Question: Kit Karnes Appendix I: DDL Financial Performance and Year 4 Plan Year 4 Year 1 Year 2 Year 3 Plan Revenue $112,500 $123,750 $135,000 $146,250

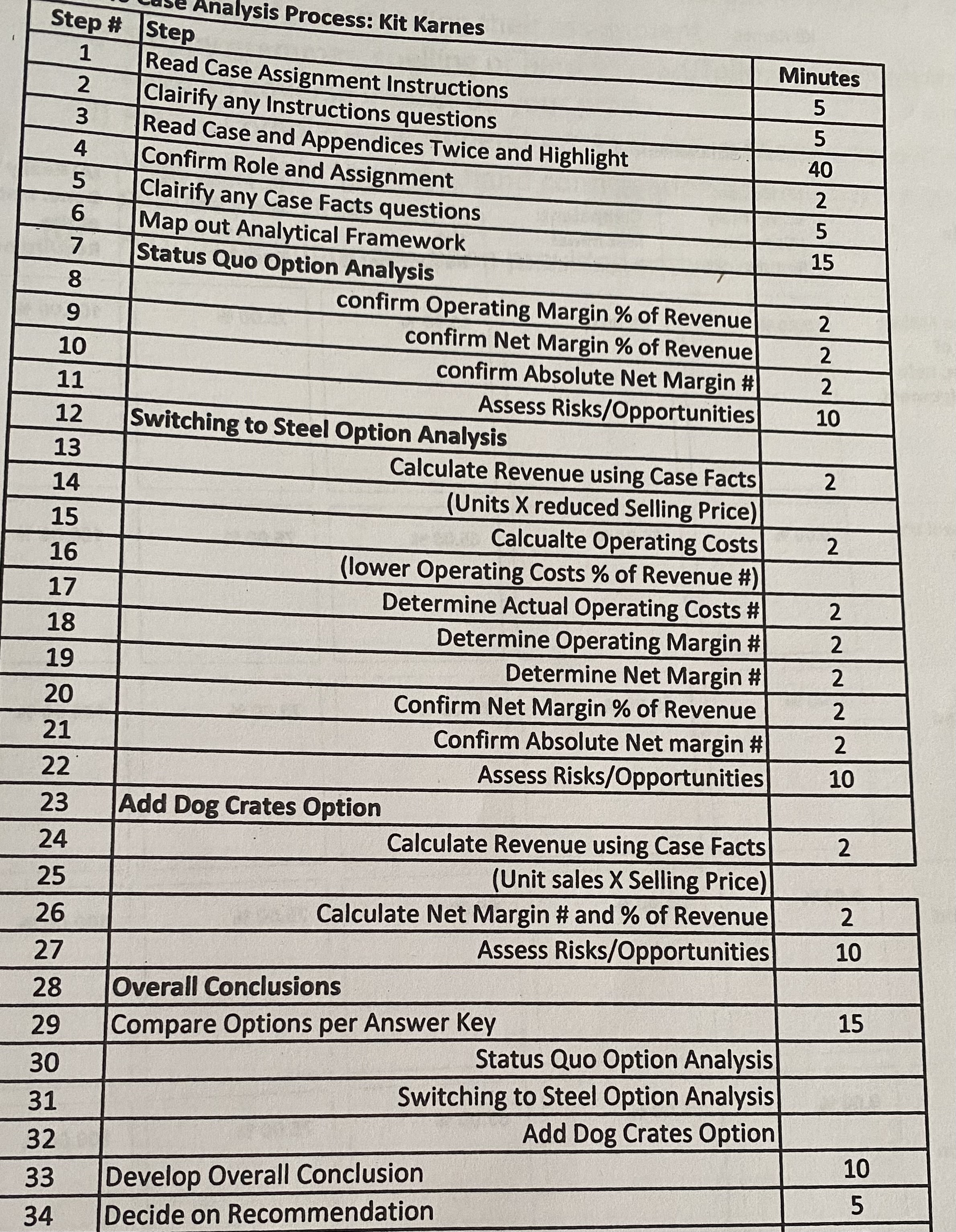

Kit Karnes Appendix I: DDL Financial Performance and Year 4 Plan Year 4 Year 1 Year 2 Year 3 Plan Revenue $112,500 $123,750 $135,000 $146,250 Operating Costs $73,125 $80,438 $87,750 $95,063 Operating Profit $39,375 $43,313 $47,250 $51,188 Fixed Costs $20,000 $20,000 $20,000 $20,000 Net Profit $19,375 $23,313 $27,250 $31,188 Units Sold 500 550 600 550 Selling Price $225 $225 $225 $225 O 4Kit Karnes Dazzle Dogs Ltd. (DDL) manufactures and sells designer seat belts for dogs. The founder and president of DDL, Kit Karnes, saw a need for this product when a law was passed that all dogs must be secured when travelling in a vehicle. Knowing that many dog owners spare no expense for their dogs, she decided to offer a premium product that is both fashionable and functional. Kit has always talked about how important it is to provide functional, safe, and fashionable travel accessories for dogs. Her mission is to provide safe and comfortable travel products for dog owners. Kit is really happy with how things are going. DDL has been profitable since it started operations three years ago after using $10,000 of her own savings to capitalize the business. Appendix I provides DDL's financial statements since the business started. DDL's customers are pet boutique shops located across Canada. Boutique owners have been very pleased with the quality and design of the seat belts, and the sales price of $225/unit has been well received. In fact, a well-known pet products consumer website recently named DDL's seat belts as "excellent quality at a fair price." Kit has not increased DDL's prices since starting her business. I muinslid ney Year 4 Plan 19q0 I jewel blues erle Jord bedzepave brice mil Kit recently met with her brother Robert, who is an accountant, to discuss DDL's Year 4 plan. Kit indicated that for the upcoming year, she felt that: . DDL could sell 650 seatbelts at the current selling price. . Operating costs as a percent of total revenue would be the same as in Year 3 . Fixed costs would be the same as Year 3.Kit Karnes The financial details for Year 4 are also shown in Appendix I. sixsso .2gob Producing and selling 650 seatbelts will consume most of her time. However, two new strategic opportunities, described below, have presented themselves for consideration. 1 101 9aneqx9 Strategic Opportunity #1: Reduce material costs by switching to Steel One of the reasons for DDL's success is that the specially designed hooks and buckles on the seat belts are made with titanium. Titanium is an extremely strong, lightweight metal, which makes the hooks and buckles virtually impossible to break. This makes DDL's seat belts safer and longer lasting than those of DDL's competitors, who use steel. Kit has learned that DDL is the only provider of seat belts using titanium for their hooks and buckles. Recently, a survey was included as part of the warranty registration process for DDL. In the survey feedback, the use of titanium in seat belts was selected as "a major factor in my buying decision" 20% of the time, "somewhat of a factor in my buying decision" 35% of the time, and "not a factor in my buying decision" 45% of the time. Over 90% of customers who purchased DDL's seat belts in Year 3 completed the survey. jon and Ji ".soing nist s is wailsup Ins However, titanium is expensive. A supplier has recently approached Kim and suggested that she could lower her operating costs to 35% of revenue if she were to switch her raw material from titanium to steel. However, Kit estimates that she would need to drop her selling price by 15% if she were to switch to steel. Strategic Option #2: Add a New Product Line Kit has also been approached by an agent representing a supplier of dog crates. He has suggested that she could significantly improve her NKit Karnes overall profitability if DDL were to add dog crates to DDL's product line. The crates are manufactured by an offshore third-party producer. The agent indicated that a bulk order for 500 crates could be purchased from the supplier for $75,000. The agent also suggested that the market price to retailers for crates is around $200 per crate. Kit has never been a fan of crates because the dogs are isolated in the rear of the vehicle, but she recognizes that there is a demand for the product. Your Assignment You are a marketing consultant at a small marketing advisory firm that works with clients looking to grow their businesses. Kit Karnes is one of your clients and is seeking your advice on the following: 1) How switching to steel would impact her Year 4 financial plan, and what the qualitative opportunities and risks of switching to steel would be. 2) How adding dog crates as a new product line would impact her Year 4 financial plan and what the qualitative opportunities and risks of adding dog crates to her product line would be. 3) What recommendations you would suggest for her to pursue in Year 4, and why? wStep # Analysis Process: Kit Karnes Step 1 Read Case Assignment Instructions Minutes Clairify any Instructions questions 5 - W N 5 Read Case and Appendices Twice and Highlight 40 5 Confirm Role and Assignment 6 Clairify any Case Facts questions 2 5 Map out Analytical Framework 15 Status Quo Option Analysis 8 confirm Operating Margin % of Revenue 10 confirm Net Margin % of Revenue 2 confirm Absolute Net Margin # IN 11 Assess Risks/Opportunities 10 12 Switching to Steel Option Analysis 13 Calculate Revenue using Case Facts 2 14 (Units X reduced Selling Price) 15 Calcualte Operating Costs 2 16 (lower Operating Costs % of Revenue #) 17 Determine Actual Operating Costs # IN 18 Determine Operating Margin # NN 19 Determine Net Margin # 20 Confirm Net Margin % of Revenue N N 21 Confirm Absolute Net margin # 22 Assess Risks/Opportunities 10 23 Add Dog Crates Option 24 Calculate Revenue using Case Facts 2 25 (Unit sales X Selling Price) N 26 Calculate Net Margin # and % of Revenue 10 27 Assess Risks/Opportunities 28 Overall Conclusions 15 29 Compare Options per Answer Key Status Quo Option Analysis 30 Switching to Steel Option Analysis 31 Add Dog Crates Option 32 10 33 Develop Overall Conclusion 5 34 Decide on Recommendation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts