Question: Knowledge Check 01 Eric Duffy and Johnnie Gladwin operate a partnership. The partnership agreement states that the income and loss will be shared based on

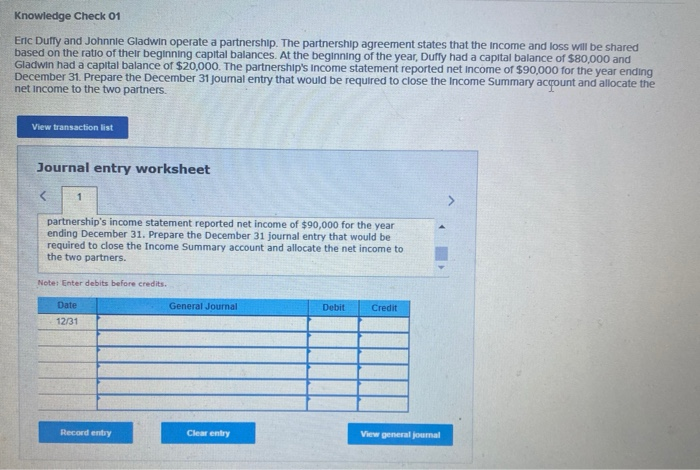

Knowledge Check 01 Eric Duffy and Johnnie Gladwin operate a partnership. The partnership agreement states that the income and loss will be shared based on the ratio of their beginning capital balances. At the beginning of the year, Dully had a capital balance of $80,000 and Gladwin had a capital balance of $20,000. The partnership's Income statement reported net income of $90,000 for the year ending December 31. Prepare the December 31 journal entry that would be required to close the income Summary account and allocate the net Income to the two partners. View transaction list Journal entry worksheet partnership's income statement reported net income of $90,000 for the year ending December 31. Prepare the December 31 journal entry that would be required to close the Income Summary account and allocate the net income to the two partners. Note: Enter debits before credits. Date General Journal Debit Credit 12/31 Recordently Clear entry View general mal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts