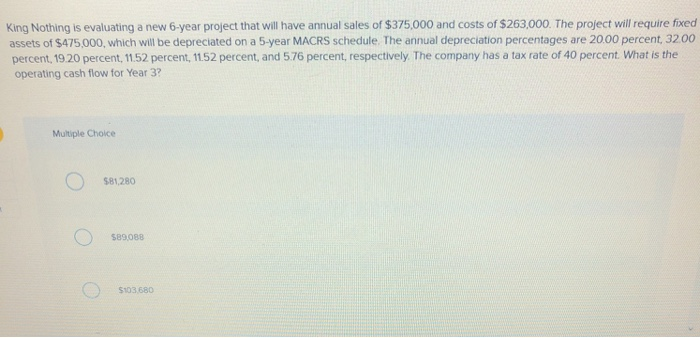

Question: King Nothing is evaluating a new 6-year project that will have annual sales of $375,000 and costs of $263,000. The project will require fixed assets

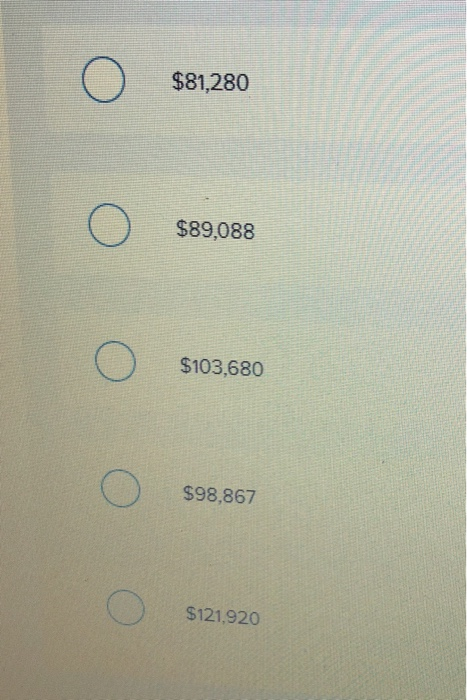

King Nothing is evaluating a new 6-year project that will have annual sales of $375,000 and costs of $263,000. The project will require fixed assets of $475,000, which will be depreciated on a 5-year MACRS schedule. The annual depreciation percentages are 20.00 percent, 3200 percent, 1920 percent, 11.52 percent, 1152 percent, and 576 percent, respectively The company has a tax rate of 40 percent. What is the operating cash flow for Year 3? Multiple Choice $81,280 89088 $103,680

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock