Question: kipped Problem 12-17 (Algo) Net Present Value Analysis; Internal Rate of Return; Simple Rate of Return [LO12-2, LO12-3, LO12-6] Casey Nelson is a divisional

![Simple Rate of Return [LO12-2, LO12-3, LO12-6] Casey Nelson is a divisional](https://s3.amazonaws.com/si.experts.images/answers/2024/05/66482855b6a55_9496648285550c54.jpg)

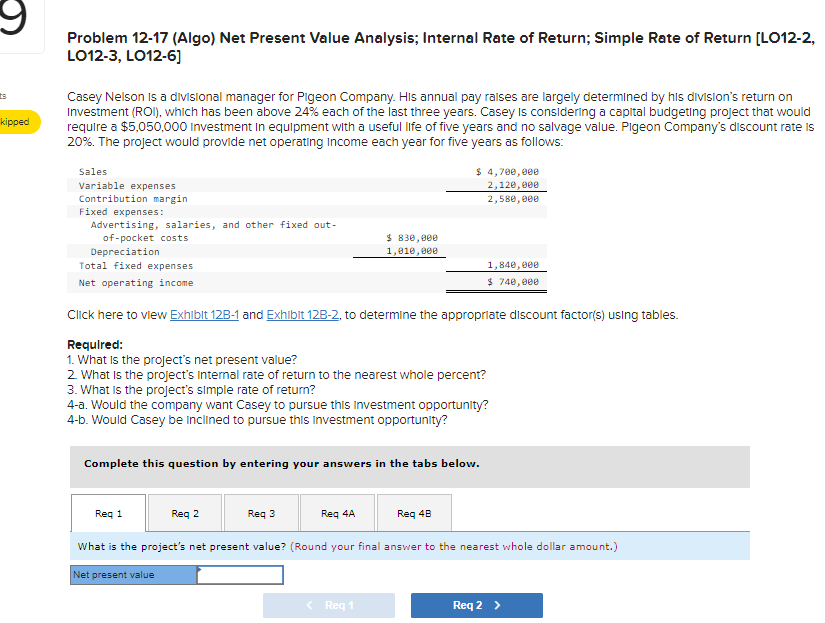

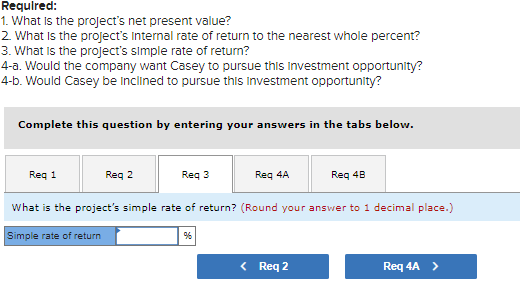

kipped Problem 12-17 (Algo) Net Present Value Analysis; Internal Rate of Return; Simple Rate of Return [LO12-2, LO12-3, LO12-6] Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division's return on Investment (ROI), which has been above 24% each of the last three years. Casey is considering a capital budgeting project that would require a $5,050,000 Investment in equipment with a useful life of five years and no salvage value. Pigeon Company's discount rate is 20%. The project would provide net operating Income each year for five years as follows: Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out- $ 830,000 1,010,000 of-pocket costs Depreciation Total fixed expenses Net operating income $ 4,700,000 2,120,000 2,580,000 1,840,000 $ 740,000 Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: 1. What is the project's net present value? 2. What is the project's internal rate of return to the nearest whole percent? 3. What is the project's simple rate of return? 4-a. Would the company want Casey to pursue this Investment opportunity? 4-b. Would Casey be inclined to pursue this Investment opportunity? Complete this question by entering your answers in the tabs below. Req 1 Req 2 Req 3 Req 4A Req 4B What is the project's net present value? (Round your final answer to the nearest whole dollar amount.) Net present value < Req 1 Req 2 > Required: 1. What is the project's net present value? 2. What is the project's internal rate of return to the nearest whole percent? 3. What is the project's simple rate of return? 4-a. Would the company want Casey to pursue this investment opportunity? 4-b. Would Casey be inclined to pursue this Investment opportunity? Complete this question by entering your answers in the tabs below. Req 1 Req 2 Req 3 Req 4A Req 4B What is the project's internal rate of return? (Round your answer to the nearest whole percentage, i. considered as 12%.) Internal rate of return %6 < Req 1 Req 3 > Required: 1. What is the project's net present value? 2. What is the project's internal rate of return to the nearest whole percent? 3. What is the project's simple rate of return? 4-a. Would the company want Casey to pursue this Investment opportunity? 4-b. Would Casey be inclined to pursue this investment opportunity? Complete this question by entering your answers in the tabs below. Req 1 Req 2 Req 3 Req 4A Req 4B What is the project's simple rate of return? (Round your answer to 1 decimal place.) Simple rate of return % < Req 2 Req 4A >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts