Question: Kindly solve question 2 and 3 SECTION B: ANSWER ANY THREE QUESTIONS QUESTION2 a. Explain the two types Capital Allowances b. Gayle commenced trading on

Kindly solve question 2 and 3

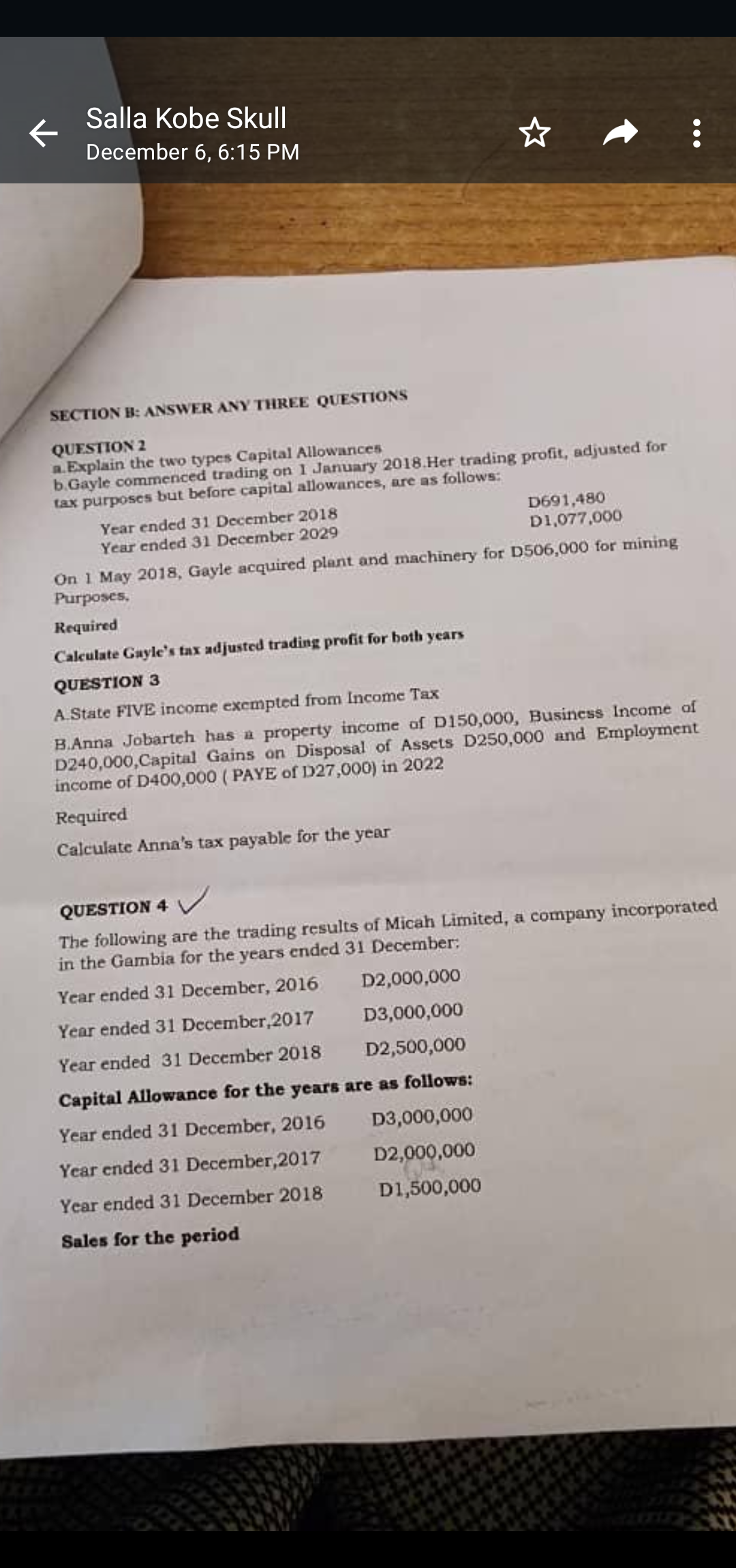

SECTION B: ANSWER ANY THREE QUESTIONS QUESTION2 a. Explain the two types Capital Allowances b. Gayle commenced trading on 1 January 2018 . Her trading profit, adjusted for tax purposes but before capital allowances, are as follows: Year ended 31 December 2018 D691,480D1,077,000 Year ended 31 December 2029 On 1 May 2018, Gayle acquired plant and machinery for D506,000 for mining Purposes. Required Calculate Gayle's tax adjusted trading profit for both years QUESTION 3 A. State FIVE income excmpted from Income Tax B.Anna Jobarteh has ie property income of D150,000, Business Income of D240,000, Capital Gains on Disposal of Assets D250,000 and Employment income of D400,000 (PAYE of D27,000) in 2022 Required Calculate Anna's tax payable for the year QUESTION 4 The following are the trading results of Micah Limited, a company incorporated A.. Wis for the vears ended 31 December

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts