Question: Kindly solve this question step by step. Information Supplied You are one of a project team members and are responsible for building a new plant

Kindly solve this question step by step.

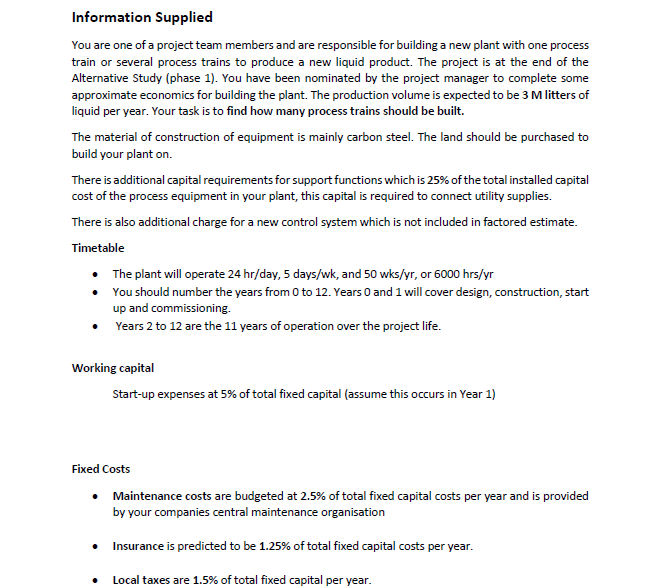

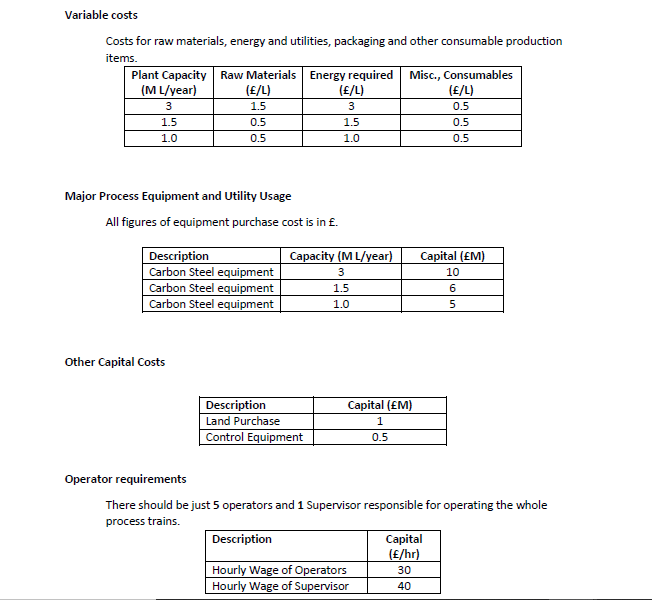

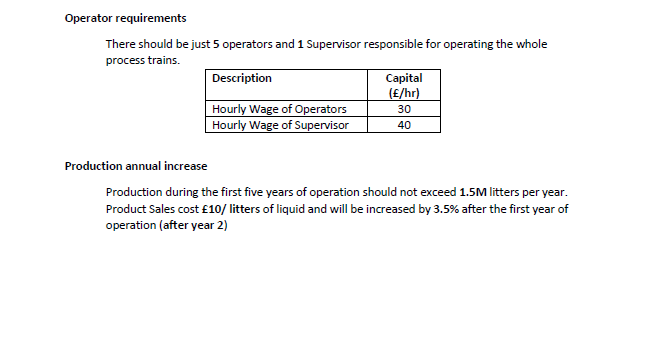

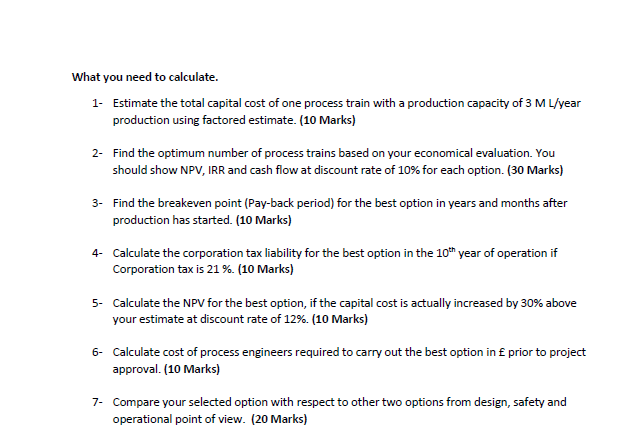

Information Supplied You are one of a project team members and are responsible for building a new plant with one process train or several process trains to produce a new liquid product. The project is at the end of the Alternative Study (phase 1). You have been nominated by the project manager to complete some approximate economics for building the plant. The production volume is expected to be 3 M litters of liquid per year. Your task is to find how many process trains should be built. The material of construction of equipment is mainly carbon steel. The land should be purchased to build your plant on There is additional capital requirements for support functions which is 25% of the total installed capital cost of the process equipment in your plant, this capital is required to connect utility supplies. There is also additional charge for a new control system which is not included in factored estimate. Timetable The plant will operate 24 hr/day, 5 days/wk, and 50 wks/yr, or 6000 hrs/yr You should number the years from 0 to 12. Years 0 and 1 will cover design, construction, start up and commissioning. Years 2 to 12 are the 11 years of operation over the project life. Working capital Start-up expenses at 5% of total fixed capital (assume this occurs in Year 1) Fixed Costs Maintenance costs are budgeted at 2.5% of total fixed capital costs per year and is provided by your companies central maintenance organisation Insurance is predicted to be 1.25% of total fixed capital costs per year. Local taxes are 1.5% of total fixed capital per year. Variable costs Costs for raw materials, energy and utilities, packaging and other consumable production items. Plant Capacity Raw Materials Energy required Misc., Consumables (ML/year) (/L) (/L) (/L) 3 0.5 1.5 0.5 3 1.5 0.5 0.5 1.5 1.0 0.5 1.0 Major Process Equipment and Utility Usage All figures of equipment purchase cost is in . Description Carbon Steel equipment Carbon Steel equipment Carbon Steel equipment Capacity (ML/year) 3 1.5 1.0 Capital (M) 10 6 5 Other Capital Costs Description Land Purchase Control Equipment Capital (M) 1 0.5 Operator requirements There should be just 5 operators and 1 Supervisor responsible for operating the whole process trains. Description Capital (/hr) Hourly Wage of Operators Hourly Wage of Supervisor 40 30 Operator requirements There should be just 5 operators and 1 Supervisor responsible for operating the whole process trains. Description Capital (/hr) Hourly Wage of Operators Hourly Wage of Supervisor 30 40 Production annual increase Production during the first five years of operation should not exceed 1.5M litters per year. Product Sales cost 10/ litters of liquid and will be increased by 3.5% after the first year of operation (after year 2) What you need to calculate. 1- Estimate the total capital cost of one process train with a production capacity of 3 M L/year production using factored estimate. (10 Marks) 2- Find the optimum number of process trains based on your economical evaluation. You should show NPV, IRR and cash flow at discount rate of 10% for each option. (30 Marks) 3. Find the breakeven point (Pay-back period) for the best option in years and months after production has started. (10 Marks) 4- Calculate the corporation tax liability for the best option in the 10th year of operation if Corporation tax is 21 %. (10 Marks) 5- Calculate the NPV for the best option, if the capital cost is actually increased by 30% above your estimate at discount rate of 12%. (10 Marks) 6- Calculate cost of process engineers required to carry out the best option in prior to project approval. (10 Marks) 7- Compare your selected option with respect to other two options from design, safety and operational point of view. (20 Marks) Information Supplied You are one of a project team members and are responsible for building a new plant with one process train or several process trains to produce a new liquid product. The project is at the end of the Alternative Study (phase 1). You have been nominated by the project manager to complete some approximate economics for building the plant. The production volume is expected to be 3 M litters of liquid per year. Your task is to find how many process trains should be built. The material of construction of equipment is mainly carbon steel. The land should be purchased to build your plant on There is additional capital requirements for support functions which is 25% of the total installed capital cost of the process equipment in your plant, this capital is required to connect utility supplies. There is also additional charge for a new control system which is not included in factored estimate. Timetable The plant will operate 24 hr/day, 5 days/wk, and 50 wks/yr, or 6000 hrs/yr You should number the years from 0 to 12. Years 0 and 1 will cover design, construction, start up and commissioning. Years 2 to 12 are the 11 years of operation over the project life. Working capital Start-up expenses at 5% of total fixed capital (assume this occurs in Year 1) Fixed Costs Maintenance costs are budgeted at 2.5% of total fixed capital costs per year and is provided by your companies central maintenance organisation Insurance is predicted to be 1.25% of total fixed capital costs per year. Local taxes are 1.5% of total fixed capital per year. Variable costs Costs for raw materials, energy and utilities, packaging and other consumable production items. Plant Capacity Raw Materials Energy required Misc., Consumables (ML/year) (/L) (/L) (/L) 3 0.5 1.5 0.5 3 1.5 0.5 0.5 1.5 1.0 0.5 1.0 Major Process Equipment and Utility Usage All figures of equipment purchase cost is in . Description Carbon Steel equipment Carbon Steel equipment Carbon Steel equipment Capacity (ML/year) 3 1.5 1.0 Capital (M) 10 6 5 Other Capital Costs Description Land Purchase Control Equipment Capital (M) 1 0.5 Operator requirements There should be just 5 operators and 1 Supervisor responsible for operating the whole process trains. Description Capital (/hr) Hourly Wage of Operators Hourly Wage of Supervisor 40 30 Operator requirements There should be just 5 operators and 1 Supervisor responsible for operating the whole process trains. Description Capital (/hr) Hourly Wage of Operators Hourly Wage of Supervisor 30 40 Production annual increase Production during the first five years of operation should not exceed 1.5M litters per year. Product Sales cost 10/ litters of liquid and will be increased by 3.5% after the first year of operation (after year 2) What you need to calculate. 1- Estimate the total capital cost of one process train with a production capacity of 3 M L/year production using factored estimate. (10 Marks) 2- Find the optimum number of process trains based on your economical evaluation. You should show NPV, IRR and cash flow at discount rate of 10% for each option. (30 Marks) 3. Find the breakeven point (Pay-back period) for the best option in years and months after production has started. (10 Marks) 4- Calculate the corporation tax liability for the best option in the 10th year of operation if Corporation tax is 21 %. (10 Marks) 5- Calculate the NPV for the best option, if the capital cost is actually increased by 30% above your estimate at discount rate of 12%. (10 Marks) 6- Calculate cost of process engineers required to carry out the best option in prior to project approval. (10 Marks) 7- Compare your selected option with respect to other two options from design, safety and operational point of view. (20 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts