Question: kindly solve the question CASE STUDY WHICH IS BETTER-DEBT OR EQUITY FINANCING? Background Information Pizza Hut Corporation has decided to enter the catering busi- Plan

kindly solve the question

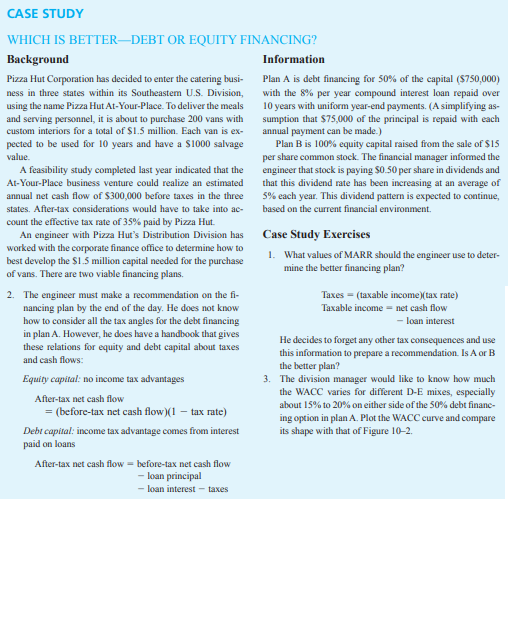

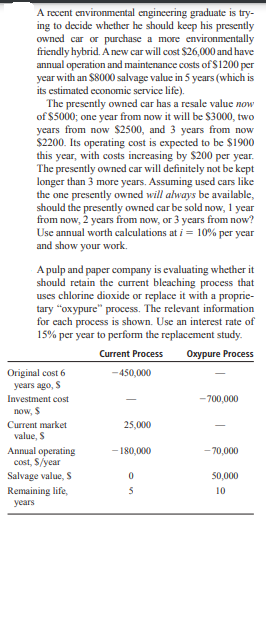

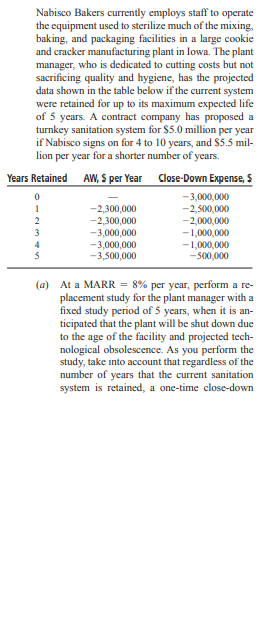

CASE STUDY WHICH IS BETTER-DEBT OR EQUITY FINANCING? Background Information Pizza Hut Corporation has decided to enter the catering busi- Plan A is debt financing for 50% of the capital ($750,000) ness in three states within its Southeastern U.S. Division, with the 8% per year compound interest loan repaid over using the name Pizza Hut At-Your-Place. To deliver the meals 10 years with uniform year-end payments. (A simplifying as- and serving personnel, it is about to purchase 200 vans with sumption that $75,000 of the principal is repaid with each custom interiors for a total of $1.5 million. Each van is ex- annual payment can be made.) pected to be used for 10 years and have a $1000 salvage Plan B is 100% equity capital raised from the sale of $15 value. per share common stock. The financial manager informed the A feasibility study completed last year indicated that the engineer that stock is paying $0.50 per share in dividends and At-Your-Place business venture could realize an estimated that this dividend rate has been increasing at an average of annual net cash flow of $300,000 before taxes in the three 5% each year. This dividend pattern is expected to continue, states. After-tax considerations would have to take into ac- based on the current financial environment. count the effective tax rate of 35% paid by Pizza Hut An engineer with Pizza Hut's Distribution Division has Case Study Exercises worked with the corporate finance office to determine how to best develop the $1.5 million capital needed for the purchase 1. What values of MARR should the engineer use to deter- of vans. There are two viable financing plans. mine the better financing plan? 2. The engineer must make a recommendation on the fi- Taxes = (taxable income )(tax rate) nancing plan by the end of the day. He does not know Taxable income = net cash flow how to consider all the tax angles for the debt financing - loan interest in plan A. However, he does have a handbook that gives He decides to forget any other tax consequences and use these relations for equity and debt capital about taxes this information to prepare a recommendation. Is A or B and cash flows: the better plan? Equity capital. no income tax advantages 3. The division manager would like to know how much the WACC varies for different D-E mixes, especially After-tax net cash flow = (before-tax net cash flow)(1 - tax rate) about 15% to 20% on either side of the 50% debt finance ing option in plan A. Plot the WACC curve and compare Debi capital: income tax advantage comes from interest its shape with that of Figure 10-2. paid on loans After-tax net cash flow = before-tax net cash flow - loan principal - loan interest - taxesA recent environmental engineering graduate is try- ing to decide whether he should keep his presently owned car or purchase a more environmentally friendly hybrid. A new car will cost $26,000 and have annual operation and maintenance costs of $1200 per year with an $8000 salvage value in 5 years (which is its estimated economic service life). The presently owned car has a resale value now of $5000; one year from now it will be $3000, two years from now $2500, and 3 years from now $2200. Its operating cost is expected to be $1900 this year, with costs increasing by $200 per year. The presently owned car will definitely not be kept longer than 3 more years. Assuming used cars like the one presently owned will always be available, should the presently owned car be sold now, 1 year from now, 2 years from now, or 3 years from now? Use annual worth calculations at i = 10% per year and show your work. A pulp and paper company is evaluating whether it should retain the current bleaching process that uses chlorine dioxide or replace it with a proprie- tary "oxypure" process. The relevant information for each process is shown. Use an interest rate of 15% per year to perform the replacement study. Current Process Oxypure Process Original cost 6 -450,000 years ago, $ Investment cost -700,000 now, $ Current market 25,000 value, $ Annual operating - 180,00 0 -70,000 cost, $/year Salvage value, $ 50,000 Remaining life, 10 yearsNabisco Bakers currently employs staff to operate the equipment used to sterilize much of the mixing baking, and packaging facilities in a large cookie and cracker manufacturing plant in Iowa. The plant manager, who is dedicated to cutting costs but not sacrificing quality and hygiene, has the projected data shown in the table below if the current system were retained for up to its maximum expected life of 5 years. A contract company has proposed a turnkey sanitation system for $5.0 million per year if Nabisco signs on for 4 to 10 years, and $5.5 mil- lion per year for a shorter number of years. Years Retained AW, $ per Year Close-Down Expense, $ -3,000,00 0 -2,300,000 -2, 500,00 0 -2,300,000 -2,000,00 0 -3,000,000 - 1,00 0,00 0 -3.000,000 - 1,00 0,00 0 -3,500,000 -500,000 (a) At a MARR = 8% per year, perform a re- placement study for the plant manager with a fixed study period of 5 years, when it is an- ticipated that the plant will be shut down due to the age of the facility and projected tech- nological obsolescence. As you perform the study, take into account that regardless of the number of years that the current sanitation system is retained, a one-time close-downThe Rockwell hardness of a metal is determined by impressing a hardened point into the surface of the metal and then measuring the depth of penetration of the point. Suppose the Rockwell hardness of a particular alloy is normally distributed with mean 70 and standard deviation 3. (Rockwell hardness is measured on a continuous scale. a. If a specimen is acceptable only if its hardness is between 67 and 75, what is the probability that a randomly chosen specimen has an acceptable hardness? b. If the acceptable range of hardness is ( 70 - c, 70 + c), for what value of c would 95% of all specimens have acceptable hardness? c. If the acceptable range is as in part (a) and the hardness of each of ten randomly selected specimens is independently determined, what is the expected number of acceptable specimens among the ten? d. What is the probability that at most eight of ten independently selected specimens have a hardness of less than 73.84? [Hint: the number among the ten specimens with hardness less than 73.84 is a binomial variable; what is p?]In response to concerns about nutritional contents of fast foods, McDonald's has announced that it will use a new cooking oil for its french fries that will decrease substantially trans fatty acid levels and increase the amount of more beneficial polyunsaturated fat. The company claims that 97 out of 100 people cannot detect a difference in taste between the new and old oils. Assuming that this figure is correct (as a long-run proportion), what is the approximate probability that in a random sample of 1000 individuals who have purchased fries at Mcdonald's, a. At least 40 can taste the difference between the two oils? b. At most 5% can taste the difference between the two oils?As in the case of the Weibull and Gamma distributions, the lognormal distribution can be modified by the introduction of a third parameter y such that the pdf is shifted to be positive only for x > y. The article cited in Exercise 4.39 suggested that a shifted lognormal distribution with shift (i.e., threshold) = 1.0, mean value = 2.16, and standard deviation = 1.03 would be an appropriate model for the ry X = maximum-to-average depth ratio of a corrosion defect in pressurized steel. a. What are the values of p and o for the proposed distribution? b. What is the probability that depth ratio exceeds 2? c. What is the median of the depth ratio distribution? d. What is the 99th percentile of the depth ratio distribution?An alternative with an infinite life has a B/C ratio of 1.5. The alternative has benefits of $50,000 per year and annual maintenance costs of $10,000 per year. The first cost of the alternative at an interest rate of 10% per year is closest to: (a) $23,300 (b) $85.400 (c) $146,100 (ad) $233,000 Cost-effectiveness analysis (CEA) differs from cost-benefit (B/C) analysis in that: (a) CEA cannot handle multiple alternatives. (b) CEA expresses outcomes in natural units rather than in currency units. (c) CEA cannot handle independent alternatives. (d) CEA is more time-consuming and resource- intensive. Several private colleges claim to have programs that are very effective at teaching enrollees how to become entrepreneurs. Two programs, identi- fied as program X and program Y, have produced 4 and 6 persons per year, respectively, who were recognized as entrepreneurs. If the total cost of the programs is $25,000 and $33,000, respec- tively, the incremental cost-effectiveness ratio is closest to: (a) 6250 (b) 5500 (c) 4000 (d) 1333

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts