Question: KKR issues a $10 million 18-month floating rate note priced at LIBOR plus 400 basis points. What is KKR's interest rate risk exposure and

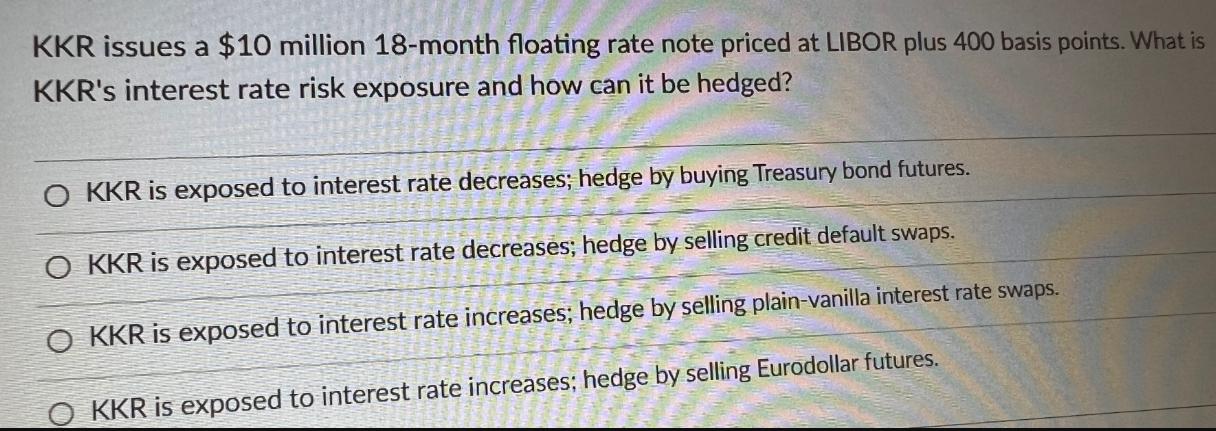

KKR issues a $10 million 18-month floating rate note priced at LIBOR plus 400 basis points. What is KKR's interest rate risk exposure and how can it be hedged? O KKR is exposed to interest rate decreases; hedge by buying Treasury bond futures. O KKR is exposed to interest rate decreases; hedge by selling credit default swaps. OKKR is exposed to interest rate increases; hedge by selling plain-vanilla interest rate swaps. KKR is exposed to interest rate increases; hedge by selling Eurodollar futures.

Step by Step Solution

There are 3 Steps involved in it

The detailed answer for the above question is provided below The correct answer is KKR is exposed to ... View full answer

Get step-by-step solutions from verified subject matter experts