Question: kk Assignment Attempts: Keep the Highest: 0/3 4. Problem 15-06 ebook Problem 15-06 As a relationship officer for a money.center commercial bank, one of your

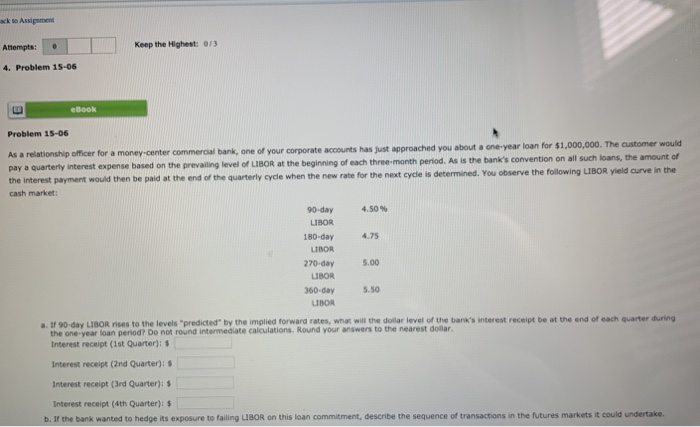

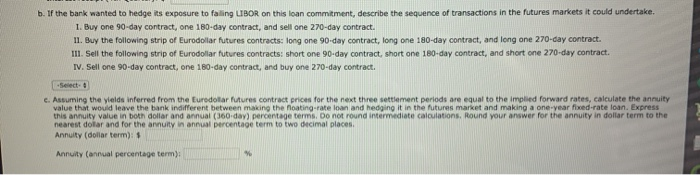

kk Assignment Attempts: Keep the Highest: 0/3 4. Problem 15-06 ebook Problem 15-06 As a relationship officer for a money.center commercial bank, one of your corporate accounts has just approached you about a one-year loan for $1,000,000. The customer would pay a quarterly interest expense based on the prevailing level of LIBOR at the beginning of each three month period. As is the bank's convention on all such loans, the amount of the interest payment would then be paid at the end of the quarterly cycle when the new rate for the next cycle is determined. You observe the following LIBOR yield curve in the cash market: 4.50 90-day LIBOR 180-day LIBOR 270-day LIBOR 360-day UBOR 5.50 90 day UBOR rises to the levels predicted by the implied forward rates, what the dollar level of the bank's interest receipt be at the end of each unter during the one-year loan period? Do not round intermediate calculations. Round your answers to the nearest dollar Interest receipt (1st Quarter): $ Interest receipt (2nd Quarter): 5 Interest receipt (3rd Quarter): Interest receipt (4th Quarter): $ b. If the bank wanted to hedge its exposure to failing LIBOR on this loan commitment, describe the sequence of transactions in the futures markets it could undertake. b. If the bank wanted to hedge its exposure to failing LIBOR on this loan commitment, describe the sequence of transactions in the futures markets it could undertake. 1. Buy one 90-day contract, one 180-day contract, and sell one 270-day contract. II. Buy the following strip of Eurodollar futures contracts: long one 90-day contract, long one 180 day contract, and long one 270-day contract. III. Sell the following strip of Eurodollar futures contracts: short one 90-day contract, short one 180-day contract, and short one 270-day contract. IV. Sell one 90-day contract, one 180-day contract, and buy one 270-day contract. -Select- c. Assuming the yields inferred from the Eurodollar futures contract prices for the next three settlement periods are equal to the implied forward rates, calculate the annuity value that would leave the bank indifferent between making the oating rate loan and hedging it in the futures market and making a one-year fixed-rate loan. Express this annuity value in both dollar and annual (360 day percentage terms. Do not round intermediate calculations. Round your answer for the annuity in dollar term to the nearest dollar and for the annuity in annual percentage term to two decimal places Annuity (dollar term): Annuity (annual percentage term): kk Assignment Attempts: Keep the Highest: 0/3 4. Problem 15-06 ebook Problem 15-06 As a relationship officer for a money.center commercial bank, one of your corporate accounts has just approached you about a one-year loan for $1,000,000. The customer would pay a quarterly interest expense based on the prevailing level of LIBOR at the beginning of each three month period. As is the bank's convention on all such loans, the amount of the interest payment would then be paid at the end of the quarterly cycle when the new rate for the next cycle is determined. You observe the following LIBOR yield curve in the cash market: 4.50 90-day LIBOR 180-day LIBOR 270-day LIBOR 360-day UBOR 5.50 90 day UBOR rises to the levels predicted by the implied forward rates, what the dollar level of the bank's interest receipt be at the end of each unter during the one-year loan period? Do not round intermediate calculations. Round your answers to the nearest dollar Interest receipt (1st Quarter): $ Interest receipt (2nd Quarter): 5 Interest receipt (3rd Quarter): Interest receipt (4th Quarter): $ b. If the bank wanted to hedge its exposure to failing LIBOR on this loan commitment, describe the sequence of transactions in the futures markets it could undertake. b. If the bank wanted to hedge its exposure to failing LIBOR on this loan commitment, describe the sequence of transactions in the futures markets it could undertake. 1. Buy one 90-day contract, one 180-day contract, and sell one 270-day contract. II. Buy the following strip of Eurodollar futures contracts: long one 90-day contract, long one 180 day contract, and long one 270-day contract. III. Sell the following strip of Eurodollar futures contracts: short one 90-day contract, short one 180-day contract, and short one 270-day contract. IV. Sell one 90-day contract, one 180-day contract, and buy one 270-day contract. -Select- c. Assuming the yields inferred from the Eurodollar futures contract prices for the next three settlement periods are equal to the implied forward rates, calculate the annuity value that would leave the bank indifferent between making the oating rate loan and hedging it in the futures market and making a one-year fixed-rate loan. Express this annuity value in both dollar and annual (360 day percentage terms. Do not round intermediate calculations. Round your answer for the annuity in dollar term to the nearest dollar and for the annuity in annual percentage term to two decimal places Annuity (dollar term): Annuity (annual percentage term)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts