fees, insurance) is estimated at \\( \\$ 85,000,000 \\) incurred at year 0 . 7 4. WaterSolution has an agreement to buy untreated water 1,600,000 cubic litre from DirtyWater Ltd at the price of \\( \\$ 0.012 \\) per cubic litre. The price of untreated water will increase by \3 per annum. 5. The annual operation cost (starting from year 1 ) is estimated to be as follows: - Management fees \\( \\$ 350,000 \\) per annum with an increase of \10 per annum - Maintenance works \\( \\$ 600,000 \\) per annum with an increase of \10 per annum - Insurance cost \\( \\$ 150,000 \\) per annum with an increase of \5 per annum Miscellaneous cost is fixed at \\( \\$ 100,000 \\) per annum Also, assume the following: 1. Current interest-free rate (based on Government bond) is \3.5 2. ABC Pty Ltd's beta is estimated to be 0.9 (based on the ratio of the standard deviation of the firm's return to the standard deviation of the stock market return) 3. Expected market return of the water industry where ABC Pty Ltd main business lies, is \15 4. WaterSolution will borrow \75 of the capital expenditure from a consortium of banks at a cost of \12. The repayment will start immediately in Year 1 and should be repaid fully in year 20 . The remaining \25 is raised through equity. 5. Assume construction completed in year 0 and operation begin immediately in year 1 . 6. Assume there is no tax involved Questions 1. Calculate payback period 2. Calculate the Project IRR 3. Calculate the NPV. (assume WACC equivalent to discount rate) 4. Calculate the PI. (assume WACC equivalent to discount rate) 5. Calculate Expected Return using CAPM. 6. Calculate the WACC. 7. Should the project go ahead using project finance scheme? Give your reasons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts