Question: Kindly solve it on a paper not Ms Excel 20. Nico Nelson, a management trainee at a large New York-based bank is try- ing to

Kindly solve it on a paper not Ms Excel

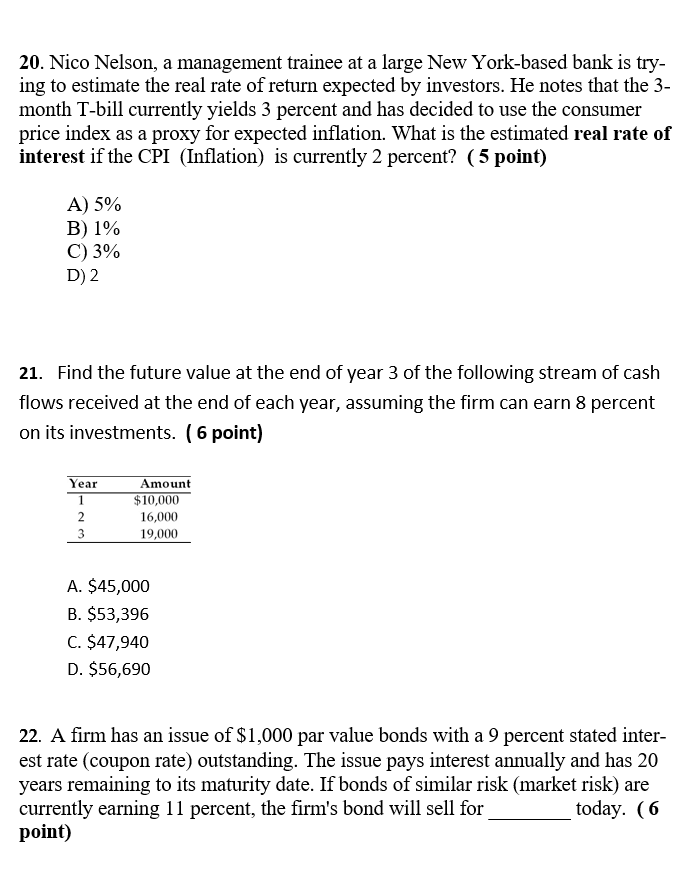

20. Nico Nelson, a management trainee at a large New York-based bank is try- ing to estimate the real rate of return expected by investors. He notes that the 3- month T-bill currently yields 3 percent and has decided to use the consumer price index as a proxy for expected inflation. What is the estimated real rate of interest if the CPI (Inflation) is currently 2 percent? (5 point) A) 5% B) 1% C) 3% D) 2 21. Find the future value at the end of year 3 of the following stream of cash flows received at the end of each year, assuming the firm can earn 8 percent on its investments. (6 point) Year 1 2 3 Amount $10,000 16,000 19,000 A. $45,000 B. $53,396 C. $47,940 D. $56,690 22. A firm has an issue of $1,000 par value bonds with a 9 percent stated inter- est rate (coupon rate) outstanding. The issue pays interest annually and has 20 years remaining to its maturity date. If bonds of similar risk (market risk) are currently earning 11 percent, the firm's bond will sell for today. (6 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts