Question: Kingston Corp. is considering purchasing a new machine, which costs $2,000,000 today. The investment is forecasted to have revenue in the first year of $600,000.

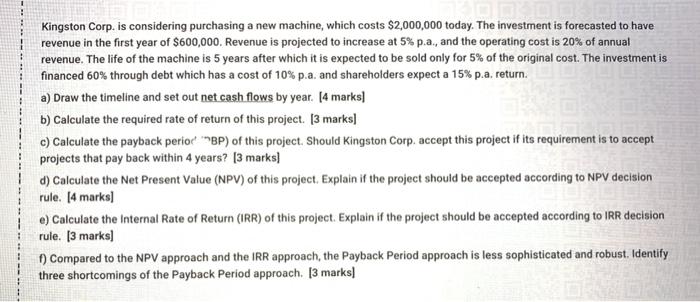

Kingston Corp. is considering purchasing a new machine, which costs $2,000,000 today. The investment is forecasted to have revenue in the first year of $600,000. Revenue is projected to increase at 5% p.a., and the operating cost is 20% of annual revenue. The life of the machine is 5 years after which it is expected to be sold only for 5% of the original cost. The investment is financed 60% through debt which has a cost of 10% p.a. and shareholders expect a 15% p.a. return. a) Draw the timeline and set out net cash flows by year. (4 marks) b) Calculate the required rate of return of this project. [3 marks] c) Calculate the payback perior BP) of this project. Should Kingston Corp. accept this project if its requirement is to accept projects that pay back within 4 years? [3 marks] d) Calculate the Net Present Value (NPV) of this project, Explain if the project should be accepted according to NPV decision rule. [4 marks) e) Calculate the Internal Rate of Return (IRR) of this project. Explain if the project should be accepted according to IRR decision rule. [3 marks) 1) Compared to the NPV approach and the IRR approach, the Payback Period approach is less sophisticated and robust. Identify three shortcomings of the Payback Period approach. [3 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts