Question: kmarks Window Help uwwtw.instructure.com Question 4 0/1 pts Suppose you know a company's stock currently sells for $24 per share and the required return on

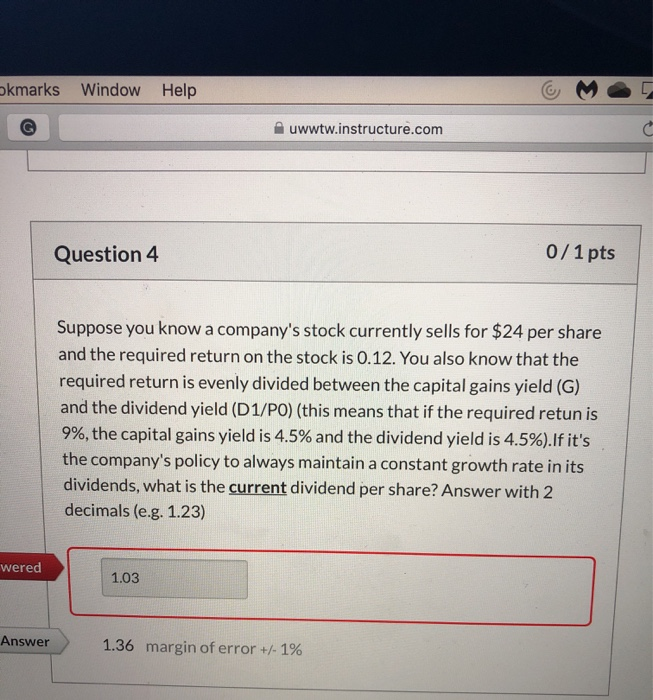

kmarks Window Help uwwtw.instructure.com Question 4 0/1 pts Suppose you know a company's stock currently sells for $24 per share and the required return on the stock is 0.12. You also know that the required return is evenly divided between the capital gains yield (G) and the dividend yield (D1/PO) (this means that if the required retun is 9%, the capital gains yield is 4.5% and the dividend yield is 4.5%).If it's the company's policy to always maintain a constant growth rate in its dividends, what is the current dividend per share? Answer with 2 decimals (e.g. 1.23) wered 1.03 Answer 1.36 margin of error +/- 1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts