Question: kindly solve ASAP Q-1: Prepare Financial Statement with the help of following data: [10 Marks] Super Sound Company as at 31 Dec, 2015 Title of

kindly solve ASAP

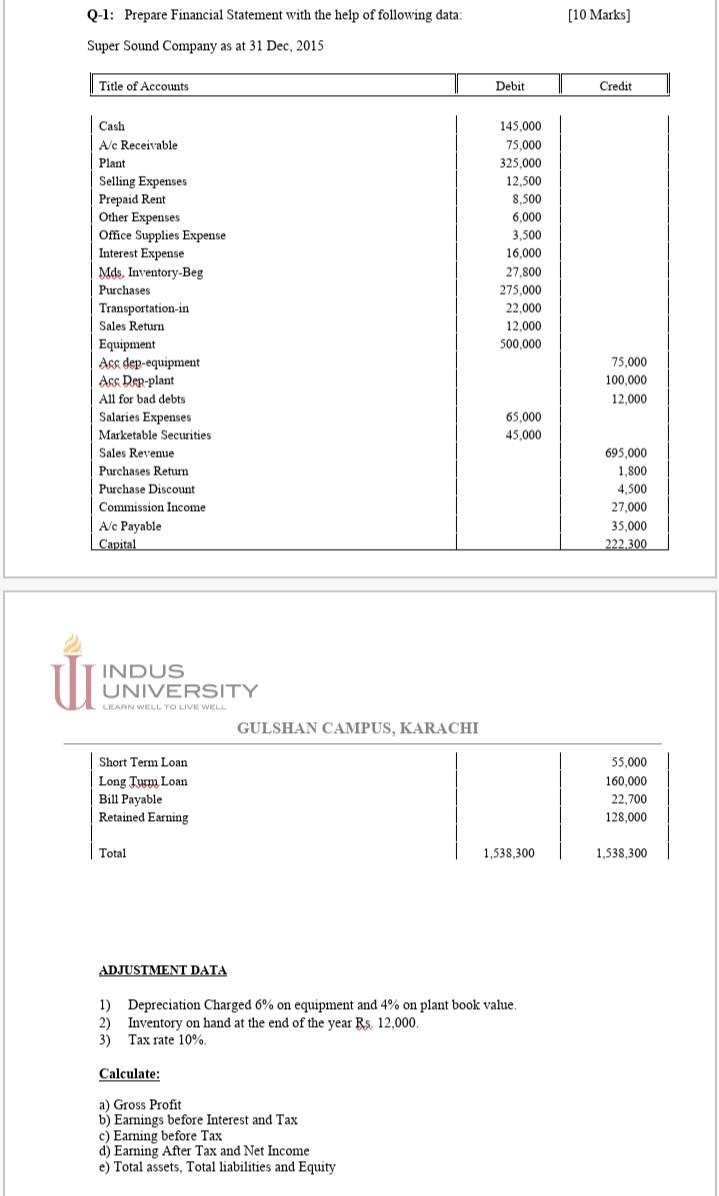

Q-1: Prepare Financial Statement with the help of following data: [10 Marks] Super Sound Company as at 31 Dec, 2015 Title of Accounts Debit Credit Cash 145,000 A/c Receivable 75,000 Plant 325,000 12.500 8.500 6,000 3,500 16.000 27.800 275,000 22.000 12.000 Selling Expenses Prepaid Rent Other Expenses Office Supplies Expense Interest Expense Mds. Inventory-Beg Purchases Transportation-in Sales Return Equipment Acc dep-equipment Acs Dep-plant All for bad debts Salaries Expenses Marketable Securities Sales Revenue Purchases Return Purchase Discount 500.000 75,000 100,000 12.000 65,000 45,000 695,000 1,800 4.500 27,000 Commission Income 35,000 A/c Payable Capital 222.300 INDUS UNIVERSITY LEAN WELL. TO LIVE WELL GULSHAN CAMPUS, KARACHI Short Term Loan Long Turm Loan Bill Payable Retained Earning 55,000 160,000 22,700 128,000 Total 1,538,300 1,538,300 ADJUSTMENT DATA 1) Depreciation Charged 6% on equipment and 4% on plant book value, 2) Inventory on hand at the end of the year Rs. 12,000. 3) Tax rate 10% Calculate: a) Gross Profit b) Earnings before Interest and Tax c) Earning before Tax d) Earning After Tax and Net Income e) Total assets, Total liabilities and Equity Q-1: Prepare Financial Statement with the help of following data: [10 Marks] Super Sound Company as at 31 Dec, 2015 Title of Accounts Debit Credit Cash 145,000 A/c Receivable 75,000 Plant 325,000 12.500 8.500 6,000 3,500 16.000 27.800 275,000 22.000 12.000 Selling Expenses Prepaid Rent Other Expenses Office Supplies Expense Interest Expense Mds. Inventory-Beg Purchases Transportation-in Sales Return Equipment Acc dep-equipment Acs Dep-plant All for bad debts Salaries Expenses Marketable Securities Sales Revenue Purchases Return Purchase Discount 500.000 75,000 100,000 12.000 65,000 45,000 695,000 1,800 4.500 27,000 Commission Income 35,000 A/c Payable Capital 222.300 INDUS UNIVERSITY LEAN WELL. TO LIVE WELL GULSHAN CAMPUS, KARACHI Short Term Loan Long Turm Loan Bill Payable Retained Earning 55,000 160,000 22,700 128,000 Total 1,538,300 1,538,300 ADJUSTMENT DATA 1) Depreciation Charged 6% on equipment and 4% on plant book value, 2) Inventory on hand at the end of the year Rs. 12,000. 3) Tax rate 10% Calculate: a) Gross Profit b) Earnings before Interest and Tax c) Earning before Tax d) Earning After Tax and Net Income e) Total assets, Total liabilities and Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts