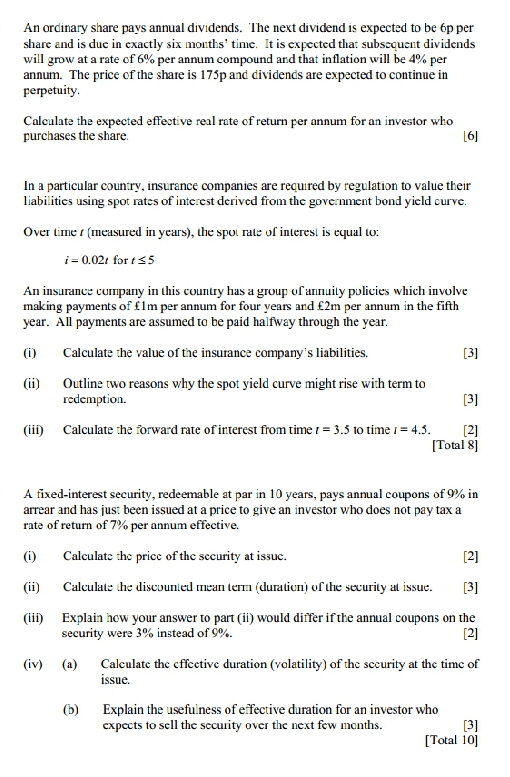

Question: Kindly solve explaining your steps well An ordinary share pays annual dividends. The next dividend is expected to be op per share and is due

Kindly solve explaining your steps well

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock