Question: kindly solve this question for me. QUESTION 2 a) Enumerate five (5) payments which are exempted from withholding tax (5 marks) b) Obaa Yaa Moko

kindly solve this question for me.

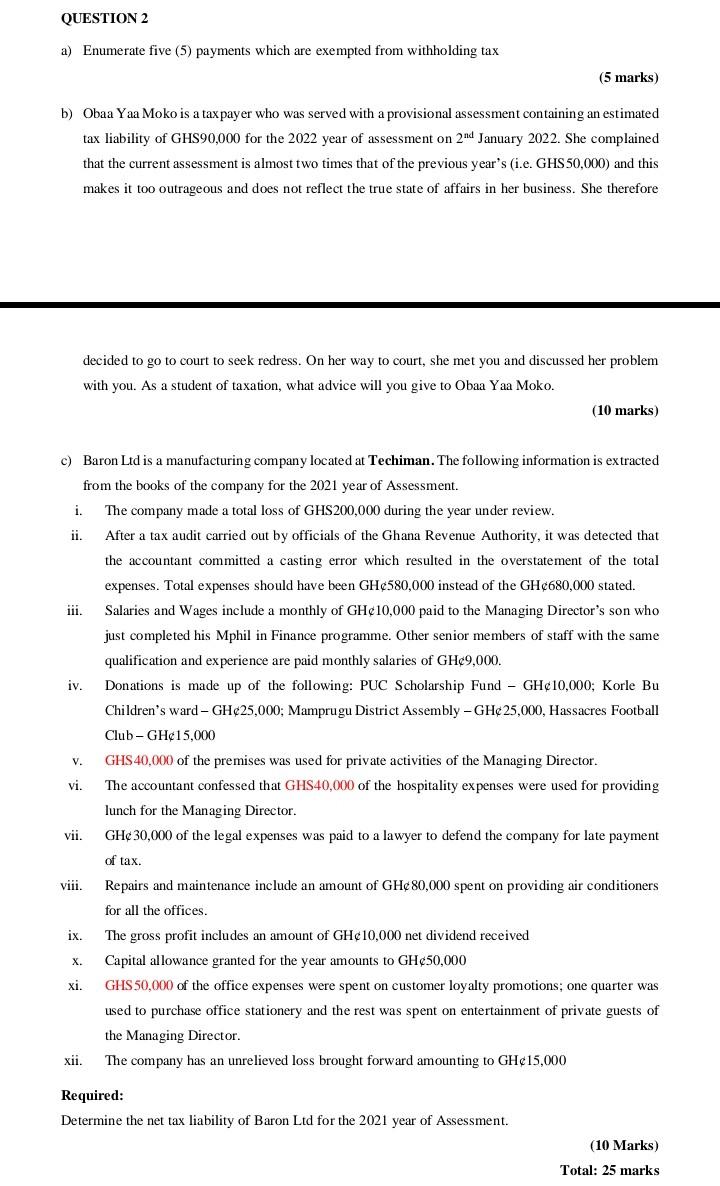

QUESTION 2 a) Enumerate five (5) payments which are exempted from withholding tax (5 marks) b) Obaa Yaa Moko is a tax payer who was served with a provisional assessment containing an estimated tax liability of GHS90,000 for the 2022 year of assessment on 2nd January 2022 . She complained that the current assessment is almost two times that of the previous year's (i.e. GHS 50,000 ) and this makes it too outrageous and does not reflect the true state of affairs in her business. She therefore decided to go to court to seek redress. On her way to court, she met you and discussed her problem with you. As a student of taxation, what advice will you give to Obaa Yaa Moko. (10 marks) c) Baron Ltd is a manufacturing company located at Techiman. The following information is extracted from the books of the company for the 2021 year of Assessment. i. The company made a total loss of GHS200,000 during the year under review. ii. After a tax audit carried out by officials of the Ghana Revenue Authority, it was detected that the accountant committed a casting error which resulted in the overstatement of the total expenses. Total expenses should have been GH 580,000 instead of the GH 680,000 stated. iii. Salaries and Wages include a monthly of GH 10,000 paid to the Managing Director's son who just completed his Mphil in Finance programme. Other senior members of staff with the same qualification and experience are paid monthly salaries of GH\&9,000. iv. Donations is made up of the following: PUC Scholarship Fund - GH 10,000; Korle Bu Children's ward - GH 25,000; Mamprugu District Assembly - GH 25,000, Hassacres Football Club - GH 15,000 v. GHS 40,000 of the premises was used for private activities of the Managing Director. vi. The accountant confessed that GHS 40,000 of the hospitality expenses were used for providing lunch for the Managing Director. vii. GH 30,000 of the legal expenses was paid to a lawyer to defend the company for late payment of tax. viii. Repairs and maintenance include an amount of GH&80,000 spent on providing air conditioners for all the offices. ix. The gross profit includes an amount of GH/10,000 net dividend received x. Capital allowance granted for the year amounts to GH50,000 xi. GHS 50,000 of the office expenses were spent on customer loyalty promotions; one quarter was used to purchase office stationery and the rest was spent on entertainment of private guests of the Managing Director. xii. The company has an unrelieved loss brought forward amounting to GH15,000 Required: Determine the net tax liability of Baron Ltd for the 2021 year of Assessment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts