Question: Knowledge Check 01 Project Marvel is a five-year project. The project has a total cash inflow of $350,000. The present value of such inflows is

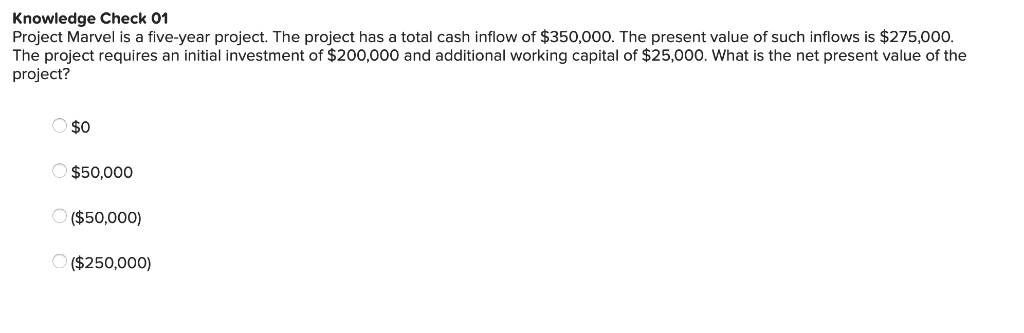

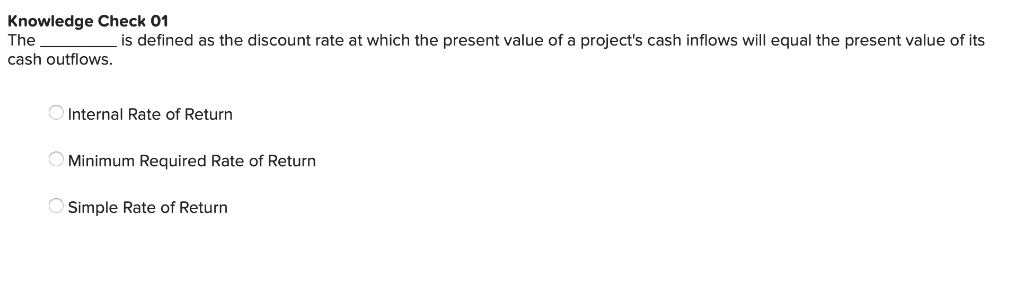

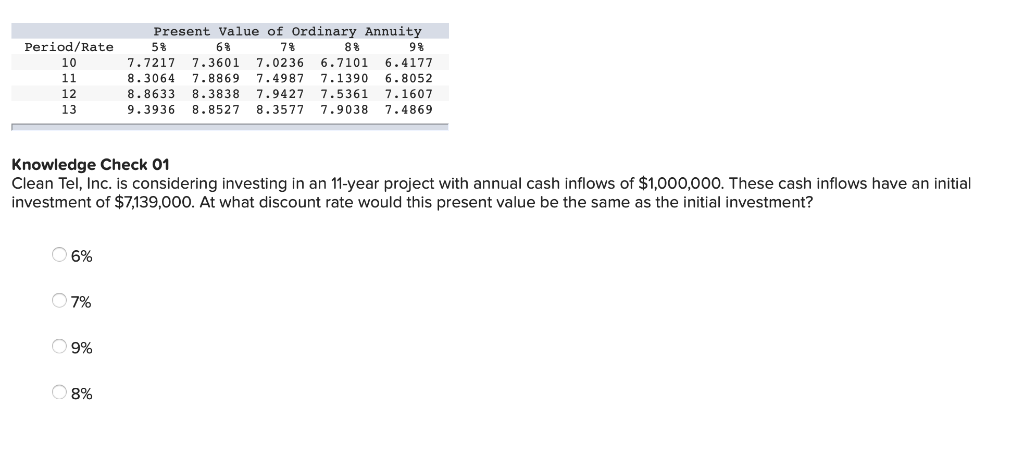

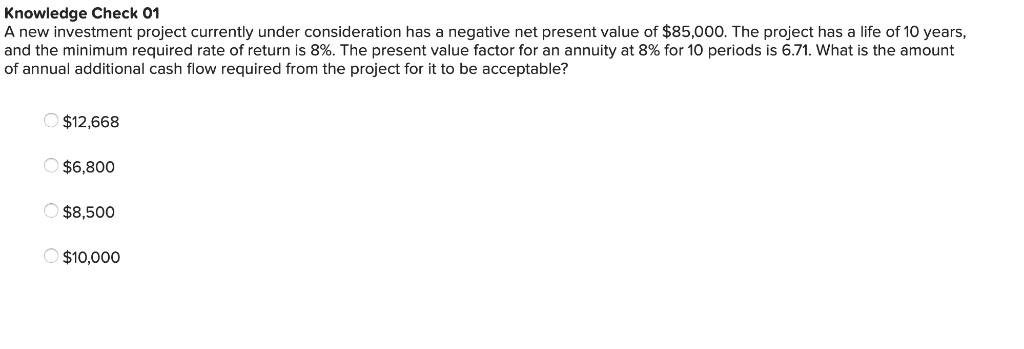

Knowledge Check 01 Project Marvel is a five-year project. The project has a total cash inflow of $350,000. The present value of such inflows is $275,000. The project requires an initial investment of $200,000 and additional working capital of $25,000. What is the net present value of the project? $C $50,000 ($50,000) ($250,000) Knowledge Check 01 The is defined as the discount rate at which the present value of a project's cash inflows will equal the present value of its cash outflows. Internal Rate of Return Minimum Required Rate of Return Simple Rate of Return Present Value of Ordinary Annuity Period/Rate 58 69 7% 8% 9% 7.3601 7.0236 6.7101 6.4177 7.7217 11 8.3064 7.8869 7.4987 7.1390 6.8052 12 8.8633 8.3838 7.9427 7.5361 7.1607 13 9.3936 8.8527 8.3577 7.9038 7.4869 Knowledge Check 01 Clean Tel, Inc. is considering investing in an 11-year project with annual cash inflows of $1,000,000. These cash inflows have an initial investment of $7,139,000. At what discount rate would this present value be the same as the initial investment? 6% 7% 9% 8% Knowledge Check 01 A new investment project currently under consideration has a negative net present value of $85,000. The project has a life of 10 years, and the minimum required rate of return is 8%. The present value factor for an annuity at 8% for 10 periods is 6.71. What is the amount of annual additional cash flow required from the project for it to be acceptable? O $12,668 $6,800 $8,500 $10,000 Knowledge Check 01 Which of the following is NOT another term used to describe preference decision making? Rationing decisions Screening decisions Ranking decisions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts