Question: Kindly Solve it soonly Question Number 1: Read the given words from the street and distinguish commercial banking from investment banking. Separating Commercial Banking from

Kindly Solve it soonly

Kindly Solve it soonly

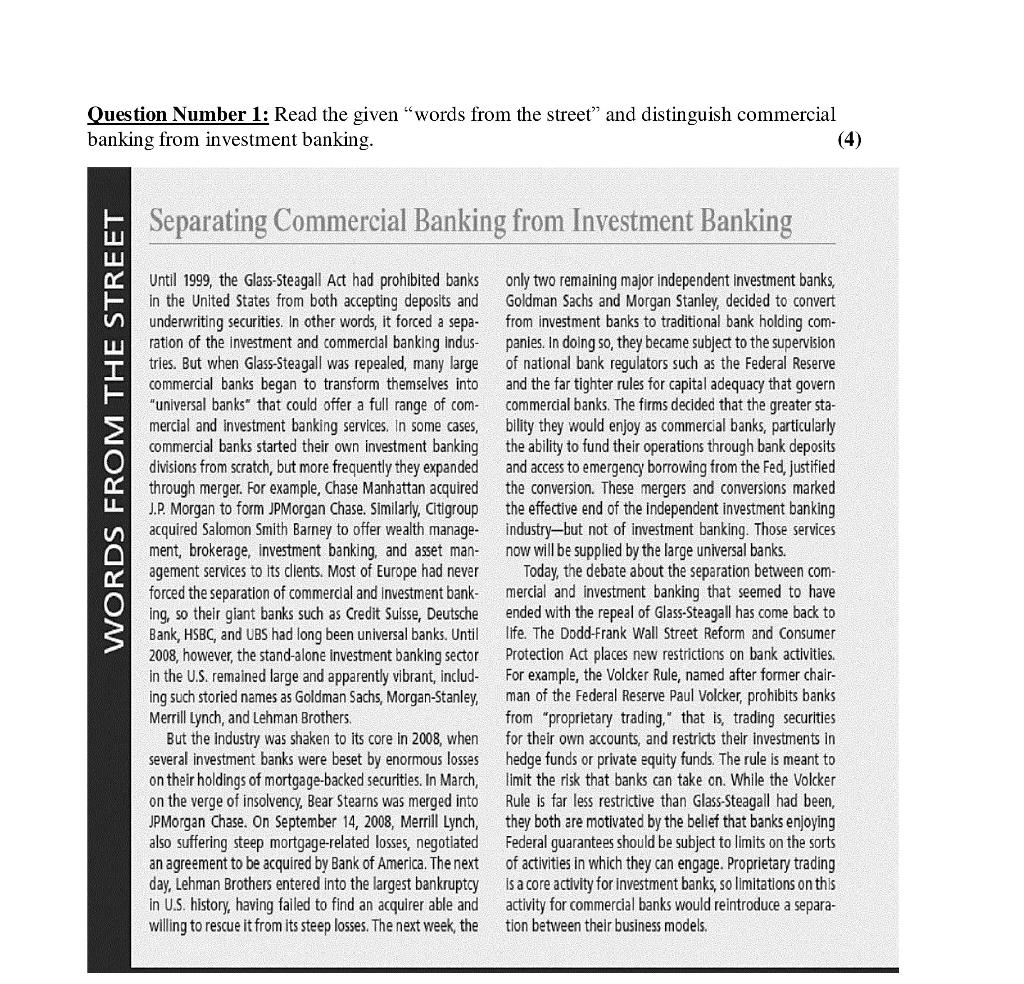

Question Number 1: Read the given words from the street and distinguish commercial banking from investment banking. Separating Commercial Banking from Investment Banking WORDS FROM THE STREET Until 1999, the Glass-Steagall Act had prohibited banks in the United States from both accepting deposits and underwriting securities. In other words, it forced a sepa- ration of the investment and commercial banking indus- tries. But when Glass-Steagall was repealed, many large commercial banks began to transform themselves into "universal banks that could offer a full range of com- mercial and Investment banking services. In some cases, commercial banks started their own investment banking divisions from scratch, but more frequently they expanded through merger. For example, Chase Manhattan acquired J.P. Morgan to form JPMorgan Chase. Similarly, Citigroup acquired Salomon Smith Barney to offer wealth manage- ment, brokerage, investment banking, and asset man- agement services to its clients. Most of Europe had never forced the separation of commercial and Investment bank- ing, so their giant banks such as Credit Suisse, Deutsche Bank, HSBC, and UBS had long been universal banks. Until 2008, however, the stand-alone investment banking sector in the U.S. remained large and apparently vibrant, includ- ing such storied names as Goldman Sachs, Morgan-Stanley, Merrill Lynch, and Lehman Brothers But the industry was shaken to its core in 2008, when several investment banks were beset by enormous losses on their holdings of mortgage-backed securities. In March, on the verge of insolvency, Bear Stearns was merged into JPMorgan Chase. On September 14, 2008, Merrill Lynch, also suffering steep mortgage-related losses, negotiated an agreement to be acquired by Bank of America. The next day, Lehman Brothers entered into the largest bankruptcy in U.S. history, having failed to find an acquirer able and willing to rescue it from its steep losses. The next week, the only two remaining major independent Investment banks, Goldman Sachs and Morgan Stanley, decided to convert from investment banks to traditional bank holding com- panies. In doing so, they became subject to the supervision of national bank regulators such as the Federal Reserve and the far tighter rules for capital adequacy that govern commercial banks. The firms decided that the greater sta- bility they would enjoy as commercial banks, particularly the ability to fund their operations through bank deposits and access to emergency borrowing from the Fed, justified the conversion. These mergers and conversions marked the effective end of the independent investment banking industrybut not of investment banking. Those services now will be supplied by the large universal banks. Today, the debate about the separation between com- mercial and investment banking that seemed to have ended with the repeal of Glass-Steagall has come back to life. The Dodd-Frank Wall Street Reform and Consumer Protection Act places new restrictions on bank activities For example, the Volcker Rule, named after former chair- man of the Federal Reserve Paul Volcker, prohibits banks from "proprietary trading," that is, trading securities for their own accounts, and restricts their investments in hedge funds or private equity funds. The rule is meant to limit the risk that banks can take on. While the Volcker Rule is far less restrictive than Glass-Steagall had been, they both are motivated by the belief that banks enjoying Federal guarantees should be subject to limits on the sorts of activities in which they can engage. Proprietary trading is a core activity for investment banks, so limitations on this activity for commercial banks would reintroduce a separa- tion between their business models

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts