Question: Ko exchanges computer equipment (five-year property) with an adjusted basis of $9,000 for a business auto (five-year property) worth $6,000. Ko also receives cash of

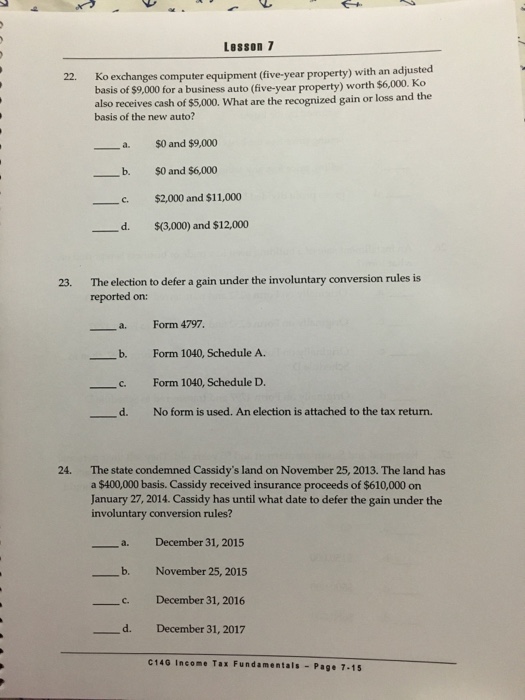

Ko exchanges computer equipment (five-year property) with an adjusted basis of $9,000 for a business auto (five-year property) worth $6,000. Ko also receives cash of $5,000. What are the recognized gain or loss and the basis of the new auto? $0 and $9,000 $0 and $6,000 $2,000 and $11,000 $(3,000) and $12,000 The election to defer a gain under the involuntary conversion rules is reported on: Form 4797. Form 1040, Schedule A. Form 1040, Schedule D. No form is used. An election is attached to the tax return. The state condemned Cassidy's land on November 25, 2013. The land has a $400,000 basis. Cassidy received insurance proceeds of $610,000 on January 27, 2014. Cassidy has until what date to defer the gain under the involuntary conversion rules? December 31, 2015 November 25, 2015 December 31, 2016 December 31, 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts